-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

Offshore Accounting Staffing: Hire Skilled Talent for Your US Firm

With our offshore staffing model, you gain access to qualified accounting professionals who manage your books, payroll, inventory, financial reporting, and more, without the overhead or hiring challenges of building an in-house department. With over 10 years of offshore staffing experience and a proven delivery framework, we recruit, train, and manage talent that aligns with your systems, processes, and time zones, so you can stay focused on scaling your business.

Choose Your Dedicated Offshore Accountant

Let our seasoned offshore accounting professionals take charge of your books, so you are always financially prepared for your next phase of growth.

Bookkeeping Specialists

Our offshore bookkeepers help you gain clean, precise, and error-free records that translate raw numbers into reliable financial reports, helping you make confident, data-backed business decisions.

Tax Professionals

Our skilled offshore accountants simplify tax compliance by handling sales tax preparation, 1099 filings, and tax returns such as Forms 1120 and 1120-S with accuracy and care.

AP Specialists

Our accounts payable specialists help with creating invoices, maintaining vendor records, reconciling accounts, and processing payments. With outsourcing, you get to save on overhead costs, have no backlogs, and manage vendor payments timely.

Financial Reporting Analysts

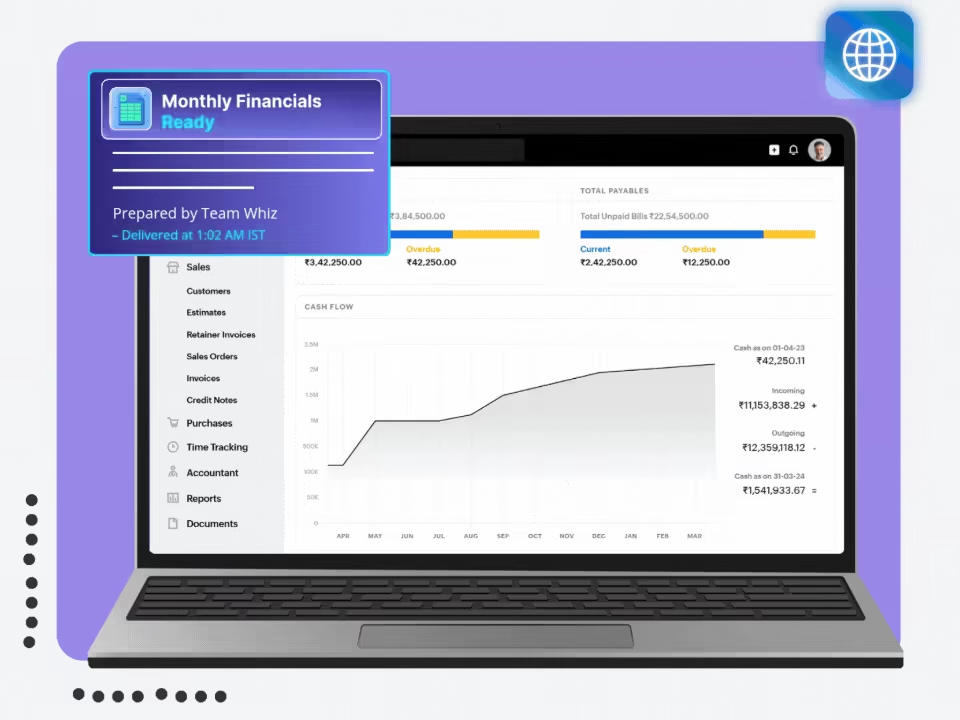

Stay fully informed with timely, in-depth financial reports. Our financial reporting analysts deliver clear profits and performance insights, giving you complete visibility into revenue streams, cash flow, and overall business health.

Hire an Expert Offshore Accountant Who:

Why Choose Us?

-

Value Driven Accounting

With our offshore staffing solutions, gain actionable financial insights that help businesses grow with confidence.

-

Accounting Automation

Our experts leverage AI in accounting workflows to improve accuracy, reduce overhead costs, and eliminate manual stress.

-

Wide Offshoring Expertise

Backed by over a decade of experience, we provide a dependable offshore partnership that is seamless, efficient, and built for long-term trust.

-

Dedicated Accountant

Work with a dedicated offshore accountant or team that operates exclusively within your workflows, systems, and reporting structure, just like an in-house hire.

-

Real-Time Support

Get timely responses and continuous support whenever you need it with a responsive team that works as an extension of yours.

-

Cost-Efficiency

With our offshore staffing solutions, reduce bookkeeping costs by up to 60%, freeing up resources to reinvest in other business activities.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

Our offshore staffing model cuts hiring and overhead costs by up to 60% while providing skilled accountants who handle your daily tasks, freeing your local team for strategic work.

Our offshore staff work according to US business hours, ensuring real-time collaboration, faster turnaround times, and seamless integration with your in-house team.

Yes, we provide continuous training on US regulations, accounting software, compliance updates, and client-specific processes to keep our offshore teams aligned and effective.

Yes, as an SOC 2 and ISO 27001 certified finance and accounting service provider, we ensure that your financial data remains completely secure with us.

Yes, you’ll have a dedicated offshore accountant who will work with your team to carry out daily tasks and offer real-time support.

You can communicate directly with our offshore team via email, MS Teams, Zoom, Google Meet, Slack, or other tools, anytime you require.

Our offshore staffing model enables rapid onboarding, allowing you to deploy a qualified accounting professional as little as 48 hours after the scope of work is finalised.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Offshore Staffing Solutions: Empowering Your Business with Dedicated, Skilled, and Reliable Talent

Our offshore staffing solutions allow you to significantly reduce operational costs while improving efficiency across your financial processes. As your offshore staffing partner, we provide dedicated accounting professionals who operate as an extension of your in-house team. Our experts deliver end-to-end accounting support that strengthens your financial foundation, offers consistent reporting, and provides real-time visibility. With the right people managing your financial complexities, you can stay focused on growing your operations.

Get a CallWhether you’re struggling with accountant turnover, rising labor costs, or seasonal workload spikes, our offshore staffing model provides stable, long-term accounting talent while also helping you reduce operational costs.

Our offshore accountants are well-versed in US IRS regulations, sales tax compliance, and payroll reporting. Our experts help you accurately file taxes and maintain regulatory compliance across federal and state requirements.

Our team includes seasoned accounting professionals with hands-on experience supporting US businesses across diverse industries, delivering reliable and precise financial management.

We follow established offshoring frameworks that enable smooth onboarding within 48 hours and ensure long-term management of your accounting operations.

Our team is trained to collaborate effectively, ensuring clear communication via Google Meet, MS Teams, Zoom, and Slack, and provide workflows that align with your operations, and give ongoing support.

Our offshore accounting services grow with your business, so you can scale resources up or down as needed while only paying for the services you use.

As an SOC 2 and ISO 27001 certified F&A service provider, we protect your financial data with advanced security measures, encrypted systems, and strict access controls.