In This Blog Post

Share This Article

- Published: Aug 21, 2024

- Last Updated: Jan 18, 2025

- 🔊 Listen

Truth be told, no one launches a business with bookkeeping in mind. However dull as it might seem, bookkeeping is a task that can’t be neglected! It is the foundation that keeps your finances organized, helping you stay prepared for taxes, comply with various regulations, and make informed business decisions. With the help of modern tools and technology, bookkeeping has become more efficient and accessible. In this ultimate guide, we’ll talk about exactly what is bookkeeping, and explore every major detail that you need to know to keep your business on the right path to success.

What is Bookkeeping?

Bookkeeping is the systematic recording and organization of all financial transactions within a business. It is a fundamental aspect of accounting, concentrating on tracking daily financial activities such as sales, expenses, payroll, and taxes. But what is bookkeeping at its core? It’s the practice that ensures every financial detail is accurately documented, providing a clear picture of the company’s financial health.

Proper bookkeeping is essential for maintaining up-to-date financial records, which are important for effective decision-making and overall financial management. Without accurate bookkeeping, a business risks accounting errors that could lead to financial discrepancies and potential challenges. The correctness of bookkeeping is critical for a company’s future growth and development.

Types of Bookkeeping

Bookkeeping can, therefore, be described as the documentation or recording of all a business’s monetary activities. So, when talking about bookkeeping, one should know about the types of bookkeeping. There are two primary types: It distinguishes between single-entry and double-entry accounting systems.

- Single-entry bookkeeping is simple and can be applied by companies with limited availability of capital. In this method, every transaction is entered just once, normally in the cash book or a special book known as the single-entry book. It is efficient for business organizations with straightforward financial transactions, thus making it more suitable to incorporate bookkeeping for small business ventures.

- Double-entry bookkeeping, on the other hand, is more comprehensive. Every transaction is recorded twice: once as a debit and once as a credit. This method provides a more detailed financial picture, helping to ensure accuracy and detect errors. Double-entry bookkeeping is widely used in the USA, particularly by businesses looking for a reliable way to manage complex finances.

Bookkeeping Basics You Should Know

Understanding bookkeeping basics is essential for managing your business’s finances effectively. When exploring what is bookkeeping, it’s important to recognize the five key bookkeeping accounts that form the foundation of this process:

-

Assets:

These are anything your business owns, including cash, accounts receivable, inventory, equipment, and furniture.

-

Liabilities:

This category includes any debts your business owes, such as accounts payable, loans, and other financial obligations.

-

Revenue/Income:

Revenue is the money your business earns from selling products or providing services. It is an important part of your financial records.

-

Expenses:

Expenses are the costs incurred in operating your business. This includes bills, employee salaries, rent, and other operational costs.

-

Equity:

Equity represents your financial interest in the business. It’s calculated by subtracting your liabilities from your assets.

Most importantly, the accounts are essential for small and medium businesses, especially if they use online bookkeeping services. This will provide the foundation for your business to operate effectively and remain profitable. Before recording any transaction, it’s necessary to understand what debits and credits are. Any entry in your ledger or the bookkeeping software will be either debit or credit.

Difference Between Accounting and Bookkeeping

Bookkeeping and accounting are closely related, yet they serve distinct roles in managing a business’s finances. Bookkeeping is the foundation, systematically recording daily financial transactions like sales, receipts, and payments. Bookkeepers use these records to keep track of a business’s financial activities, ensuring everything is organized and accurate. This process, often handled through online bookkeeping, is crucial for maintaining a clear picture of cash flow, especially in bookkeeping for small businesses.

Accounting, on the other hand, builds on bookkeeping. Accountants take the recorded data, summarize it, and analyze it to provide insights into the business’s financial health. They prepare reports that help businesses make informed decisions and ensure compliance with financial regulations like GAAP (Generally Accepted Accounting Principles). In general, the difference between accounting and bookkeeping can be explained as: while bookkeeping answers “What is bookkeeping?”, accounting answers ” So what?” by interpreting the numbers to guide strategic planning.

Methods of Bookkeeping

In the next part of understanding what is bookkeeping, you need to know there are different methods that one can use while recording financial transactions. Under the cash-based method, transactions are recorded only when money is exchanged — revenue is recognized once payment has been made, and expenses are accrued as they are paid. This method is simple and mainly used for some small-scale businesses.

Compared with cash-based accounting, your income is only recorded in the period you earn it under an accrual-based method, and expenses are typically recognized as soon as they are incurred or consumed. This method is more accurate and generally accepted as per accounting principles.

Choosing these methods depends on your business’s needs and the required financial details.

Importance of Bookkeeping

For businessmen, just knowing what is bookkeeping isn’t enough in the USA. So, here we explain the importance of bookkeeping:

-

Facilitates Accurate Budgeting

Bookkeeping provides a detailed and organized view of your business’s income and expenses. This information is crucial for creating an accurate budget and a roadmap for managing your finances. With clear financial data, you can make informed decisions about where to allocate resources and control costs more effectively.

-

Keeps You Prepared for Taxes

Regular bookkeeping ensures that all financial records are up-to-date and easily accessible. This preparation is vital when tax season arrives, as it prevents the last-minute scramble to find documents. By keeping accurate records, you can file taxes smoothly, avoid errors, and comply with tax regulations.

-

Maintains Organized Records

Consistent bookkeeping ensures that your financial records are well-organized and readily available when needed. This organization saves time and reduces stress, especially during financial audits or when you need to retrieve specific information quickly.

-

Enables Proper Reporting to Investors

Investors rely on accurate financial reports to assess the performance and potential of a business. Regular bookkeeping lets you generate profit and loss statements and other financial reports that give investors confidence in how their money is being used. This transparency helps build trust and supports better decision-making.

-

Aids in Setting and Monitoring Business Goals

By closely monitoring your financial records, you can set realistic business goals and track your progress over time. Bookkeeping allows you to monitor key financial metrics, helping you adjust as needed to stay on course and achieve your objectives.

-

Ensures Compliance with Government Regulations

In the United States, government regulations, such as those from the IRS and other federal and state agencies, mandate that businesses maintain accurate financial records. Regular bookkeeping ensures compliance with these regulations, helping businesses avoid fines, penalties, or legal complications. Accurate record-keeping is necessary for filing taxes correctly and crucial for audits and demonstrating your business’s financial integrity. Meeting these regulatory requirements through proper bookkeeping helps safeguard your business and maintain transparency with the government and stakeholders.

Challenges and Solutions for Bookkeeping for Businesses

Bookkeeping can be challenging for many businesses, particularly small ones. However, with the right tools and strategies, these challenges can be effectively managed.

-

Challenge 1: Managing Time-Consuming Tasks

For small businesses, bookkeeping can quickly become overwhelming, especially when time is limited. Manual data entry, reconciling accounts, and tracking expenses can take up significant time that could be better spent on growing the business.

Solution:

Utilizing bookkeeping software can streamline these tasks, making them more manageable. Software automates many processes, reducing the time needed for manual entry and minimizing errors. For those who find even this daunting, outsourced bookkeeping services can be a game-changer, allowing experts to handle the heavy lifting.

-

Challenge 2: Keeping Accurate Records

Maintaining accurate financial records is crucial but challenging, particularly when the business experiences rapid growth. Inaccurate records can lead to financial mismanagement and compliance issues.

Solution:

Engaging in professional bookkeeping services ensures that your records are accurate and up-to-date. Whether through online or a dedicated bookkeeping service, professionals can help keep your financials in order, ensuring you meet all regulatory requirements.

-

Challenge 3: Cost Efficiency

Hiring in-house bookkeeping staff can be expensive, especially for small businesses. The costs of salaries, benefits, and training can add up quickly.

Solution:

Outsourced bookkeeping services offer a cost-effective alternative. By outsourcing, businesses can access expert bookkeeping without the overhead costs associated with full-time employees. This is particularly beneficial for bookkeeping for small business ventures where budgets may be tight.

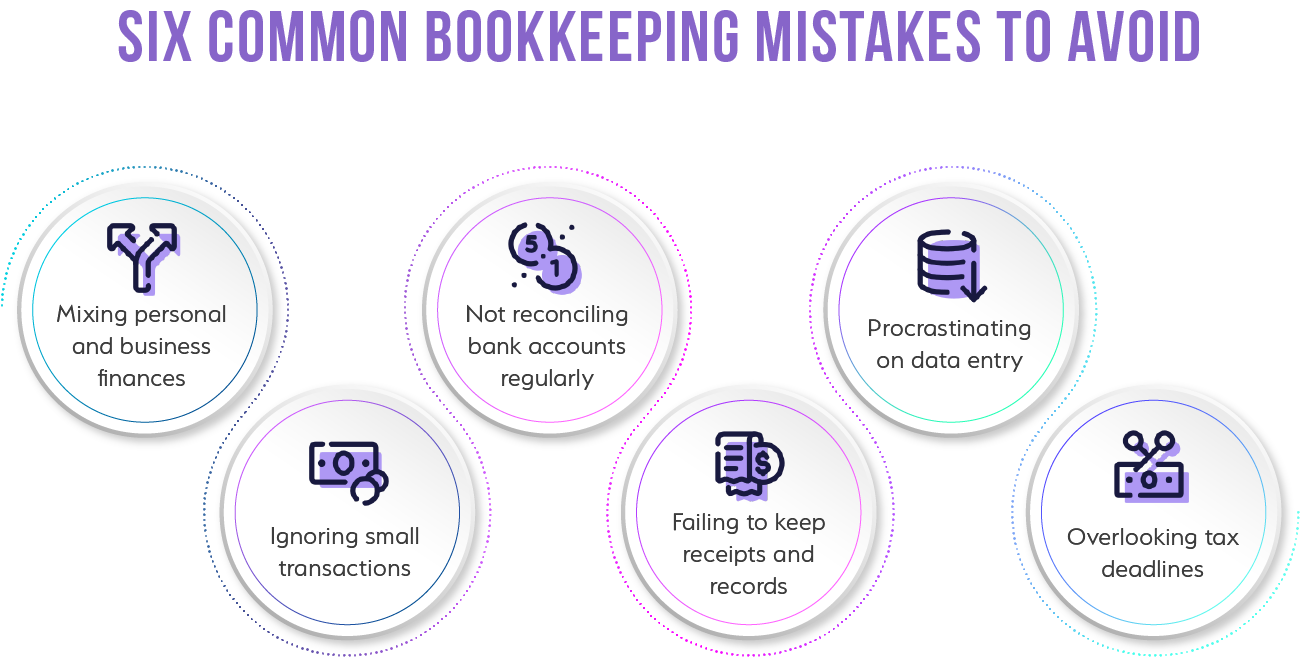

While bookkeeping presents several challenges, solutions like bookkeeping software, outsourced bookkeeping services or online bookkeeping can help businesses maintain accurate records, save time, and stay cost-efficient. Leveraging these tools and services to avoid bookkeeping pitfalls ensures businesses can focus on growth while staying financially organized and compliant.

Outsourced Bookkeeping: Why and When to Consider?

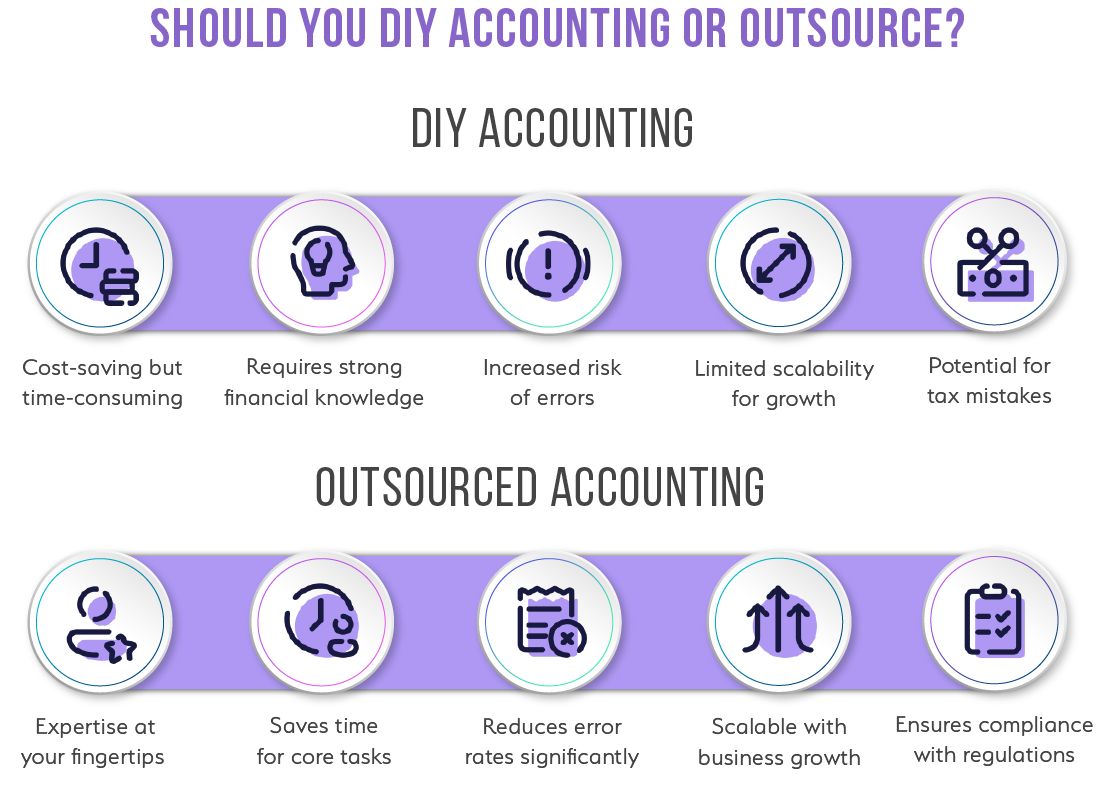

Outsourced bookkeeping is a smart solution for businesses that want to streamline their financial management without handling it in-house. Outsourced bookkeeping services take care of the entire recording and organizing of financial transactions, freeing you from the burden of managing these tasks as your business grows.

Why Consider Outsourcing?

Outsourcing your bookkeeping lets you focus on core business activities while experts handle your financial records. This particularly benefits small businesses and startups, where managing finances can be time-consuming and complex. Bookkeeping firms for startups offer specialized services tailored to the unique needs of new businesses, ensuring that your financials are accurate and up to date.

When to Consider Outsourcing?

Consider outsourcing when your business grows and managing the books becomes too complex or time-consuming. If you’re searching for “bookkeeping services near me,” it’s a sign you might need help. Also, if you’re already using online bookkeeping but still feel overwhelmed, outsourced bookkeeping services can provide peace of mind.

Outsourcing accounting and bookkeeping services is a cost-effective and efficient solution for businesses of all sizes. Whether you’re a startup or a small business, outsourcing can help you stay organized, compliant, and focused on growth.

Conclusion

In conclusion, knowing what is bookkeeping and why it matters is essential for any business that wants to succeed. Be it a small, medium or large business, effective bookkeeping keeps your finances in check, ensures you’re ready for tax time, and helps you stay on the right side of regulations. By using tools like online bookkeeping or opting for outsourced services, you can simplify this process and concentrate on what matters—growing your business. Good bookkeeping is about more than just numbers; it’s about securing your business’s future.

Get customized plan that supports your growth