-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Decide the Future of Your Finance with Us

Struggling to make sense of your finances? Let’s change that. Our budgeting and forecasting services are designed to give you clarity and confidence in your financial decisions. We don’t just deliver spreadsheets – we provide a clear roadmap to help you allocate resources, anticipate challenges, and seize opportunities. With our expert guidance, you’ll have the tools to stay on track, adapt to changes, and achieve your business goals. Stop guessing, start planning smarter!

Challenges in Budgeting and Forecasting We Solve for You

At Whiz Consulting, we understand the pain points businesses face in budgeting and forecasting and have tailored solutions to address them effectively.

Inaccurate Financial Data

Errors in data can skew your budgets and forecasts, leading to poor decision-making. We provide precise data validation and reporting, ensuring your financial insights are accurate and reliable.

Lack of Clarity in Financial Trends

Unclear trends and misaligned projections can derail strategic planning. Our experts use advanced tools to deliver clear, actionable insights into your financial trajectory, keeping your business on track.

Missed Opportunities Due to Poor Planning

Inefficient planning can mean missed growth opportunities. We deliver proactive financial forecasts to help you seize opportunities and mitigate risks with confidence.

Your Financial Roadmap, Simplified

From navigating cash flow complexities to delivering precise financial reports, our solutions are built to empower your business. With advanced tools and expert strategies, we eliminate guesswork, minimize risks, and ensure every decision is backed by accurate data. Let us handle the details, so you can focus on driving growth and achieving your financial goals with clarity and ease.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

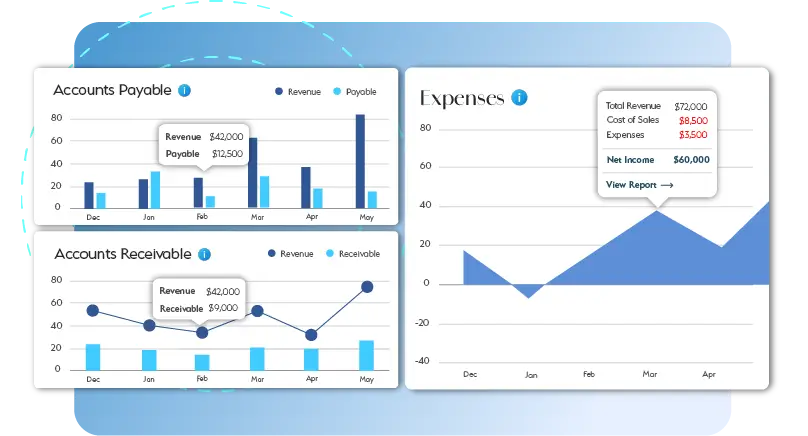

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Cash flow forecasting helps predict your business’s future financial position by analyzing expected inflows and outflows. This enables proactive financial management and decision-making.

Budgeting services assist small businesses in managing resources efficiently, setting financial goals, and avoiding unnecessary expenses. They also provide a foundation for growth and stability.

While no forecast is perfect, professional cash flow forecasting services use reliable data and advanced tools to provide highly accurate predictions, helping businesses plan effectively.

Yes, budgeting and forecasting services are tailored to meet the unique needs of your business, whether you need a detailed twelve-week cash flow forecast or broader financial planning.

Startups benefit significantly from these services as they establish a solid financial foundation, manage limited resources, and plan for sustainable growth.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Budgeting and Forecasting Services: Your Path to Financial Clarity

Effective financial management requires more than just tracking expenses; it demands accurate planning and foresight. Budgeting and forecasting services empower businesses to anticipate challenges and seize opportunities. Whether it’s preparing a twelve-week cash flow forecast or creating a comprehensive budget, these services provide the tools needed to maintain financial stability and growth. Intrigued? Let’s explore how budgeting and forecasting services can benefit your business:

Get a CallBudgeting services help you allocate resources effectively and ensure you’re on track to meet your financial goals. From cash flow forecasting to long-term planning, these solutions provide a clear view of your financial health and future.

Accurate budgeting and cash flow forecasting allow you to make data-driven decisions. With insights from a twelve-week cash flow forecast or detailed projections, you can confidently invest in opportunities, mitigate risks, and plan for the future.

Cash flow forecasting services simplify financial management by providing real-time visibility into your business’s liquidity. With the right tools and expertise, you can anticipate and navigate cash flow challenges before they arise.

Budgeting and forecasting services adapt to your business’s unique needs. Whether you’re a startup or a growing enterprise, these solutions scale effortlessly, ensuring you always have the support needed for precise financial planning.

Professionals delivering budgeting and forecasting services ensure compliance with regulations and accuracy in all projections. This reduces the risk of costly errors and keeps your business aligned with financial standards.