-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Effortless Financial Reporting Made for You

We deliver more than just numbers: we provide precise, actionable insights to highlight your financial performance. From ensuring accuracy and compliance to uncovering critical trends, we manage every detail, allowing you to focus on growing your business. At Whiz Consulting, financial clarity is our promise to you.

Financial Reporting Services We Offer

- General ledger reports

- Trial balance preparation

- Fixed asset and depreciation calculation

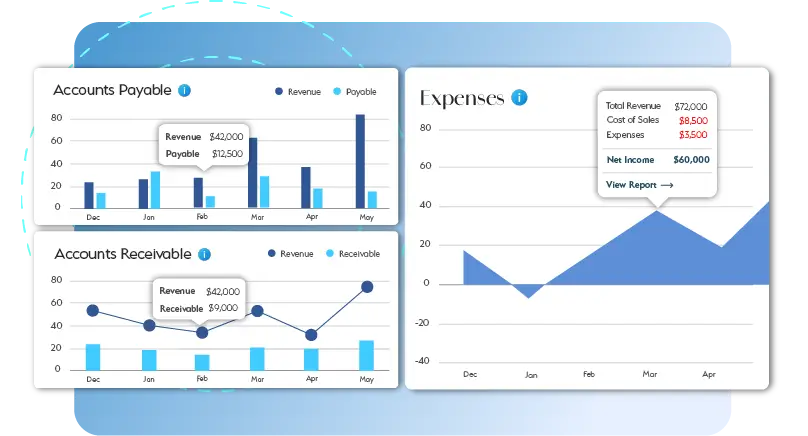

- Accounts payable reports

- Accounts receivables reports

- Financial Statement Analysis

- Bank reconciliation reports

- Inventory reports

Challenges We Tackle for You

Our financial reporting services turn challenges into clarity, keeping your finances on track and your business ahead.

Managing Unorganized Financial Data:

Inconsistent financial records can hinder decision-making and cloud business insights. We ensure your data is accurate, well-structured, and easy to interpret, providing a reliable foundation for informed strategic decisions.

Simplifying Complex Financial Standards:

Keeping up with intricate accounting rules and compliance requirements can be challenging. Our expert accountants stay updated on the latest standards, ensuring your financial records meet all regulatory guidelines with precision.

Turning Numbers into Clarity:

Raw financial data can be complex and hard to analyze. We distill your numbers into clear, actionable insights, giving you the clarity and confidence to make informed, data-driven decisions for your business.

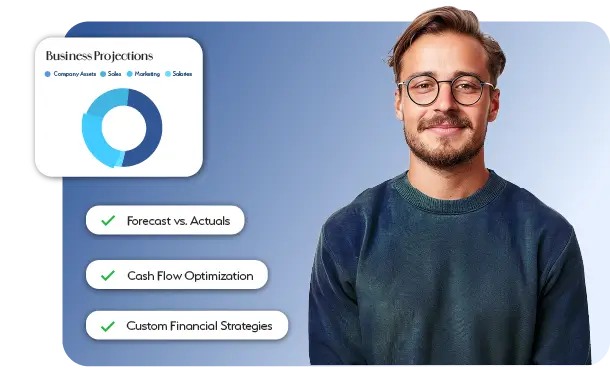

Strengthening Your Financial Foundation

Transform complex financial data into actionable insights with our tailored financial reporting services. From staying ahead of changing standards to delivering precise and timely reports, we use advanced tools and expert analysis to empower your business. Gain clarity, reduce errors, and make confident decisions that drive success.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Yes, your data is fully protected. We use advanced encryption, adhere to strict confidentiality protocols, and comply with industry standards to ensure the highest level of security.

Absolutely! Outsourcing is a cost-effective solution for small businesses. It provides access to skilled professionals, streamlines reporting processes, and lets you focus on growing your business.

Yes, you remain in full control. We ensure transparency, keep you updated regularly, and allow you to review and approve all reports while we handle the detailed tasks.

Outsourcing saves time, reduces overhead costs, and ensures accurate reporting. It provides access to experienced professionals and advanced tools, enhancing decision-making and ensuring compliance.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Financial Reporting Services: A Smart Choice for Businesses

Accurate financial reporting is important for informed decision-making and regulatory compliance. However, managing financial reporting in-house can be complex, time-consuming, and costly. This is where outsourced financial reporting services come into play. Businesses of all sizes are increasingly moving towards outsourcing as a strategic solution to improve efficiency and accuracy while reducing operational burdens.

Get a CallMaintaining an in-house financial reporting team requires significant investments in salaries, training, and technology. Outsourcing helps businesses cut costs by eliminating the need for full-time staff and reducing administrative expenses.

Financial reporting involves complex accounting standards and regulatory requirements. Outsourced professionals are well-versed in industry regulations, ensuring financial reports comply with relevant frameworks.

Preparing financial reports in-house can be time-consuming, diverting attention from core business activities. Outsourcing allows businesses to focus on growth and operations while experts handle financial reporting efficiently.

Outsourced financial reporting services providers use cutting-edge software and automation tools to enhance accuracy and streamline reporting processes. This avoids the requirement for businesses to invest in expensive financial technology.

As businesses grow, financial reporting needs to evolve. Outsourced services offer scalability, allowing businesses to adjust service levels based on their needs without hiring additional staff.

Errors in financial reporting can lead to compliance issues, penalties, and reputational damage. Outsourced providers implement stringent quality controls to minimise risks and ensure accurate reporting.