-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Professional Payroll Outsourcing Services for Your Business

Payroll isn’t just about paychecks: it’s about precision and peace of mind. We ensure your payroll runs effortlessly and accurately, saving you time and minimizing workplace stress. From managing employee benefits and tax withholdings to ensuring compliance with labor laws, we handle it all.

Outsourced Payroll Services We Offer

- Payroll data entry and processing

- Accurate employee payments after tax deductions

- Timely payslip generation and distribution

- Recordkeeping and administrative support

- State and federal return preparation

- Monthly, quarterly, and annual state-wide filings

Payroll Challenges We Tackle for You

We offer payroll outsourcing services designed to address the key payroll challenges businesses face, ensuring smooth and efficient management of payroll operations.

Precision in Payroll Processing

Payroll errors can cause compliance risks and impact employee satisfaction. Our team ensures accurate calculations for salaries, tax withholdings, and deductions, delivering timely and error-free payments.

Achieving Payroll Excellence

We design streamlined payroll processes tailored to ensure accuracy and consistency, minimizing errors and integrating industry best practices.

Simplifying Payroll Management

In-house payroll management can drain time and resources. Let us take care of everything, from accurate data entry to generating payslips, so your team can concentrate on driving your business forward.

Payroll Outsourcing in Australia: Your Payroll, Perfected

Our payroll outsourcing services simplify and enhance your payroll processes, removing the hassle and ensuring accuracy every step of the way. Using cutting-edge technology and industry best practices, we guarantee precise calculations, timely payments, and seamless compliance with all regulations. By partnering with us, you save valuable time and resources, allowing you to focus on what truly matters, driving your business forward.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

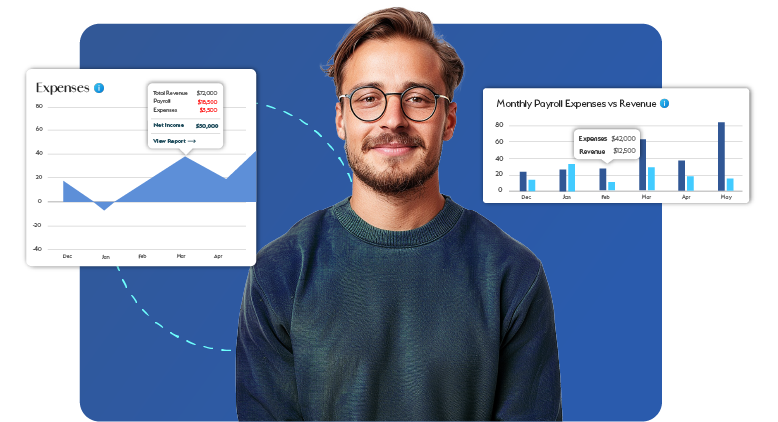

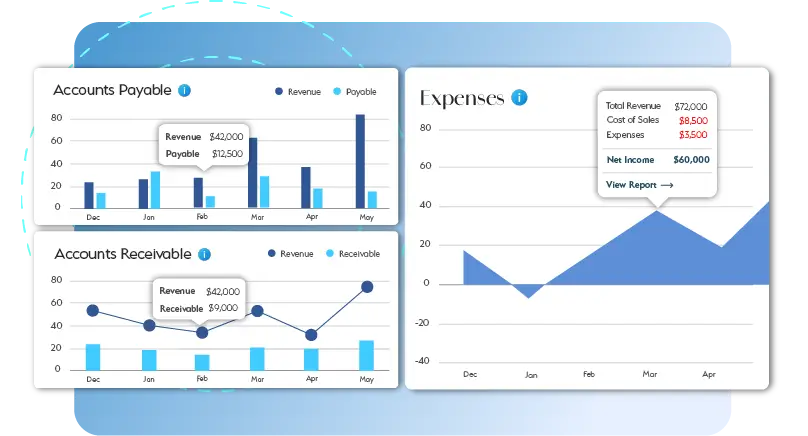

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Absolutely. Trusted outsourced payroll providers in Australia use advanced security measures such as encryption and strict access controls to safeguard sensitive payroll data and comply with privacy regulations.

The cost varies based on factors such as workforce size and required services. Most providers offer flexible pricing plans tailored to business needs.

The cost depends on factors like the number of employees and services provided. Most payroll outsourcing services offer competitive, scalable pricing tailored to businesses of varying sizes and needs.

Yes, payroll outsourcing services are scalable. Providers adapt to changing needs, offering flexibility to accommodate employee growth, evolving payroll complexities, and compliance with new regulations.

No, you always retain control. We work with your team to ensure maximum efficiency and accuracy in payroll processing.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Payroll Accounting Services

Outsourced payroll accounting services are a smart move for businesses looking to improve efficiency, maintain compliance, and enhance security. By partnering with a reliable payroll provider, companies can focus on their core operations while ensuring employees are paid accurately and on time. If you are looking to simplify your payroll management process, outsourcing could be the perfect solution for your business.

Get a CallProcessing payroll in-house requires dedicated personnel, software, and continuous monitoring of tax regulations. By outsourcing, businesses can reduce operational costs and free up valuable time to focus on primary business activities.

Payroll errors can lead to significant financial penalties and compliance issues. Outsourced payroll providers in Australia ensure accurate wage calculations, deductions, tax filings, and adherence to government regulations, reducing the risk of non-compliance.

Payroll processing involves handling sensitive employee information. Reputable payroll outsourcing firms implement advanced security measures, data encryption, and secure servers to prevent data breaches and identity theft.

Outsourcing firms use the latest payroll software and employ experienced professionals who stay updated with tax laws and compliance changes. This ensures businesses receive accurate and efficient payroll services without the hassle of staying updated on legislative changes.

As businesses grow, payroll complexities increase. Outsourced payroll accounting services can easily scale to accommodate changes in workforce size, salary structures, and compliance requirements, making it a flexible solution for growing businesses.

Timely and accurate payroll processing ensures employees receive their wages without delays or errors, fostering trust and satisfaction. Many outsourced payroll providers also offer self-service portals where employees can get access to their pay stubs, tax forms, and leave balances.