Table of Content

Share This Article

- Published: October 12, 2023

- Last Updated: March 5, 2025

Have you ever struggled with keeping track of your finances? Do you get overwhelmed by all the numbers and accounts that come with managing your business or personal finances? Well, fear no more! Accounts reconciliation is here to make your life easier. Whether you are a small business or a large business owner, or just someone trying to stay on top of their finances, this ultimate guide to the reconciliation of accounts will provide you with all the knowledge and tools necessary to keep everything in check. So, sit back, relax, and let us dive into the world of accounts reconciliation!

What is Accounts Reconciliation and Why Is It Important?

Account reconciliation is a critical aspect of accounting that involves comparing financial records in order to identify discrepancies and ensure accurate reporting. It involves examining individual transactions and statements from various sources, including banks or credit card providers, against the business’s internal financial records, such as general ledger accounts. This process allows accountants to verify that all recorded transactions are correct and accounted for appropriately. Additionally, effective accounts reconciliation helps businesses maintain integrity in their financial statements by highlighting errors or omissions that may jeopardise asset management or hinder decision-making processes for stakeholders.

In essence, it provides an opportunity for businesses to fine-tune their books by cross-referencing transactions with relevant data points such as bank statements, invoice receipts, and ledger accounts. A failure to reconcile accounts properly can lead to various consequences ranging from audit issues to compliance violations, which ultimately could harm a business’s reputation and bottom line. Hence, it is crucial to recognise that the reconciliation of accounts is a fundamental element in every business, serving as the cornerstone for maintaining the financial well-being of businesses and meeting regulatory compliance requirements.

What Are the Different Types of Reconciliation?

-

Bank Reconciliation:

Bank reconciliation involves matching a business’s bank statement with its own internal accounting records to ensure that all transactions have been recorded correctly. Any differences in amounts must be investigated and resolved.

-

Vendor Reconciliation:

Vendor reconciliation refers to the process of verifying and settling transactions between a business and its suppliers or vendors. It involves reconciling the purchase amounts with the corresponding payment amounts to ensure the accuracy and completeness of the transaction records. This process helps businesses maintain good relationships with their vendors by ensuring timely payments.

-

Intercompany Reconciliation:

Intercompany reconciliation checks the balance between two related entities within the same corporate structure (of the same parent company). The goal is to eliminate any imbalances or errors in shared accounts and create accurate financial statements for both entities.

-

Business-Specific Reconciliation:

Business-specific reconciliation involves analysing the unique transactions and financial activities associated with a particular industry or business type. For instance, an e-commerce business that specialises in selling clothing online regularly performs business-specific reconciliation to ensure financial accuracy. They compare their internal sales data, which includes the number of clothing items sold and the revenue generated, with the data from their payment gateway. This helps them identify and resolve any discrepancies, ensuring that their financial records are precise and that they can promptly address any payment-related issues.

What Is the Ideal Time to Perform Accounts Reconciliation?

When it comes to the reconciliation of accounts, timing is key. The ideal time for reconciling accounts varies depending on the size and complexity of a business. But in general, it is recommended to perform accounts reconciliation at least once a month or more frequently if transactions are heavy. This helps ensure that all transactions are accounted for and any discrepancies are quickly identified and resolved. Additionally, accounts reconciliation should ideally take place after all transactions have been processed but before accounting entries are finalised for a particular period. This allows for adequate time to review and address any discrepancies while still ensuring that financial reporting deadlines are met in a timely manner. Overall, consistent attention paid to accounts reconciliation will provide a stronger sense of control over your business’s finances- which helps drive long-term growth strategies with confidence!

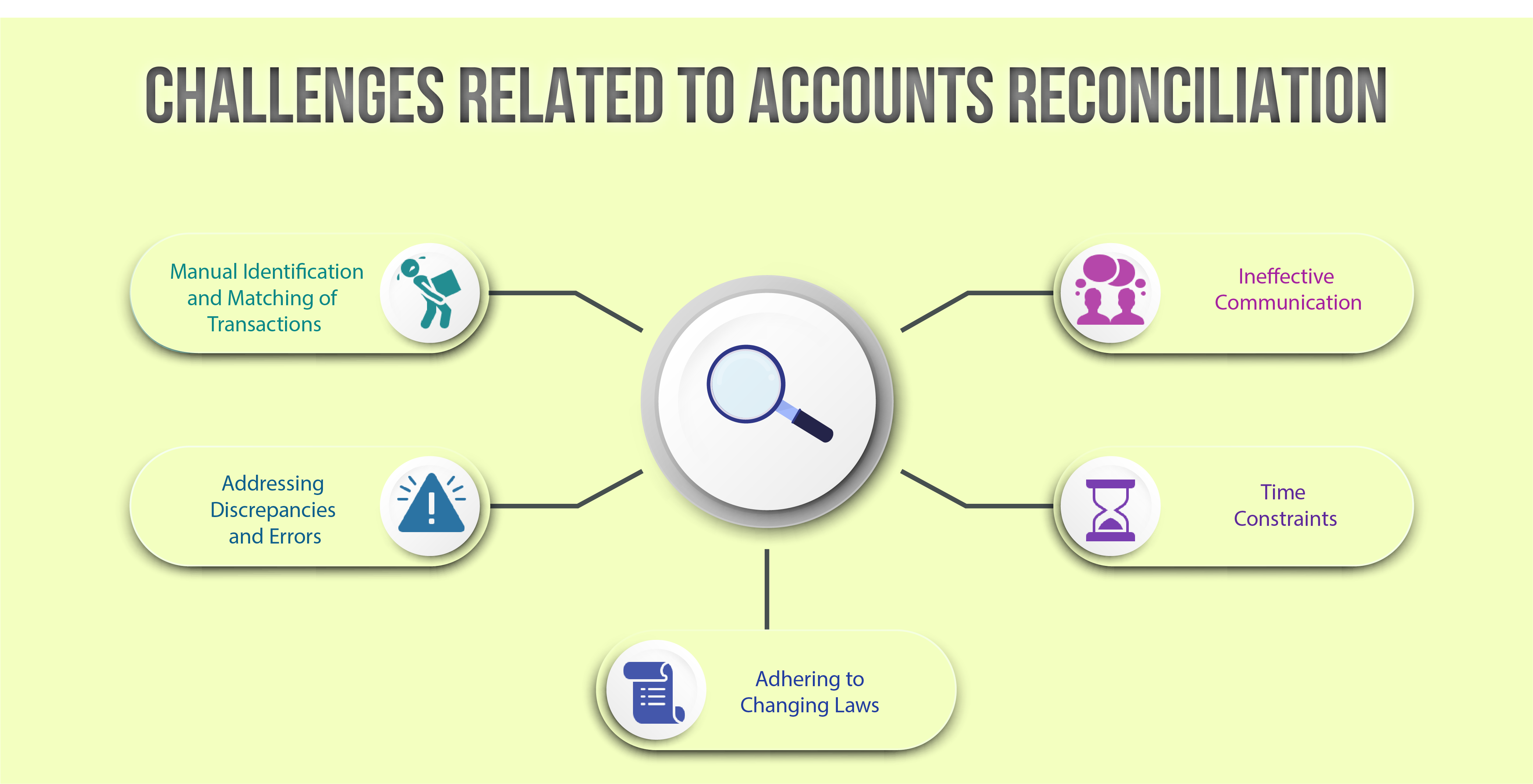

Challenges Associated With the Accounts Reconciliation Process

-

Identifying and Matching Transactions:

One common challenge related to accounts reconciliation is identifying and matching transactions accurately. This requires a lot of manual effort, which can often lead to errors or delays. However, it can be avoided by using cloud-based accounting software such as QuickBooks, Sage, Xero, etc. This way, you will be able to eliminate all the human errors and ensure accurate identification and matching of transactions.

-

Addressing Discrepancies:

Another significant challenge associated with accounts reconciliation is addressing discrepancies and errors that are identified during the process. These issues may arise due to incorrect or missing data entry, fraud, or other factors. Though resolving these discrepancies can be time-consuming, it can be done through a robust bookkeeping system and effective coordination among departments.

-

Adherence to Changing Laws:

The next challenge is to keep up with the changing regulations and compliance requirements. With a team of high-skilled professionals who are well-versed regarding the latest laws and regulations, it can become easy to keep up and comply with the ever-changing laws and regulations. In this matter, relying on an outsourced accounting and bookkeeping services provider can work wonders. These service providers comprise of a team of accounting and bookkeeping experts who are well-aware of all the relevant laws and regulations, thereby helping eliminate potential fines and legal penalties.

-

Timing Constraints:

Another major challenge is time constraints, as reconciling large amounts of data can take a significant amount of time and resources. When schedules are tight, it becomes challenging to allocate sufficient resources toward tackling this task without sacrificing other critical business activities. However, all of this becomes quite easy by leveraging accounting technologies under the expert assistance of an accounting and bookkeeping services provider. These professionals are well-versed in multiple accounting software and can help reduce manual errors, saving significant time and resources for businesses.

-

Ineffective Communication:

Lastly, communication gaps between departments can also lead to accounts reconciliation failure. Poor coordination may cause delays in obtaining required documents or identification of any irregularities during the process. Such a challenge can be tackled by developing proper workflow and implementing robust communication channels among departments.

How Outsourcing Tackles Accounts Reconciliation Challenges?

Outsourcing has become an effective strategy to overcome the challenges related to the reconciliation of accounts. Outsourcing the reconciliation process to a third-party provider can help overcome the challenges in several ways. Firstly, outsourcing allows businesses to tap into the expertise and experience of professionals who specialise in this field. These providers have dedicated teams with extensive knowledge and skills in handling different types of transactions across various industries.

Secondly, outsourcing eliminates the need for businesses to invest significant resources (time, money, manpower) into developing internal capabilities for reconciling accounts effectively. This way, they can focus their energies on their core competencies rather than spending excessive time on tasks that fall outside their area of expertise.

Thirdly, outsourcing ensures cost savings by reducing overhead expenses related to hiring additional staff to manage the monthly accounts reconciliation workload. Outsourced services providers offering reconciliation services bring proven processes and technologies designed specifically for this type of work so that business owners do not make any substantial investments upfront; instead pay only for services used, thus realising long-term cost advantages.

Hence, by choosing outsourcing as a strategy when dealing with accounts reconciliation challenges, you receive high-quality services resulting in substantial cost savings, enabling you to allocate resources elsewhere within your business strategically.

Conclusion

There is no question that accounts reconciliation is important for every business to ensure accurate and up-to-date financial records. However, managing all of this on your own can be a bit complex. The solution lies in finding an expert accounting services provider who can help navigate all the complexities associated with accounts reconciliation. If you are looking for a suitable service provider but are in a quandary as to which service provider is the best for your business, rest assured, Whiz Consulting has got you covered. Our team of qualified accountants and bookkeepers will ensure that your reconciliation process is accurate, consistent, and reliable for optimal results. This way, you will be able to prioritise the essentials without having to fret about tedious administrative tasks. Contact us today to bid farewell to reconciliation worries and hello to precise outcomes.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.