In This Blog Post

Share This Article

- Published: Sep 22, 2023

- Last Updated: Jan 18, 2025

- 🔊 Listen

It is no secret that accounting can be a complicated and daunting task, especially when it comes to reconciling your business transactions. However, taking time to properly reconcile your accounts can save you money, prevent errors, and provide valuable insights into your financial health. It is an important business process that ensures the reliability of your financial statements and reports. Whether the accounts reconciliation process is managed with the help of an in-house professional or outsourced accounts reconciliation services provider, having a basic understanding of the process enables businesses to have a better insight into the process. Therefore, before you indulge in reconciling your accounts, it is crucial to understand what it is, why it is important, and how it is done. To help you out, we have prepared a comprehensive guide covering everything you need to know about accounts reconciliation. Let us take a look at this ultimate guide to accounts reconciliation for businesses in detail.

What is Accounts Reconciliation?

Accounts reconciliation is the process of comparing an organization’s financial records to ensure that they are accurate and complete. This process involves comparing the data in the organization’s accounting system to external sources, such as bank statements or vendor invoices, to verify that the information is correct.

Accounts reconciliation is an important task for businesses because it allows them to identify errors or discrepancies in their financial records and correct them before they turn into bigger problems. By reconciling accounts regularly, businesses can also ensure that their financial statements are reliable, which is important for making informed business decisions. It can be done on a regular basis, such as monthly or quarterly, to ensure that there are no discrepancies in your records.

The accounts reconciliation process can be time-consuming and complex, so it is often done by experienced in-house accountants or accounts reconciliation services providers. Furthermore, software tools can also help businesses automate the accounts reconciliation process, making it faster and more efficient.

What are the different types of Accounts Reconciliation?

To ensure the accuracy and reliability of a business’s financial data, it is crucial to reconcile the records, and based on different business functions, there are different types of accounts reconciliation. There are 4 main types of reconciliations:

-

Bank reconciliation:

This compares your company’s bank statements with your internal records to ensure zero discrepancies.

-

Credit card reconciliation:

This ensures that all transactions on your credit card statement match the corresponding entries in your records.

-

Loan reconciliation:

If you have a loan from another business or institution, you will need to reconcile the balance periodically to make sure you are making payments according to the loan agreement terms.

-

Investment reconciliation:

This compares your records of investments (such as stocks, bonds, and mutual funds) with the current market value to ensure that the investment values in your records are accurate.

How to perform Accounts Reconciliations?

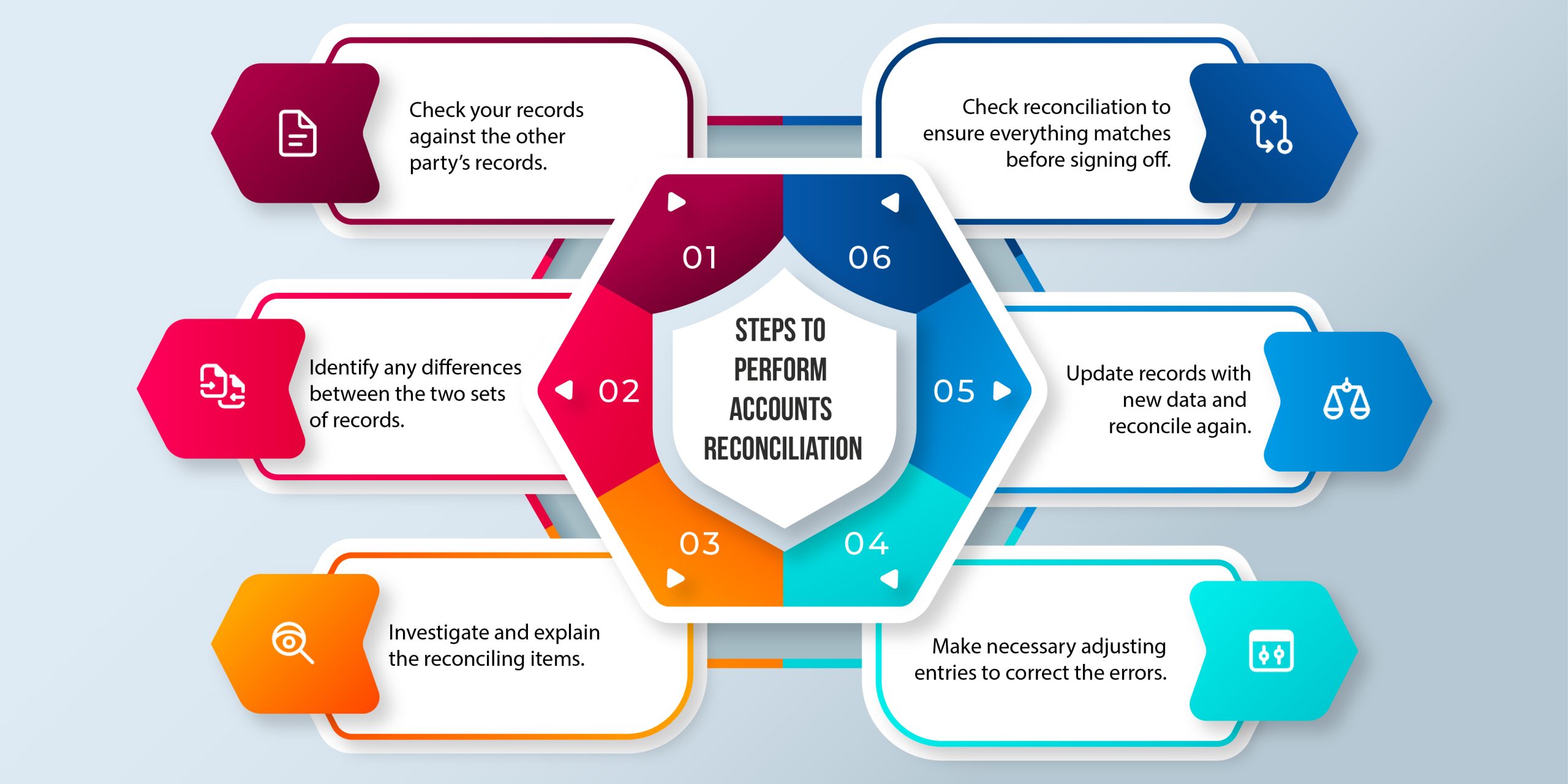

To reconcile accounts, you need to follow these steps:

- Check your records against the other party’s records. It can be done by looking at statements, invoices, and receipts or by using accounting software.

- Identify any differences between the two sets of records. These differences are called reconciling items.

- Investigate and analyze the reason behind the reconciling items. It may involve talking to employees, customers, or suppliers.

- Make adjustment entries in your records as necessary to correct any errors.

- Update your records with the new information and reconcile again until there are no more reconciling items.

- Check the reconciliation and make sure everything agrees before signing off on it.

How Frequently Should a Business Conduct Accounts Reconciliation?

Accounts reconciliation is a process that needs to be conducted regularly. However, the frequency of this process varies for different types of reconciliations based on the specific requirements of a business. It is recommended to conduct bank account reconciliation and credit card reconciliations at least once a month. But, in the case of credit cards, many businesses conduct reconciliations more frequently, such as bi-monthly or quarterly, depending on the volume of transactions through credit cards and the financial needs.

In the case of loan accounts, reconciliation should be done at least quarterly. The frequency of reconciliation can be increased if there are some significant changes in the loan portfolio or signs of discrepancies. Reconciliation is also important at the time when the loan is paid off. The ideal frequency of investment account reconciliation is at least monthly or quarterly. Businesses should also conduct ad-hoc reconciliations whenever there are significant changes or any events that affect the investment accounts, such as acquisitions, mergers, or major investment decisions.

All other types of accounts, such as accounts payables, accounts receivables, etc., may require more frequent reconciliations like weekly or even daily reconciliations. This frequency depends on the volume and importance of business transactions. Businesses must establish a reconciliation schedule that suits their needs and helps maintain accurate and reliable business records.

The Benefits of Accounts Reconciliation

There are many benefits to reconciling your business accounts regularly. Perhaps the most obvious benefit is that it helps ensure the accuracy of your financial records and your accounting and bookkeeping process. By regularly comparing your records with supporting documents, you can catch any discrepancies and ensure your books are balanced.

Another important benefit of reconciliation is that it can help you identify and prevent fraud. These threats can significantly affect your business’s operations and financial stability. By reconciling your accounts on a regular basis, you can help protect yourself against possible malpractices, thefts, and other types of fraud.

By reconciling cash flows regularly, businesses can maintain an accurate and up-to-date understanding of their cash position. This includes knowing the amount of cash at hand, outstanding payments, pending receivables, and other factors affecting liquidity.

Finally, reconciliation can give you peace of mind. When you know that all of your accounts are up-to-date and in order, it can help reduce stress and anxiety around financial matters. Hence, it allows you to focus on other aspects of running your business.

Tips for Successful Accounts Reconciliation

It is a well-known fact that accurate accounting and bookkeeping are essential for every business’s success. However, the chances of having errors are also there, as managing the records is a complex process. That is why regular and efficient accounts reconciliation is necessary. Since we have already discussed the benefits of regular accounts reconciliation, let us now look at some tips to ensure successful accounts reconciliation.

-

Keep good records:

It may seem like a no-brainer, but it is important to have a system for tracking your income and expenses. It will simplify the reconciliation process and help you catch any mistakes that might have been committed along the way.

-

Compare your records to relevant supporting documents:

Once you have your records in order, take some time to compare them to relevant supporting documents. It will help you identify any discrepancies and will give you a better understanding of where your money is going.

-

Make adjustments as needed:

If you find any discrepancies between your records and your bank statement, make the necessary adjustments in your records. It will ensure that everything is accurate and up to date.

-

Stay on top of it:

Reconciling your accounts on a regular basis will help you catch errors early and prevent them from snowballing into bigger problems down the road. Set aside some time each month to review your records and update your books accordingly, and this will help you stay on top of your records.

By following these tips, you can ensure that your account reconciliation process is successful and that your financial records are accurate and up to date. You can handle this process on your own or with the help of your in-house accountant or through outsourced service providers offering accounts reconciliation services, bank reconciliation services, etc.

Conclusion

Accounting systems are becoming increasingly complex, but with diligent monitoring, accurate record-keeping, and good communication between stakeholders, reconciling your accounts should be a breeze. The benefits of regular reconciliations far outweigh any potential hassle – better cash flow management and improved financial understanding. It leads to more informed business decisions, making the reconciliation process an important step for businesses today.

The complexity and regular requirements of this process make it difficult to manage it in-house as it involves investing significant time and resources to conduct and execute the process accurately. So, the next best solution is hiring outsourced service providers. Choose an expert service provider, such as Whiz Consulting, to help you with the process. At Whiz Consulting, we offer customized accounting and bookkeeping services based on your needs with the help of our experts with years of experience and proficiency in different accounting software. So, make the right choice and choose the best solution for your business to ensure futuristic growth.

Get customized plan that supports your growth