-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

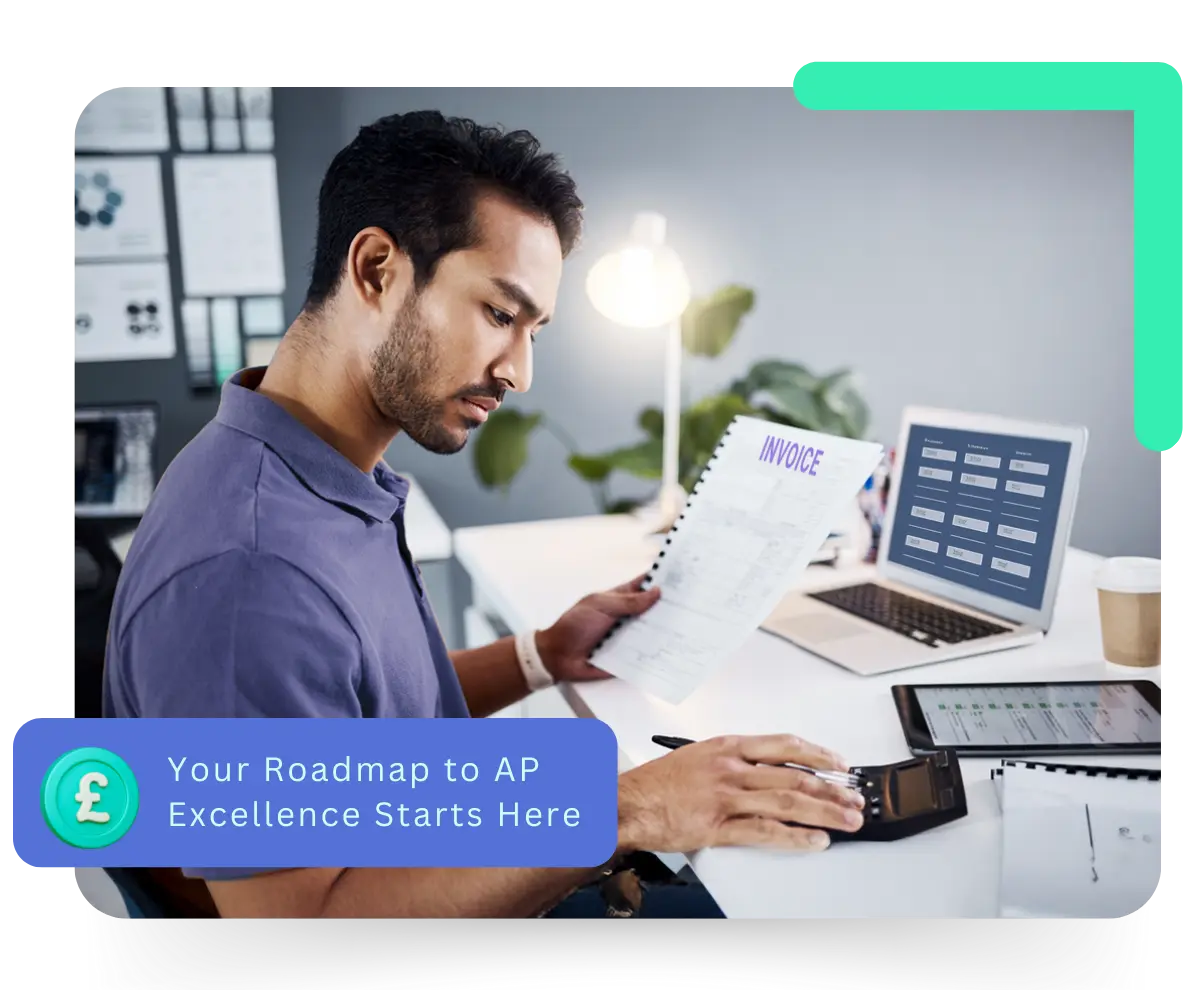

Hassle-Free Accounts Payable Services for Smooth Cash Flow

From tracking due dates to capturing every invoice detail, managing accounts payable can feel like an uphill struggle. That’s why we provide comprehensive outsourced solutions to simplify your accounting process. With our expert team managing it all, you can trust that your bills are paid on time, keeping your cash flow running seamlessly.

Outsourced Accounts Payable Services We Offer

- Invoice Processing & Management

- Vendor Management & Reconciliation

- Payment Scheduling & Processing

- Expense Tracking & Reporting

- Compliance & Regulatory Adherence

Challenges We Tackle for You

Managing accounts payable can be complex, but with our 10+ years of experience, you can overcome common accounts payable challenges effortlessly.

Late or Missed Payments

Our outsourced accounts payable services guarantee that all payments are processed on time, minimizing the chances of overdue bills and penalties. Forget the stress of missed deadlines and enjoy the assurance of prompt, consistent payments.

Inaccurate or Misplaced Invoices

Using cutting-edge accounts payable automation, we capture every aspect of your invoices, from payment terms to itemized details, ensuring flawless transactions. By digitizing and organizing your invoices, we save you the hassle of sifting through stacks of paperwork, making retrieval effortless.

Challenges in Managing Cash Flow

As experienced accounts payable professionals, we streamline your payment schedules to sustain healthy cash flow and prevent operational hiccups. By optimizing payment timing and uncovering early payment discount opportunities, we help you manage outgoing funds with precision.

Streamline Your Accounts Payable Process with Ease!

At Whiz Consulting, we turn your accounts payable process from a challenge into a hassle-free experience. By working with us, you gain access to experienced professionals, advanced technology, and proven methods that reduce risks, cut costs, and boost efficiency. From managing vendor relationships to ensuring full compliance with payment regulations, we deliver a bespoke solution for seamless accounts payable management.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner may sound like a task, but with Whiz, it’s completely stress-free. We support you at every step, guaranteeing a seamless transition without downtime or disruptions. Leave your bookkeeping to us, so you can focus on what you do best.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Why Choose Us?

-

Innovative Workflow

We utilise cutting-edge technology and proven best practices to design streamlined workflows that guarantee accuracy, efficiency, and the timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you to ensure effective communication and a thorough understanding of your bookkeeping needs. Whether it’s a quick update or a strategic discussion, we’re always just a call away.

-

Decade of Experience

With over 10 years of industry expertise, we have a proven history of helping businesses across various sectors stay organised and financially sound.

-

Dedicated Experts

Our team comprises highly skilled and certified professionals, dedicated to supporting your business. From accountants to financial analysts, we have the expertise to tackle your unique challenges.

-

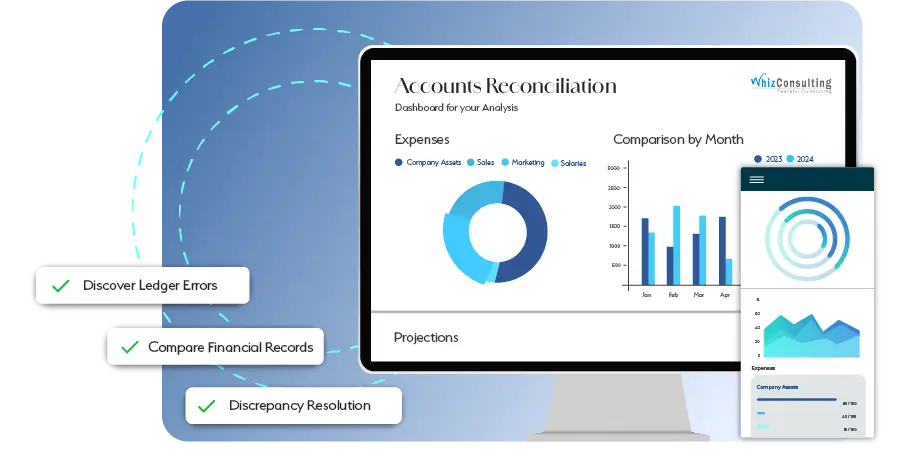

Real-Time Insights

Enjoy a clear, up-to-date view of your financial health at any time. Our real-time reporting and dashboards provide actionable insights to help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us reduces overhead costs. Our scalable services are tailored to your needs, saving you the expense of hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimising disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Yes, outsourcing accounts payable can be a cost-effective solution for small businesses. It allows small businesses to benefit from expert AP management without the overhead of hiring full-time staff.

Outsourcing gives you peace of mind by letting accounts payable specialists take care of time-consuming tasks, so you can focus on growing your business.

Automation simplifies your accounts payable process, reduces errors, and speeds up payments, giving you more time to focus on what matters most.

Absolutely! By streamlining processes and managing payments better, accounts payable outsourcing can help boost your turnover ratio and cash flow.

Not at all. Outsourcing gives you real-time visibility and full control, with experts managing the details to ensure everything runs smoothly.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Accounts Payable Outsourcing Services

With the growing trend of remote work, many businesses are adopting accounts payable outsourcing services. They are a great solution as business get to manage their AP functions seamlessly from anywhere using cloud-based software, automation tools, and expert virtual teams.

Get a Call

You can easily manage your accounts payable from any location with ease, thanks to the technology and tools offered by accounts payable outsourcing services. This allows for streamlined processes, improving efficiency in your accounts payable process.

You work with skilled professionals, who understand the complexities of the process. They bring expertise to ensure best practices and optimization of the accounts payable turnover ratio.

We ensure adherence to financial regulations and robust data protection practices with expert outsourced AP service providers. This reduces the risks of non-compliance and safeguards sensitive financial data.

Our experts reduce overheads associated with in-house AP management by leveraging the cost-effective nature of accounts payable outsourcing. This allows businesses to allocate resources more strategically, improving the overall financial health.

We leverage accounts payable automation and professional oversight to minimize errors and enhance accuracy in your accounts payable process. With automated systems in place, you can ensure timely payments and improve overall efficiency.