Table of Content

Share This Article

- Published: July 1, 2024

- Last Updated: July 4, 2025

- 🔊 Read Article

Key Takeaways

- Hotel accounting differs from general accounting due to fluctuating demand, seasonal trends, and diverse revenue streams.

- Effective control over perishable inventory, high labor turnover, and variable staffing costs plays a vital role in maintaining margins.

- Hotels rely on dynamic pricing strategies influenced by seasonality and market demand, and accounting systems must accommodate these variations, track multiple revenue streams, and follow strict revenue recognition principles.

- Tracking hotel KPIs including GOP, RevPAR, ADR, CPOR, ALOS, and EBITDA offers insights into profitability, cost efficiency, occupancy trends, and guest behavior.

- Software like Xero, QuickBooks, and M3 streamline transaction management, real-time reporting, and budgeting.

- Outsourcing hotel accounting to specialists ensures regulatory compliance, enhances accuracy, and frees internal teams to focus on guest experience.

Numbers That Serve

Strategic Finance Support For Hospitality Professionals

Running a lucrative and effective hotel business requires an understanding of the complex financial aspects of the industry. In this competitive sector, efficient hotel accounting is essential to sustaining profitability and guaranteeing operational effectiveness. The market size of the hotel business worldwide is expected to reach $1.5 trillion (about $4,600 per person in the US) by 2027, according to recent estimates, highlighting the enormous development potential. This hotel accounting guide covers all the fundamentals that you need to know about hotel accounting. Now, let’s get started and learn the keys to hotel financial success!

How Does Hospitality Accounting Stand Out?

-

Navigating Seasonality and Fluctuating Demand:

In the world of hospitality, the only constant is change. Hotels, resorts, and other hospitality businesses experience seasonal fluctuations and unpredictable demand patterns. This dynamic environment requires a different approach to hospitality accounting. To cater to the ever-growing demands of the customers, hospitality accountants must be adept at managing cash flow during slow seasons, planning for peak periods, and forecasting effectively to ensure the business remains profitable throughout the year.

-

Management of Inventory and Cost Control:

Inventory management is a critical aspect of hospitality accounting, particularly in industries such as hotels and restaurants where perishable goods are involved. As professionals, hospitality accountants must monitor inventory levels, track usage patterns, and implement cost-saving measures to minimize waste and maximize. Moreover, they must negotiate supplier contracts and pricing to ensure the business gets the best possible deals.

-

Labor Costs and Turnover:

Labor costs are one of the biggest expenses for hospitality businesses and managing them effectively is crucial for profitability. This makes it essential to factor in labor-related costs such as benefits, training, and overtime pay other than wages. Furthermore, high staff turnover rates are common in this industry, which further complicates labor cost management. Hospitality accountants must work closely with HR departments to develop strategies for reducing turnover and managing labor costs more effectively in hospitality accounting.

-

Cultivating Customer Connections:

In hospitality, customer satisfaction is paramount. Hospitality accountants play a key role in analyzing customer feedback and data to identify trends and preferences. This information is used to develop pricing strategies, loyalty programs, and marketing campaigns that resonate with customers and keep them coming back. By understanding the unique needs and preferences of their guests, hospitality businesses can build strong, lasting relationships that drive repeat business and ensure long-term success.

-

Complexity of Revenue Recognition:

Hospitality businesses often have multiple revenue streams, each requiring careful accounting and management. For example, hotels may generate revenue from room bookings, food and beverage sales, conference and event bookings, spa services, and more. Each of these revenue streams may have different pricing structures, payment terms, and accounting requirements. Additionally, revenue recognition in the hospitality industry can be complex due to the timing of services rendered and the associated revenue recognition rules. For instance, revenue from room bookings is typically recognized at the time of the stay, while revenue from food and beverage sales is recognized when the service is provided.

What Does Hotel Accounting Include?

Hotel accounting is a specialized form of accounting that focuses on the financial management of hotels, resorts, and other lodging establishments. It involves tracking revenues, expenses, assets, and liabilities specific to the hospitality industry.

When it comes to accounting for hotels, several essential aspects should be considered-

-

Managing Diverse Revenue Streams and Expenses:

Hotels deal with diverse revenue sources, including room bookings, food and beverage sales, and ancillary services. Each revenue stream has unique accounting requirements, necessitating meticulous tracking and categorization. Similarly, hotels incur various expenses, such as labor, utilities, maintenance, and supplies, which require careful monitoring to maintain profitability. Effective hotel accounting requires efficient handling of these diverse revenue streams and expenses.

-

Adapting to Dynamic Pricing Strategies:

Hotels often employ dynamic pricing strategies to adjust room rates based on demand, seasonality, and market conditions. Accounting systems must be able to adapt to these pricing changes and accurately reflect revenue fluctuations. This requires robust revenue management tools and accounting practices tailored to the hotel industry. Incorporating robust accounting practices can enhance financial success, benefiting not only the hotel industry but also a wide range of businesses across various sectors.

-

Managing 24/7 Transactions:

Hotels operate around the clock, with transactions occurring at all hours. Accounting systems should be capable of handling continuous transactions, providing real-time reporting, and ensuring data security. This includes managing guest transactions, ensuring accurate billing, and preventing fraud.

-

Navigating Complex Payroll Systems:

The hotel industry’s payroll structure is complex, with various employee categories, including full-time, part-time, and seasonal staff. This demands a high level of accounting proficiency to guarantee accurate payroll processing and compliance with regulatory requirements. For hotels seeking streamlined payroll and regulatory compliance, outsourced hotel accountants can handle everything from wages, benefits, and taxes to compliance with labor laws. This way, hoteliers will have sufficient time to invest in core business activities rather than struggling with payroll and compliance matters.

-

Vendor Contracts and Relationships:

Hotels work with numerous vendors for supplies, equipment, and services. Managing vendor contracts involves negotiating terms, pricing, and payment schedules. Experienced hotel accountants play a crucial role in managing vendor relationships, ensuring contract compliance, and optimizing vendor management practices to control costs and maintain quality.

What Makes Hotel Accounting So Critical?

Efficient accounting stands as the cornerstone of a hotel’s financial health. Operating amidst a constant whirl of transactions—from room reservations to dining expenditures—hotels rely on accurate accounting to navigate their cash flows, monitor expenses, and drive profitability. The complexity deepens with nuanced pricing strategies, including seasonal rates and promotional discounts, necessitating meticulous hotel accounting to safeguard against revenue discrepancies. Finally, and notably, adept hotel accounting ensures compliance with regulatory standards and furnishes timely, insightful financial reports crucial for strategic decision-making and investor confidence.

How to Kickstart Your Hotel Accounting Journey?

-

Getting Set Up:

To embark on your hotel accounting journey, start by selecting robust hotel accounting software that suits your property’s unique needs. The software should be capable of managing the high volume of transactions typical of the hotel industry. Integrate this software with your Point of Sale (POS) system to ensure seamless data transfer and accurate financial reporting. Additionally, set up standardized bookkeeping templates within the software to streamline your record-keeping processes.

-

Partner with a Hotel Accountant:

Consider partnering with a specialized professional like a hotel accountant or bookkeeper to navigate the complexities of hotel accounting. Hotel accountants are well-versed in the specific challenges and requirements of the hospitality industry, making them valuable partners in ensuring accurate financial management. This calls for outsourced hotel accountants to possess a deep understanding of hotel accounting and its complexities. Outsourcing your accounting tasks to skilled hotel accountants can give you peace of mind and the freedom to concentrate on delivering exceptional guest experiences.

-

Track Revenue and Expenses:

Vigilantly monitor your hotel’s revenue and expenses to maintain a healthy financial outlook. Utilize your hotel accounting software to track income from room bookings, restaurant sales, and other services, as well as expenses such as payroll, utilities, and supplies. Regularly reviewing these financial metrics can help you identify trends and make informed decisions to optimize your hotel’s profitability.

-

Analyse KPIs:

In addition to revenue and expenses, monitor the hotel industry’s KPIs. These may include Average Daily Rate (ADR), Revenue per Available Room (RevPAR), and Gross Operating Profit per Available Room (GOPPAR). Monitoring these KPIs can provide valuable insights into your business’s performance and help you identify areas for improvement.

-

Regular Reconciliation:

Reconcile your accounts regularly to ensure the accuracy of your financial records. This involves comparing your bank statements, invoices, and other financial documents to identify and rectify any discrepancies. Regular reconciliation can help you maintain accurate financial records and avoid costly errors.

-

Master Your AP, AR, and Payroll:

Efficient management of accounts payable, accounts receivable, and payroll is essential for the smooth operation of your hotel. Establish clear procedures for approving and processing payments to vendors and use your accounting software to track these transactions. Similarly, manage your AR (accounts receivable) process effectively to ensure the timely collection of payments from guests and other sources. Likewise, streamline your payroll process to ensure accurate and timely payments to employees.

Challenges Associated with Hotel Accounting

-

High Volume and Complexity of Transactions:

Hotel accounting involves managing a high volume of daily transactions, including room bookings, restaurant bills, and other services. This requires meticulous attention to detail to ensure accurate recording and reporting. The sheer number and variety of transactions can make this a daunting task, necessitating robust hotel accounting software to handle the workload efficiently.

-

Complex Pricing Structures:

Hotels often deal with complex pricing structures, such as seasonal rates and discounts. Managing these pricing variations demands careful monitoring and analysis to optimize revenue streams and prevent revenue leakage. Accurate tracking and adjustment of these rates are essential to maintaining profitability and ensuring competitive pricing in the market.

-

Regulatory Compliance:

Hotels must adhere to various regulatory requirements, including tax laws, labor laws, and industry-specific regulations. Ensuring compliance with these regulations can be challenging, requiring diligent record-keeping and regular updates to accounting practices. Non-compliance can lead to significant penalties and damage to the hotel’s reputation.

-

Financial Reporting and Analysis:

Generating accurate financial reports is essential to formulate informed business decisions. However, the complexity of hotel accounting can make this task challenging. This requires advanced hotel accounting software and experts like hotel accountants and bookkeepers.

-

Fluctuating Occupancy Rates:

Hotels often experience fluctuating occupancy rates due to seasonal variations and market conditions. Managing these fluctuations requires careful financial planning and forecasting to ensure steady cash flow and operational efficiency during both peak and off-peak seasons.

-

Varying Accommodation Costs:

The costs associated with maintaining and upgrading accommodation can vary significantly. These include expenses for room refurbishments, maintenance, and housekeeping. Accurately tracking these varying costs helps in budgeting and ensuring that resources are allocated efficiently.

-

Room Service Charges:

Room service charges add another layer of complexity to hotel accounting. These charges must be accurately recorded and integrated with the guest’s overall bill. Efficiently managing room service transactions is crucial to maintaining accurate financial records and ensuring guest satisfaction.

Optimal Accounting Practices for Hotels

-

Enhance Payment Processing Efficiency:

Implementing efficient payment processing systems is crucial for hotels to ensure timely and secure transactions. Utilize secure payment gateways that comply with Payment Card Industry Data Security Standard (PCI DSS) requirements. This not only enhances guest satisfaction but also reduces the risk of fraudulent activities.

-

Implement Robust Fraud Detection Mechanisms:

Establishing stringent internal controls is vital to identify and prevent fraudulent activities. Implement regular audits, segregation of duties, and transaction monitoring processes. These measures help safeguard hotel assets and maintain financial integrity.

-

Maintain Detailed Audit Trails:

Maintaining comprehensive records of all financial transactions is essential for accountability and transparency. This includes keeping records of receipts, invoices, and bank statements. An audit trail ensures that financial transactions can be easily traced and verified, enhancing financial reporting accuracy.

-

Adopt Effective Revenue Management Strategies:

Effective revenue management is key to optimizing hotel revenue. Use data analytics to forecast demand and adjust room pricing accordingly. Implement dynamic pricing strategies and offer personalized packages to help maximize revenue opportunities.

-

Select the Appropriate Accounting Basis:

Choosing the right accounting method, such as accrual or cash-basis accounting, is essential for accurate financial reporting. When selecting an accounting basis, consider factors such as the size and complexity of your hotel operations and regulatory requirements.

-

Specialized Knowledge and Expertise:

Navigating the complexities of hotel accounting requires specialized knowledge and expertise. Partnering with a specialized hotel accountant or outsourced hospitality accounting services can help hotel businesses address the above-mentioned challenges effectively. These professionals bring industry-specific insights and experience, ensuring accurate financial management and compliance with relevant regulations, ultimately contributing to the hotel’s success.

-

Leverage Advanced Accounting Software:

Investing in specialized accounting software tailored for hotel accounting can significantly streamline financial operations. Look for features like automated revenue recognition, integrated payroll, and comprehensive reporting capabilities. Utilizing accounting software for hotels ensures accurate financial data management and facilitates compliance with industry-specific regulations.

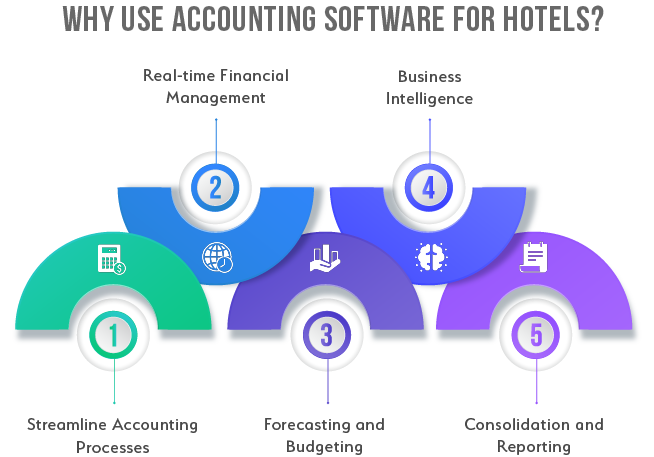

Why Do You Need Accounting Software for Hotel Accounting?

-

Streamline Accounting Processes:

Accounting software for hotels streamlines various accounting processes by automating repetitive tasks such as invoicing, payment processing, and financial record-keeping. This automation reduces the likelihood of errors and saves valuable time, allowing hotel staff to focus on more strategic activities that enhance guest experiences and operational efficiency.

-

Real-time Financial Management:

Real-time financial management is crucial for the dynamic environment of hotel operations. Accounting software provides up-to-date financial data, enabling hotel managers to make informed decisions quickly. This immediate access to financial information helps in monitoring cash flow, tracking expenses, and managing budgets effectively, ensuring the hotel’s financial health.

-

Forecasting and Budgeting:

Effective forecasting and budgeting are also essential for maintaining a hotel’s profitability. Accounting software offers robust tools for creating detailed financial forecasts and budgets. These tools allow hoteliers to plan for seasonal fluctuations, anticipate expenses, and allocate resources efficiently. Accurate forecasting and budgeting help in making strategic decisions that drive the hotel’s growth and success.

-

Business Intelligence:

Advanced accounting software for hotels comes equipped with business intelligence capabilities that provide valuable insights into the hotel’s financial performance. By analyzing data from various revenue streams and operational costs, hotel managers can identify trends, uncover opportunities for cost savings, and optimize pricing strategies.

-

Consolidation and Reporting:

Lastly, consolidation and reporting are other critical components for hotels. Accounting software simplifies the consolidation of financial data from various sources, providing a comprehensive view of the hotel’s financial performance. The software also offers robust reporting features that generate detailed financial statements, helping hotel managers comply with regulatory requirements and make informed business decisions.

Top 5 Hotel Accounting Software

-

Xero:

Xero is a popular cloud-based accounting software that offers a comprehensive suite of features tailored for the hospitality industry. It provides real-time financial management, robust reporting capabilities, and seamless integration with various property management systems. Xero’s user-friendly interface and scalability make it ideal for hotels of all sizes, ensuring efficient hotel accounting and financial oversight.

-

Sage:

Sage is another versatile accounting software known for its powerful financial management tools. It offers customized solutions for hotel accounting, including advanced reporting, budgeting, and forecasting capabilities. Sage’s integration with other hotel management software allows for streamlined operations and accurate financial tracking, making it a preferred choice for many hoteliers.

-

QuickBooks:

Another widely used accounting software that offers tailored solutions for the hospitality industry is QuickBooks. It provides comprehensive financial management features such as invoicing, expense tracking, and payroll management. QuickBooks’ integration with various hotel management systems ensures that financial data is consistently updated and easily accessible, supporting efficient hotel accounting processes.

-

M3:

M3 is specialized hotel accounting software designed specifically for the hospitality industry. It offers features like financial reporting, budgeting, payroll management, and accounts payable/receivable. M3’s unique focus on hotel accounting ensures that it meets hotels’ specific needs, providing detailed insights into financial performance and operational efficiency.

-

Cloudbeds:

Cloudbeds is an integrated property management and accounting software solution designed for the hospitality industry. It offers features like real-time financial tracking, automated invoicing, and comprehensive reporting. Cloudbeds’ seamless integration with other hotel management tools helps streamline hotel accounting processes, making it easier to manage multiple revenue streams and operational costs.

Top 8 KPIs for Hotel Performance Measurement

-

Gross Operating Profit (GOP):

This KPI measures the total revenue generated from hotel operations minus operating expenses. It provides a clear picture of the hotel’s profitability and operational efficiency. Monitoring GOP helps identify cost-saving opportunities and optimize revenue streams.

-

Gross Operating Profit Per Available Room (GOPPAR):

GOPPAR is another crucial KPIs for hotels that divides the gross operating profit by the number of available rooms in the hotel. This KPI helps in assessing the profitability of each room, regardless of occupancy. It offers insights into the overall financial health of the property.

-

Revenue Per Available Room (RevPAR):

RevPAR combines the occupancy rate and the average daily rate (ADR) to measure the revenue generated per available room. It is calculated by multiplying the ADR by the occupancy rate. This KPI is essential for evaluating the hotel’s ability to fill rooms at profitable rates.

-

Cost Per Occupied Room (CPOR):

CPOR calculates the average cost incurred for each occupied room. It includes all operational expenses related to maintaining and servicing the room. This KPI for hotel helps identify areas where cost efficiency can be improved without compromising service quality.

-

Occupancy Rate:

The occupancy rate measures the percentage of available rooms that are occupied over a specific period. It is a key indicator of demand and market competitiveness.

-

Average Daily Rate (ADR):

ADR represents the average revenue earned per occupied room per day. It is calculated by dividing the total room revenue by the number of rooms sold. This essential one KPIs for hotel helps in understanding the pricing strategy’s effectiveness and the ability to attract higher-paying guests.

-

Average Length of Stay (ALOS):

ALOS measures the average duration of a guest’s stay at the hotel. It is calculated by dividing the total number of room nights by the number of reservations. This hotel KPI provides insights into guest satisfaction and booking trends, which can be beneficial for marketing and operational strategies.

-

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA):

EBITDA is a comprehensive measure of the hotel’s overall financial performance. It represents the earnings generated from operations before accounting for financial and non-operational expenses. This KPI helps in assessing the hotel’s profitability and cash flow potential.

How Can Outsourcing Assist in Hotel Accounting?

-

Strategic Financial Management:

Outsourcing provides access to financial experts who specialize in the hospitality industry. These professionals can offer strategic insights and advanced financial planning, helping hotels optimize their gross operating profit (GOP) and other key performance indicators (KPIs for hotels). With their expertise, hotels can develop robust financial strategies that align with their business goals.

-

Efficiency Through Automation:

Outsourced accounting services providers utilize the latest accounting software and technologies, enabling hotels to automate routine financial tasks. This includes everything from payroll processing to revenue management. By leveraging advanced accounting software for hotels, outsourcing partners can streamline operations, reduce manual errors, and improve overall efficiency.

-

Scalability for Growth:

As hotels expand, their financial management needs become more complex. Hiring hospitality accounting services from experienced professionals provides scalability, allowing hotels to adjust the level of service according to their growth. Whether adding new properties or entering new markets, outsourcing partners can provide the necessary support to manage increased financial workloads without compromising accuracy or efficiency.

-

Ensuring Compliance & Accuracy:

Outsourced accounting and bookkeeping services providers stay current with the latest industry regulations and accounting standards, ensuring that hotels remain compliant with all legal requirements. This reduces the risk of financial discrepancies and legal issues. By maintaining rigorous audit trails and implementing internal controls, outsourcing partners ensure the accuracy of financial data, which is crucial for KPIs like ADR and EBITDA.

-

Focus on Hospitality Excellence:

By outsourcing accounting tasks, hotel management can focus on core competencies, such as enhancing guest experiences and improving service quality. This allows hotel staff to dedicate more time to hospitality excellence, directly impacting guest satisfaction and, consequently, performance metrics like average length of stay (ALOS) and occupancy rate.

-

Cost-Effectiveness:

Hiring hospitality accounting services can be more cost-effective than maintaining an in-house accounting team. It eliminates the need for hiring, training, and retaining specialized staff, reducing overhead costs. Additionally, outsourcing partners often offer flexible pricing models, allowing hotels to manage their budgets more effectively.

What’s Next for Hotel Accounting?

As we look to the future, the hotel industry stands on the brink of transformational change, driven by advancements in technology and shifting guest expectations. The effective integration of sophisticated accounting software and strategic financial management is more crucial than ever to navigate these waters successfully. By embracing innovative solutions and exploring new financial strategies, hoteliers can ensure profitability and sustainability in an increasingly competitive market.

Stepping forward, the adoption of AI-driven analytics, outsourcing, and global financial standards will optimize operational efficiencies and enhance guest experiences. This proactive approach to refining your hotel’s financial practices is the key to unlocking new opportunities and securing a robust future in the dynamic world of hospitality.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.