-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Whiz Consulting: Your Reliable Partner for Account Reconciliation

Having your financial records in order and up to date is critical for confident decision-making in the business. At Whiz Consulting, we help you keep your accounts in sync, catching any discrepancies at the earliest before they can result in costly mistakes. With our correct account reconciliation services, you will have a clear picture of your finances at all time. Allow us to deal with the particulars so you can concentrate on operating your business system efficiently.

Challenges We Address for You

Our accounts reconciliation services are designed to tackle the key pain points businesses face.

Handling Large Volumes of Transactions

Reconciling numerous transactions across multiple accounts can feel daunting. We simplify the process by managing the workload efficiently, ensuring every detail aligns to keep your finances accurate.

Identifying Discrepancies Quickly

Unmatched entries or errors in records can cause delays and confusion. Our meticulous approach helps detect and resolve discrepancies promptly, keeping your financial reports error-free and dependable.

Maintaining Timely Reconciliation

Falling behind on reconciliation can disrupt financial planning and compliance. We ensure your accounts are reconciled regularly, giving you peace of mind and a clear financial picture.

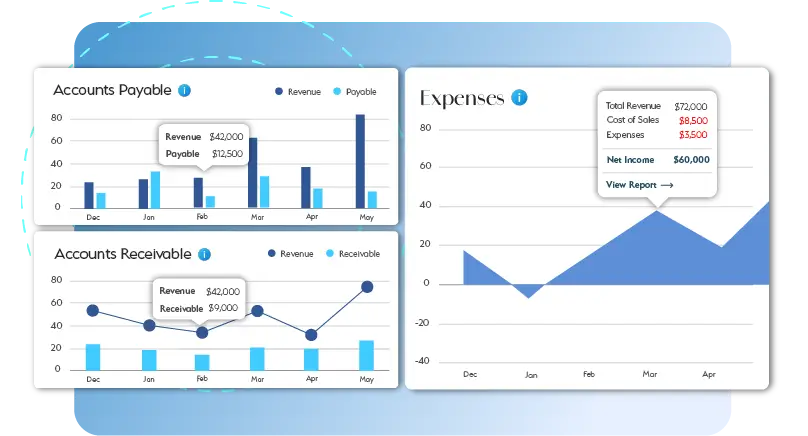

Accurate Accounts, Confident Decisions

Managing account balances accurately demands precision, expertise, and efficient tools. Our accounts reconciliation services tackle the toughest challenges, ensuring every transaction is aligned and discrepancies are resolved swiftly. Using advanced techniques, we keep your records up-to-date, eliminate delays, and enhance financial clarity. With our support, you can focus on growth, knowing your finances are in safe hands.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Accounts reconciliation involves comparing financial records with external statements (like bank or credit card statements) to ensure accuracy. It helps identify discrepancies, prevent fraud, and maintain financial integrity.

Yes, bookkeepers can perform bank reconciliation. They compare a business’s financial records with bank statements, ensuring all transactions are recorded correctly and resolving any discrepancies to maintain accurate financial data.

An accounts reconciliation specialist reviews and reconciles financial records, identifies and resolves discrepancies, ensures compliance with accounting standards, and supports accurate financial reporting for informed business decisions.

Regular financial reconciliation ensures accurate records, prevents fraud, identifies errors early, and supports informed decision-making. It also helps businesses maintain compliance with regulations and manage cash flow effectively.

Outsourcing bookkeeping streamlines operations by leveraging expert knowledge and innovative tools. It lowers errors, saves time, and enables organizations to focus on growth while maintaining accurate and compliant financial records.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Accounts Reconciliation Services: Ensuring Accuracy in Financial Records

Maintaining accurate financial records is essential for any business, but reconciling accounts can often become time-consuming and overwhelming. The process demands precision and attention to detail, which can divert your focus from core business activities. Outsourcing accounts reconciliation services offers a solution by entrusting experts to verify your financial data. This not only ensures accuracy but also fosters better financial management. Curious to learn more? Let’s dive into the benefits of accounts reconciliation services:

Get a CallAccount reconciliation involves cross-checking financial records against bank statements, credit card transactions, and other external documents. Any mismatch can lead to discrepancies that impact financial decision-making. Outsourced reconciliation experts are skilled in identifying and rectifying errors, ensuring accurate and reliable financial data.

Reconciling accounts in-house requires significant time, effort, and expertise. Hiring and training staff for this specific task may not be cost-effective for your business. By outsourcing, you save valuable resources and gain access to specialists who handle the process efficiently, freeing up your internal team for strategic tasks.

Accounts reconciliation services utilize cutting-edge software to automate and streamline the reconciliation process. These tools improve accuracy, reduce manual errors, and provide a clearer view of your financial health. With cloud-based technology, you can access real-time updates and reports from anywhere, at any time.

Financial regulations and accounting standards frequently change, and staying compliant is crucial to avoid penalties. Outsourcing to experts who are up-to-date with these regulations ensures your business adheres to all legal requirements. Moreover, accurate reconciliations minimize risks associated with fraud and financial mismanagement.

By identifying and addressing discrepancies promptly, accounts reconciliation services enable better cash flow management. You receive accurate insights into available funds, outstanding payments, and other financial metrics. This helps in planning budgets, forecasting expenses, and making informed investment decisions.

As your business expands, the complexity and volume of transactions also increase. Outsourced reconciliation services are highly scalable, allowing you to adapt the level of service based on your business needs. This flexibility ensures you only pay for what you require, avoiding unnecessary costs.

Accurate financial records are the backbone of sound decision-making. By outsourcing accounts reconciliation, you ensure your data is reliable, leaving you with more time and confidence to focus on strategic growth initiatives and long-term goals.

Outsourcing accounts reconciliation services is an efficient way to maintain financial accuracy, ensure compliance, and enhance operational efficiency. With the right service provider, you can simplify your financial processes, improve cash flow management, and pave the way for sustainable business growth.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.