In This Blog Post

Share This Article

- Published: Feb 26, 2025

- Last Updated: Jul 16, 2025

- 🔊 Listen

Quick Reads

- E-commerce financial statements such as income statements and cash flow statements provide clear insights into profits and growth.

- The statement of retained earnings shows how profits are reinvested for business growth.

- Regularly reviewing e-commerce financial statements allows for proactive identification and resolution of potential issues.

- Effective cash flow management is vital for preventing cash shortages and ensuring smooth operations.

- Smart inventory management balances stock levels to avoid overstocking or stockouts.

From Data to Dollars

Elevate Your Ecommerce with Smart Accounting & Analytics

Overwhelmed by e-commerce finances? Then you are not alone! It can feel like a maze of numbers, but understanding your financial statements is key to success.

In this blog, we will explore the key e-commerce financial statements you need to understand and provide best practices to keep your e-commerce finances in tip-top shape.

Whether you are just starting out or looking to improve your existing processes, this blog will equip you with the knowledge you need.

Financial Statements in Ecommerce: Why it Matters?

Financial statements are super important for any e-commerce business—they give you a clear picture of how your business is doing. The income statement shows your revenue, expenses, and profits, while the balance sheet helps you track assets like inventory.

Then there is the cash flow statement, which tells you if you have enough money moving in and out to keep things running smoothly. These reports also come in handy when filing taxes, getting investors on board, or making big business decisions.

By keeping an eye on your financials, you can spot growth opportunities, adjust pricing, cut unnecessary costs, and plan better for the future. Additionally, having accurate numbers helps you stay ahead of the competition and build a sustainable, profitable e-commerce business.

Key E-commerce Financial Statements to Track

Running an e-commerce business is not just about selling products; keeping a close eye on financial health is just as important. Without proper tracking, profitability can take a hit, cash flow can dry up, and unexpected financial issues can arise. That is why certain e commerce financial statements should always be monitored to ensure the business stays on track:

Income Statement (Profit & Loss Statement):

The income statement shows how much money the business is making and spending over a specific period. Revenue, the cost of goods sold (COGS), and operating expenses like marketing, salaries, and software subscriptions are all listed here.

By reviewing this statement, it becomes easier for you to see whether profits are growing or if expenses are cutting into earnings too much.

Balance Sheet:

A snapshot of a business financial standing at any given moment is provided by the balance sheet. Assets like cash, inventory, and accounts receivable are compared against liabilities such as loans, accounts payable, and taxes. What’s left is the equity in the business.

This e-commerce financial statement helps you to determine if the company is financially stable or if debts are piling up too fast.

Cash Flow Statement:

It reveals how money moves in and out of the business through 3 main areas which is, operating activities (day-to-day transactions), investing activities (buying or selling assets), and financing activities (funding through loans or investors). Even if the business looks profitable on paper, cash flow shortages can still happen, so keeping a close eye on this report is crucial.

Statement of Retained Earnings:

The statement of retained earnings is often overlooked, but it plays a crucial role in tracking how profits are reinvested into the business. It starts with the beginning retained earnings, adds net income, subtracts dividends paid out (if any), and ends with the final retained earnings.

For those considering reinvestments or expansion, this e-commerce financial statement provides clarity on how much profit is being put back into the business.

Inventory Reports:

Inventory management can make or break an e-commerce business, and inventory reports help in avoiding costly mistakes. Stock levels, turnover rates, and inventory costs are tracked to ensure that capital is not tied up in excess inventory or that stockouts are not driving customers away.

A well-maintained inventory report prevents unnecessary losses and keeps operations running smoothly.

Break-Even Analysis:

A break-even analysis is a great way to figure out how much needs to be sold to cover all costs. It calculates the point at which total revenue matches total expenses, before any profit is made. Understanding this number helps with pricing strategies, sales targets, and overall business planning. Without it, there is no clear way to know if the business is actually sustainable or not.

Best Practices for E-commerce Financial Management

Managing ecommerce accounting can feel like juggling with flaming torches, one wrong move, and things can spiral out of control. But with the right financial habits, a business can stay profitable without breaking a sweat:

Keep Cash Flow in Check:

It has been seen that businesses don’t fail just because of low sales but also due to poor cash flow management. When money is tied up in inventory or delayed payments, operations can come to a standstill.

A close watch must be kept on incoming and outgoing cash. Moreover, supplier payment terms should be negotiated wisely, and unnecessary expenses must be cut before they pile up.

Review Financial Statements Regularly:

E-commerce financial statements are like a business’s report card. Those who review them monthly can spot trouble before it escalates. Profit and loss statements, cash flow reports, and balance sheets should be checked to ensure that all is running smoothly.

Analysing Growth and Sales Trend:

Watching your growth and sales trends is like checking the pulse of your e-commerce business. It tells you if you are moving in the right direction or if it is time to switch things up. By tracking things like sales velocity, customer acquisition costs, and conversion rates, you can make smarter decisions, tweak your strategies, and keep your profits on the rise.

Manage Inventory Wisely:

Too much inventory locks up cash, while too little leads to lost sales. Smart businesses use inventory tracking systems and forecasting tools to strike the right balance. A product that’s flying off the shelves today could be gathering dust tomorrow.

Automate Financial Processes:

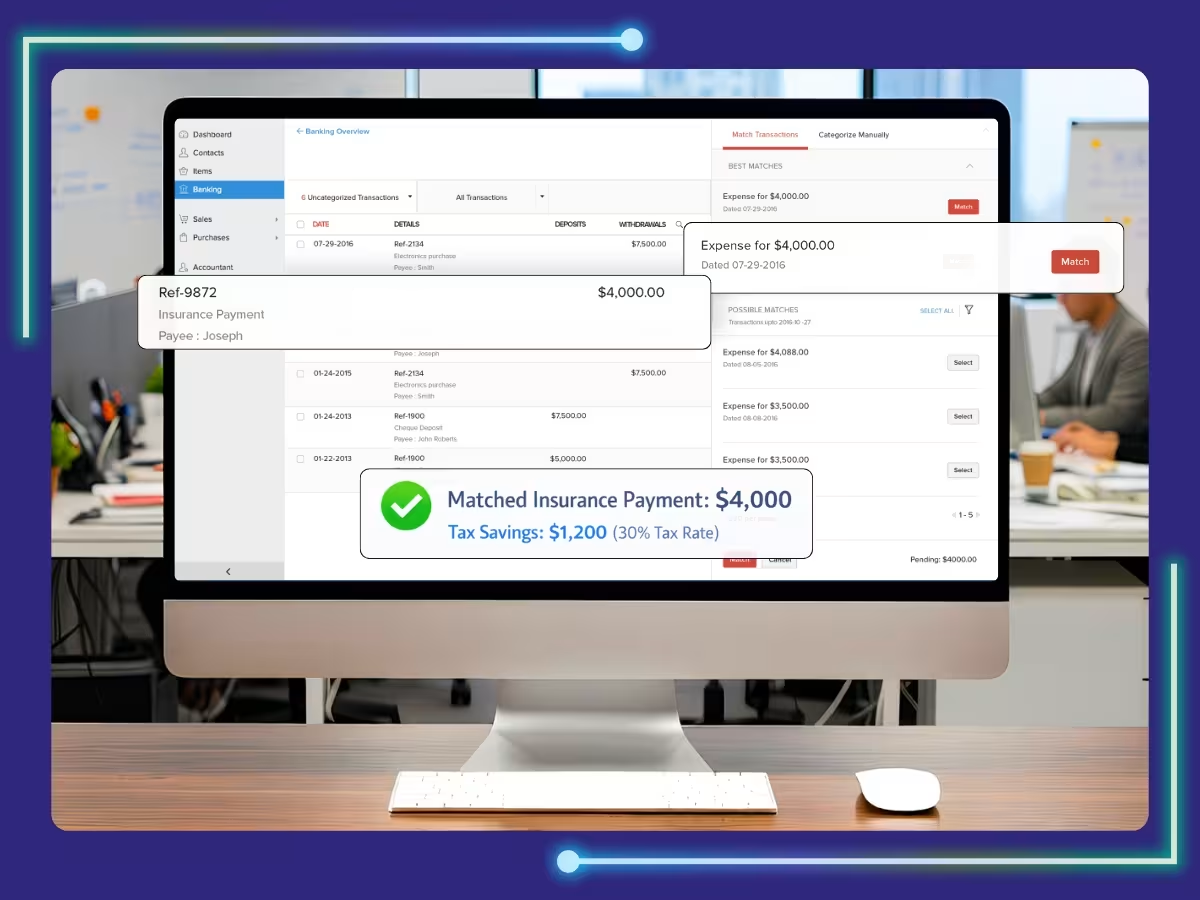

Spreadsheets are great, but they can’t compete with automation. Accounting software like QuickBooks and Xero helps in automating recording of sale transactions, payments, generating reports, and keeping tax records tidy.

Separate Business and Personal Finances:

Many entrepreneurs make the mistake of mixing personal and business finances, and come tax season, it turns into a nightmare. A dedicated business account should be used to track expenses, making life easier when filing taxes. It’s like keeping salt and sugar separate—both are important but mixing them up can be disastrous!

Final Words

Understanding and managing your e-commerce financial statements is critical for business success. Executing best practices, such as monitoring cash flow, managing inventory, and automating financial processes, will help you stay on top of your finances.

Our ecommerce accounting services provide expert financial guidance by streamlining your accounting practices, and ensuring your business stays financially sound. Let’s connect and strategize how to manage your financial statements efficiently!

Get customized plan that supports your growth