-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

End-to-End Tax Services for US Businesses

Focus on growing your US-based business while we handle your taxes with precision. With over a decade of experience and more than 150 accountants, our professional tax services help with filing forms for LLCs, Sole Proprietors, Partnerships, and S and C corporations. With us, you get dedicated support in filing federal, state & payroll taxes, planning for year-end closing, and managing state-specific incentives. Avoid costly penalties, notices, and audits with accurate, IRS-compliant tax filings handled by experienced professionals.

Expert Tax Services for Every Business Structure in the US

Our team of tax specialists is here to guide you through the complexities of filing taxes, no matter your business structure.

S-Corporation

We simplify the filing process for S-corporations, by taking care of Form 1120-S and Schedule K-1, as well as payroll Forms 941, 943, and 940, W2, W3. Additionally, our tax planning services ensure smooth filing for S-corporation shareholders, including Forms 1040, 1040-SR, Schedule E, and 1040-ES.

C-Corporation

Our professionals assist with preparing and filing Forms 1120 , along with all employee-related forms, such as 940, 941, W-2, W-3, W-9, 1099-NEC, and 1096.

Partnership

Partnerships are required to file annual information returns to report income, deductions, and profits. We handle the filing of Form 1065 (Schedule K-1), along with payroll forms 940, 941, 943, 1099-NEC, W2, W3, and 8990.

LLC

Whether you’re filing as a single-member LLC or electing to treat your LLC as a Partnership or Corporation, we offer comprehensive assistance with Forms 1040, 1040-SR (Schedule E), and 8849.

Sole Proprietorship

As a sole proprietor, you need to file Forms 1040, 1040-SR, and Schedule C to report your profits and losses.

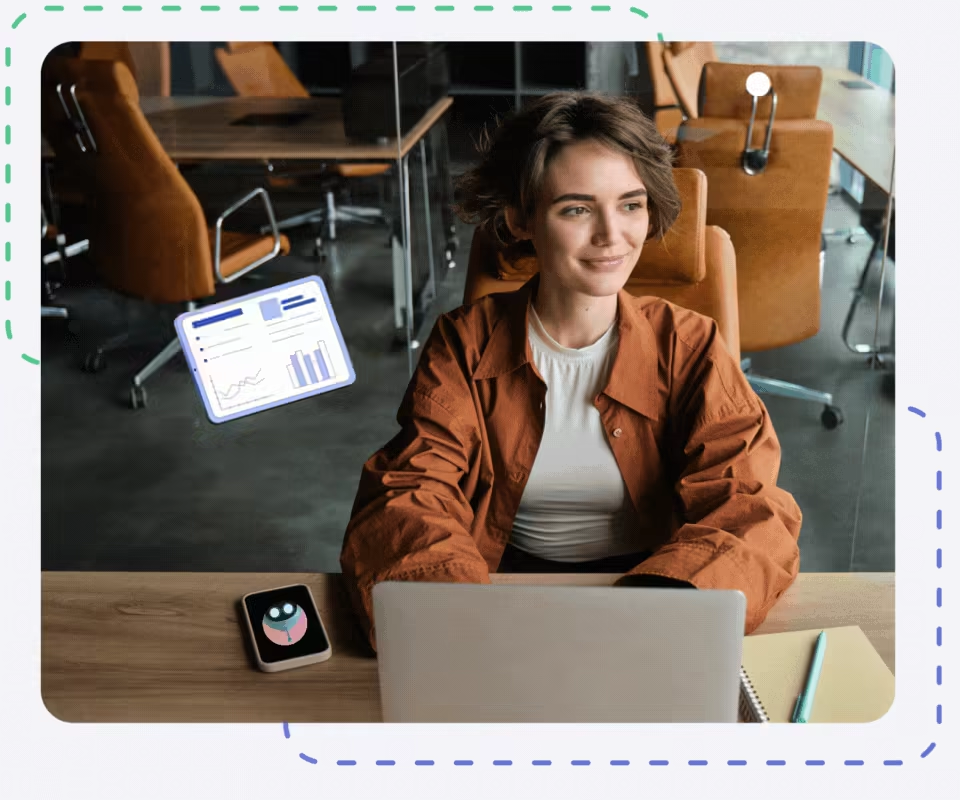

Hire an Expert US Tax Specialist Who:

Why Choose Us?

-

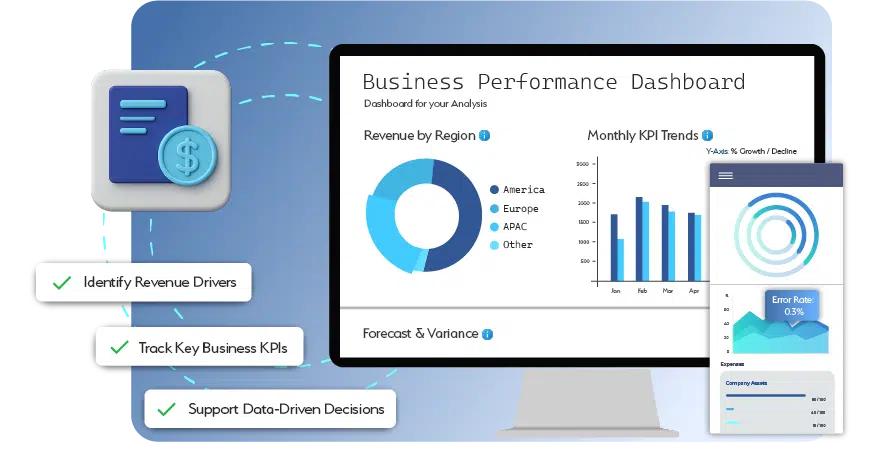

Value Driven Accounting

We deliver clear, actionable insights that help you make informed decisions, optimize tax strategies, and plan with confidence.

-

Accounting Automation

Using AI-driven tools and automated workflows, we streamline tax preparation, calculations, and filings.

-

Wide Outsourcing Expertise

With over 10 years of experience, we offer a reliable offshore partnership that’s built on precision, compliance, and trust.

-

Dedicated Tax Specialist

Work with a dedicated team of tax specialists who understand your business structure and deliver customized solutions.

-

Real-Time Support

Receive prompt guidance, updates, and ongoing tax support. We ensure that your business meets tax deadlines effortlessly.

-

Cost Efficiency

Outsourcing your tax functions to us can reduce operational costs by up to 60%, helping you improve profits while maintaining IRS compliance.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

As an SOC 2 and ISO 27001 certified F&A service provider, we keep your financial data completely secure. Our experts have strict access controls, bank-grade encryption, and multi-factor authentication in place to avoid data breaches.

You can start with our tax preparation services within 48 hours after signing the scope of work. Once onboarded, leave the challenges of meeting tax compliance with us, while you focus on scaling your business with full force.

With our tax services, you get to save up to 60% on overhead costs, while accessing a team of experts who help you file, register, and submit necessary forms.

Yes, our skilled virtual accountants can update your books, even if they haven’t been updated for a whole year.

Our professional virtual accountants will take over the responsibility of completing your books on time, so you can meet necessary deadlines without any complexity.

Yes, you will be assigned a committed tax accountant who will help you with filing your tax returns, optimizing your savings, and keeping you updated with the latest requirements.

Our virtual accountants connect with you via secure platforms, such as Google Meet, Slack, Microsoft Teams, and Zoom. Moreover, we make use of Google Drive, OneDrive, Dropbox, and to securely collaborate with your teams.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Tax Services for US Firms: Plan, Prepare & Strategize with Dedicated Support

At Whiz Consulting, we have been delivering trusted tax preparation services to US businesses for over a decade. Whether you want to outsource a specific tax function or require end-to-end finance and accounting support, we have the scale and expertise to manage it seamlessly. With a team of 150+ qualified accountants, we ensure secure, accurate, and dependable tax planning services tailored to your business structure.

Get a CallOur outsourced tax services help you reduce overhead while maintaining high-quality outcomes. You gain access to experienced professionals at a fraction of in-house costs, allowing you to redirect resources toward growth.

Our virtual accountants are well-versed in US GAAP, IRS regulations, and state-level tax compliance. From W-2 and 1099 reporting to Forms 1065 and 1120, we manage filings meticulously.

Our dedicated tax specialists bring years of expertise in supporting US-based businesses, offering industry-specific financial reporting, compliance support, and strategic tax insights aligned with their goals.

We follow a structured and proven outsourcing process that allows you to onboard in as little as 48 hours. Our workflows ensure a smooth transition and ongoing day-to-day accounting and tax operations.

We align with your time zones and workflows to ensure clear communication via Google Meet, Slack, Zoom, and MS Teams. Further, we use secure platforms, such as Hubdoc, Google Drive, and OneDrive, to share files and documents safely with you.

Our accounting outsourcing services scale with your business, whether you are a fast-growing startup or an established enterprise expanding to new states.

Your confidential financial data is protected with bank-grade security measures, encrypted access controls, and compliant protocols. Our business tax services ensure your financial information remains confidential, so you can enjoy peace of mind.