-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Your Trusted Partner for Expert Payroll Outsourcing Services

We do more than just handling paychecks, we ensure your payroll operations run smoothly and accurately at all times, saving time and reducing stress. Our outsourced payroll services take care of everything, from employee benefits to tax deductions. Focus on what you do best, and we will handle your payroll. Rely on us to keep your team satisfied and your business flowing!

Outsource Payroll Services to Streamlining Your Workforce Operations

Our payroll management services bring peace and efficiency to your operations by ensuring everyone is paid the right amount, at the right time.

Ensuring Payroll Accuracy

Errors in payroll calculations can lead to compliance issues and dissatisfied employees. We ensure precise calculations for wages, tax withholdings, and deductions, guaranteeing accurate and timely employee payments.

Fostering Best Practices

We implement streamlined payroll procedures that ensure accuracy and consistency, reducing the risk of errors. By focusing on industry standards and the latest payroll technology, we support your business in maintaining efficient payroll operations.

Streamlining Time-Consuming Processes

Managing payroll in-house can be tedious and resource intensive. We handle everything from data entry to payslip generation, freeing up your team to focus on strategic business priorities.

Payroll Made Simple, Business Made Strong

Our payroll outsourcing services simplify and enhance your payroll processes, removing the hassle and ensuring accuracy every step of the way. Using cutting-edge technology and industry best practices, we guarantee precise calculations, timely payments, and seamless compliance with all regulations. By partnering with us, you save valuable time and resources, allowing you to focus on what truly matters, driving your business forward.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

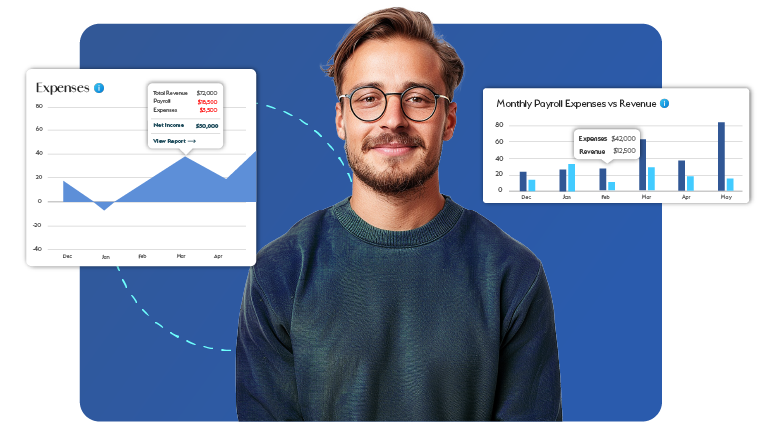

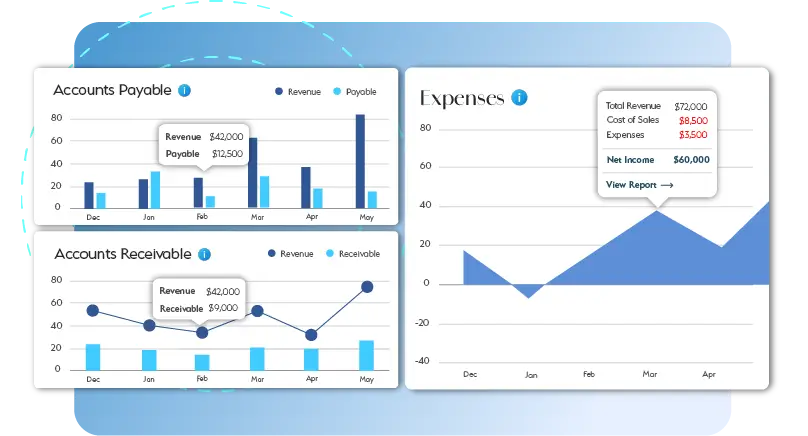

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Payroll outsourcing services manage payroll processing, tax compliance, and employee payments. They streamline operations, reduce errors, and ensure adherence to regulations, allowing businesses to focus on core functions.

Yes, reputable providers of outsourced payroll services implement robust security measures, including encryption and data access controls, ensuring your sensitive payroll data remains protected and compliant with privacy regulations.

The cost depends on factors like the number of employees and services provided. Most payroll processing services offer competitive, scalable pricing tailored to businesses of varying sizes and needs.

Ask about experience, compliance knowledge, security practices, software compatibility, and customer support. Ensuring alignment with your business requirements is crucial when selecting a payroll outsourcing provider.

Yes, payroll outsourcing services are scalable. Providers adapt to changing needs, offering flexibility to accommodate employee growth, evolving payroll complexities, and compliance with new regulations.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Payroll Outsourcing Services: Streamlining Your Workforce Operations

Managing payroll in-house can be time-intensive and prone to errors. The administrative burden of handling employee wages, tax filings, and compliance distracts businesses from their core functions. Payroll outsourcing offers an efficient solution, putting experts in charge of these critical tasks. By opting for outsourced payroll services, businesses can streamline processes, enhance accuracy, and focus on growth. Let’s explore how payroll outsourcing services can transform your operations:

Get a CallOutsourcing payroll management services to professionals who specialize in payroll management. Payroll outsourcing services eliminate the need for in-house infrastructure and reduce administrative overhead, allowing businesses to allocate resources toward strategic initiatives.

Outsourced payroll services provide access to the latest payroll software and tools. These advanced technologies simplify payroll processing, ensuring accurate calculations, timely tax filings, and compliance with labor laws.

With cloud-based systems used by payroll outsourcing providers, businesses can securely access payroll data anytime, anywhere, making the entire process more transparent and efficient.

Payroll involves complex calculations, deductions, and legal requirements. Errors in processing can lead to penalties or dissatisfied employees. Outsourced payroll services ensure that experienced professionals handle these tasks, reducing the risk of mistakes and ensuring compliance with federal, state, and local laws.

By choosing to outsource payroll, businesses can stay confident that their payroll operations are accurate, compliant, and up to date with regulatory changes.

As businesses grow, their payroll needs become more complex. Outsourcing payroll processing services provides the flexibility to scale operations seamlessly. Whether your workforce expands or contracts, outsourced payroll services can adjust to meet your requirements without additional strain on your internal team.

Outsourcing payroll management allows businesses to shift their focus back to their core objectives. By entrusting payroll processing to experts, you can save time, reduce operational complexities, and concentrate on growing your business.

Payroll outsourcing offers unparalleled benefits for businesses of all sizes. From reducing costs to enhancing accuracy and compliance, outsourced payroll services simplify workforce management and improve operational efficiency. Partnering with a reliable provider ensures you stay ahead in a competitive marketplace while maintaining the satisfaction of your employees and compliance with regulations.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.