-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Whiz Consulting: Your One-Stop Bookkeeping Solution

We don’t just track your numbers; we give you clear, actionable insights that help you make smarter, data-driven decisions. From organizing your finances to managing cash flow and preparing for tax season, we keep your books in top shape so you can focus on what matters most- growing your business. Stay ahead of the curve with a partner you can trust!

Challenges We Tackle for You

Our comprehensive bookkeeping services are designed to tackle the most pressing challenges businesses face.

Maintaining Accuracy Across Complex Transactions

We ensure every financial transaction is recorded accurately, from simple daily expenses to intricate multi-transaction processes. This attention to detail helps prevent errors and provides clear financial insights.

Ensuring Best Accounting Practices

With over a decade of experience serving local clients, we’ve honed our expertise to deliver exceptional accounting solutions. Trust us to keep your finances in perfect order, backed by the best practices tailored to your needs.

More Time in Your Hands

Bookkeeping can be time-consuming and distract from core business functions. We handle the complexities of financial record-keeping, allowing you to focus on growing your business while saving valuable time and resources.

Hire Your Dedicated Online Bookkeeper

-

Bookkeeping

Specialist -

Tax

Professional -

Accounts Payable

Specialist -

Financial Reporting

Analyst

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Accounting Automation

Our expert team is well-versed in accounting tools to reduce errors and fasten the process to bring more efficiency.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

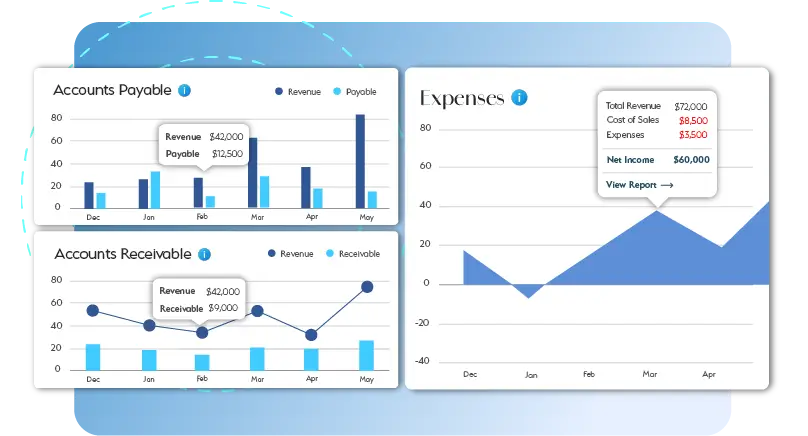

Real-Time Insights

Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Our outsourced bookkeeping services are tailored to your needs and help you save up to 60% on overheads.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Absolutely. Bookkeeping services play a crucial role in preparing accurate financial records, which makes tax filing much more straightforward. By maintaining organized records, bookkeepers ensure that all relevant information is readily available, reducing the risk of errors and missed deductions.

Bookkeeping is crucial for small businesses for many reasons. The process helps with budgeting, preparing for taxes, maintaining records, reporting to investing, and monitoring business goals. Keeping financial records updated helps small businesses make the most of opportunities.

Data confidentiality and security are top priorities. Bookkeeping services use secure, encrypted platforms to handle financial information and limits.

Books should ideally be updated monthly, though the frequency can depend on the volume of transactions and your business needs. Regular updates help you stay on top of finances and make informed decisions.

Yes, we offer online bookkeeping services tailored for startups. We help set up efficient financial systems from the beginning, ensuring your business starts on a solid financial footing.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Bookkeeping Services: Keeping Your Finances at the Forefront

Managing all accounting and bookkeeping tasks in-house may be costly and unmanageable. The time you spend doing bookkeeping could be invested in focusing on core business activities. Outsourced bookkeeping services put experts in charge of recording your business’s financial transactions. Additionally, the right bookkeeping services keep your finances in order and promote cost-saving. Intrigued to know more? Let’s discuss in detail how outsourced bookkeeping services can help your business:

Get a CallBookkeeping has various components, and you need experts who can easily tackle these elements’ complexities. This includes the cost of hiring the right staff, in-house infrastructure, and training and development. All these add up to a hefty sum; are you in a position to make the investment?

Another important reason to choose business bookkeeping online is access to the right technology. Outsourced bookkeepers are service providers dedicated to tackling all aspects of bookkeeping, and they do that by leveraging the best software in the market.

The way you handle your finances continues to change with the growing scale of operations. Outsourcing bookkeeping services provides flexibility, allowing you to scale services with ease. If your business has fluctuating needs, outsourced services can adjust accordingly to ensure you only pay for what you need.

Navigating various financial regulations and standards can be complicated. Online bookkeeping services ensure you adhere to all guidelines and standards that govern your practice. Additionally, these experts keep updated with changing laws in accounting and can make changes accordingly.