-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

Outsourced Accounts Receivable Services for US Firms

With over a decade of experience in financial outsourcing, we help US businesses get paid faster and run leaner. Our team of 100+ online accountants specialize in managing every aspect of accounts receivable, from invoicing and payment follow-ups to credit control and reconciliation. When you outsource accounts receivable to us, you gain a reliable F&A expert who will help you enhance cash flow and client relationships.

Accounting Challenges We Tackle for US Businesses

Our outsourced accounts receivable services simplify your processes to help you keep your cash flow predictable.

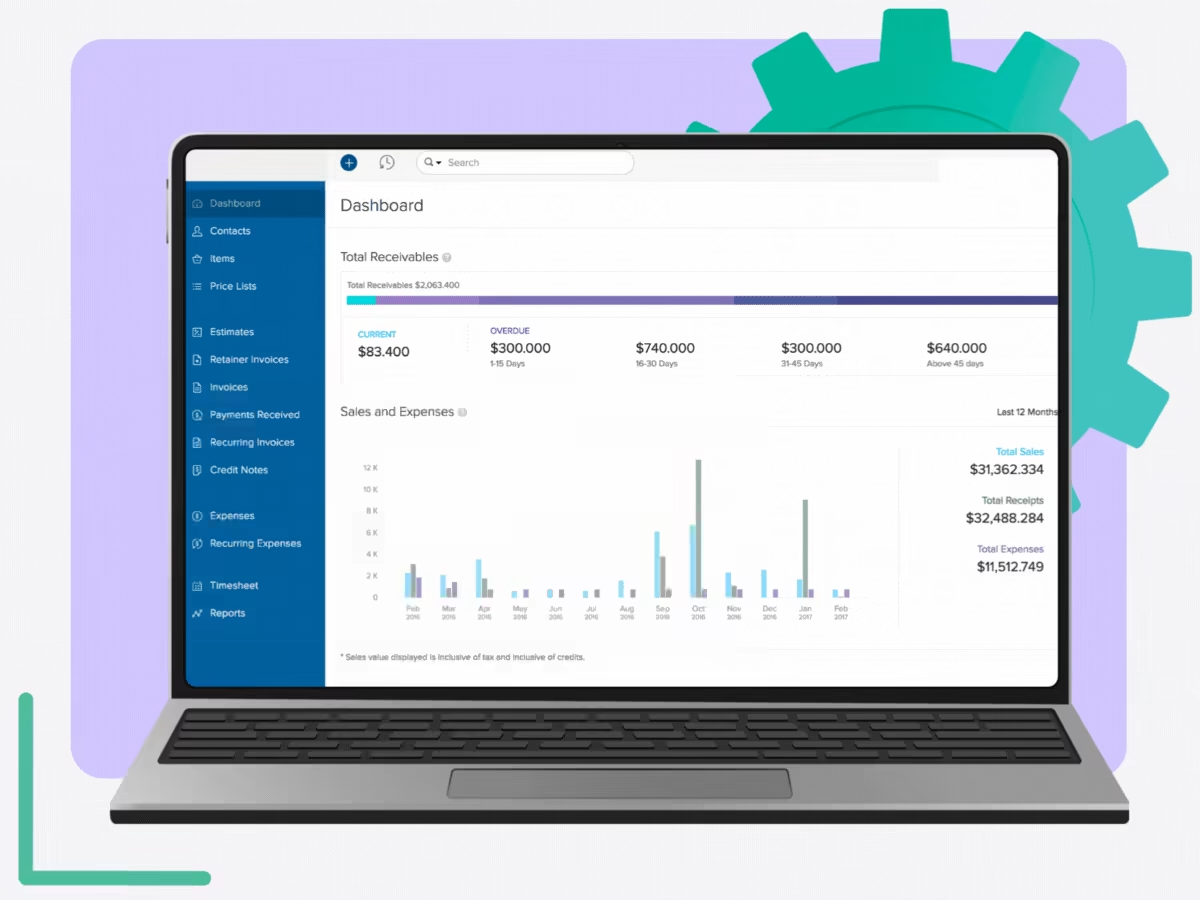

Accurate Invoicing and Payment

We take full charge of your billing cycle, ensuring each invoice is prepared with precision and sent on time. Our virtual accountants help with accurate, automated invoicing and a smoother payment experience for your clients.

Enhanced Reporting

Get real-time visibility into your receivables through customized reports that give you clarity on ageing balances, payment trends, and cash forecasts, helping you reinforce your decision-making process.

Reliable Compliance Support

Our team ensures your AR processes comply with U.S. tax laws and financial reporting standards, including GAAP, IRS Section 451 for revenue recognition, and state-specific sales tax regulations.

Hire an Accounts Receivable Specialist Who:

Why Choose Us?

-

Value-Driven Accounting

We don’t just manage your receivables; we turn them into financial insights that empower smarter cash flow and credit control decisions.

-

Accounting Automation

Our AR specialists use advanced automation tools and AI to streamline your accounts receivable processes, ensuring faster collections and fewer errors.

-

Outsourcing Experience

With over 10 years of experience, we bring seamless, efficient, and trustworthy accounts receivable support to global businesses like yours.

-

Dedicated Accountants

You’ll work with a dedicated team of receivable specialists who understand your billing cycles, customer patterns, and AR priorities.

-

Real-time Support

Get immediate answers and assistance when it matters most! Our AR specialists are always ready to support your operations in real-time.

-

Significant Cost Savings

Outsourcing accounts receivable to us can cut your internal costs by up to 60%, a direct boost to your financial efficiency and ROI.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

We are ISO 9001:27001 and SOC 2 organization and follow strict protocols. With advanced encryption, cloud security, compliance with international regulations, and confidentiality agreements, we ensure your financial data is secure.

Our outsourced accounts receivable services come with a flat rate that can be customized according to your business requirements. Outsourcing accounting services come with significant savings, often up to 60%, compared to in-house staffing, without compromising quality or compliance.

Our AR specialists typically work across multiple industries such as real-estate, healthcare, e-commerce, and hospitality services, ensuring that your invoicing, credit policies, and payment follow-ups align with standard practices and compliance expectations.

Communication is handled via your preferred channels such as Slack, Teams, email, or Zoom calls with dedicated AR managers or teams. You’ll receive regular status updates, escalation protocols, and clear SLAs for timely follow-up and resolution.

Yes, our AR specialists are proficient in platforms like QuickBooks, Xero, Zoho Books, MS Dynamics, and NetSuite. Before onboarding, the team is aligned with your system, and custom workflows are set up to ensure seamless integration.

Yes, you’ll get a dedicated accounts receivable specialist who manages your invoicing, follow-ups, and collections, ensuring timely payments and smooth communication tailored to your workflow.

Absolutely, our AR operations follow U.S. GAAP, IRS regulations, and state-specific compliance rules. Accounts receivable processes are handled in line with U.S. standards, with audit-ready documentation maintained.

You can choose the reporting cadence; daily, weekly, bi-weekly, or monthly based on your needs. We offer AR reports such as outstanding balances, aging analysis, collection efficiency, and other KPIs to help you monitor cash flow and AR health.

Owing to our well-established outsourcing process, we can get you started within 48 hours of initial consultation and signing the scope of work.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Accounts Receivable Services: Steady Cash Flow for US Firms

Managing receivables in-house can strain your team and cash flow. Our outsourced accounts receivable services help you stay ahead with streamlined processes, timely collections, and full visibility while reducing overheads and improving customer experience.

Get a CallOur outsourced accounts receivable services significantly cut down on hiring, training, and tech costs. You pay only for what you need, freeing up capital while maintaining efficiency in your accounts receivable process.

With 10+ of experience, we’ve built a proven, end-to-end accounts receivable management process to ensure consistency and faster collections.

We ensure your accounts receivable process are fully compliant with US GAAP and IRS regulations, reducing audit risks and penalties. Our team stays updated with the latest federal and state compliance rules to safeguard your financial operations.

You get a dedicated accountant working exclusively on your accounts receivable management, ensuring personalized attention, faster response times, and consistency.

Our team is proficient in cloud-based tools such as Zoho Books, QuickBooks, Xero, NetSuite, and MS Dynamics to give you complete visibility into your accounts receivable process.

When you outsource accounts receivable services to us, your data is properly safeguarded. Our process is bound by bank-grade encryption, access controls, and compliance protocols to keep your financials safe and secure.

Our team communicates with you through secure platforms such as MS Team, Zoom, and Slack. Moreover, we use Dropbox, Google Drive, and OneDrive to collaborate with teams securely.

Whether you’re growing fast or managing seasonal demand, our outsourced accounts receivable services scale up or down easily, without disrupting your current workflow or compromising the accounts receivable process quality.