In This Blog Post

Share This Article

- Published: Sep 2, 2025

- Last Updated: Sep 4, 2025

- 🔊 Listen

Quick Reads

- Buildium QuickBooks integration transforms a fragmented workflow into a seamless, automated process, eliminating duplicate data entry and manual errors.

- By automating data sync, the integration saves countless hours, simplifies reporting, and makes financial oversight and decision-making more efficient.

- The integration automates the flow of critical financial data, including the trial balance, invoices, bills, and vendor expenses.

- It ensures accurate records for customers and vendors in both systems, reducing administrative errors and improving client management.

- Professional Buildium accounting services can further simplify the process by providing expert support for reconciliations, reporting, and tax compliance.

Managing properties already demands enough attention without wrestling with disconnected systems. Buildium handles the day-to-day, while QuickBooks manages the numbers, but switching between the two often means duplicate work, delays, and errors.

But here’s the good news, these platforms don’t have to operate in silos. When integrated, they create a streamlined financial workflow that cuts manual effort and boosts accuracy. Let’s look at how connecting Buildium with QuickBooks can help you save time and gain real-time clarity.

Buildium, Expertly Handled

Simplify property accounting with end-to-end automation.

Buildium QuickBooks Integration Explained

Buildium QuickBooks integration streamlines property management accounting by automating financial data synchronization between both platforms, reducing manual bookkeeping and potential errors. When connected, Buildium automatically posts transactions like rent receipts, expenses, and payment records directly into QuickBooks, ensuring that accounting data is always current and accurate.

This integration supports custom mapping, allowing users to tailor the sync based on their specific accounting processes and reporting requirements. By having real-time data transfer, property managers gain up-to-date financial tracking and enhanced reporting capabilities, making tax preparation and compliance easier.

How to Setup Buildium QuickBooks Integration?

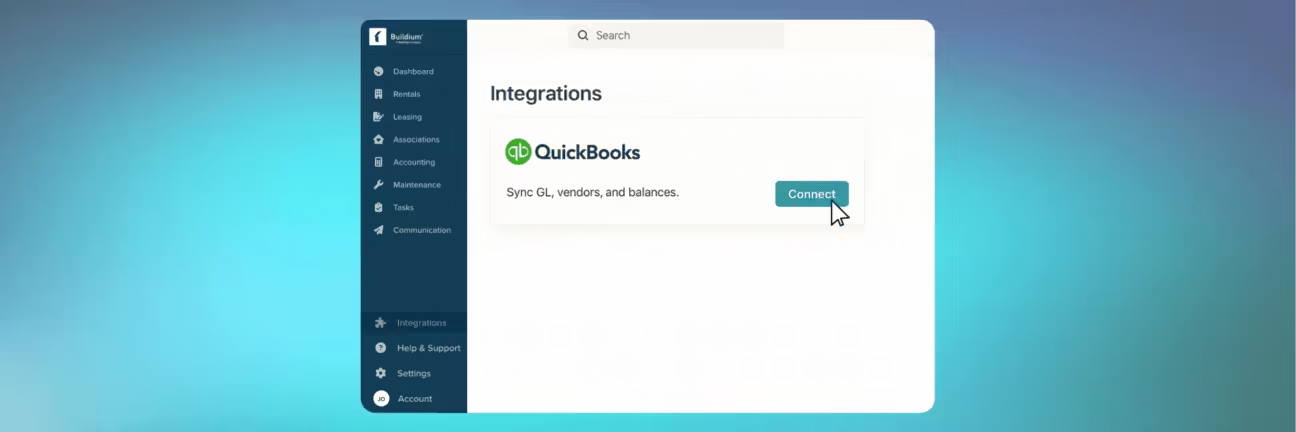

Buildium QuickBooks integration doesn’t take long, but it does require a few structured steps. You will begin by opening the integration tab in Buildium, connecting it to your QuickBooks account, authorizing access, and then mapping your chart of accounts so everything aligns properly. Once done, you can sync data between the two platforms with ease.

Let’s walk through each step one by one.

Navigate to Integration in Buildium

Start by logging into your Buildium account. From the main dashboard, go to Settings and select the Integrations option. Here, you will find QuickBooks listed among the available integration choices.

Connect to QuickBooks

Choose whether you want to connect Buildium to QuickBooks Online or QuickBooks Desktop. Click Connect to begin the linking process. This will open a secure connection between the two systems.

Authorize QuickBooks Accounts

A QuickBooks login screen will appear. Sign in with your QuickBooks credentials and allow Buildium to access your data. This authorization step is required so the two platforms can share information securely.

Map Chart of Accounts

Match Buildium categories (rental income, security deposits, operating expenses) to the right QuickBooks accounts. Loop in your real estate accountant here to validate mapping reflects how you report at property, portfolio, and owner levels.

Sync Data

Once the accounts are mapped, run your first data sync. Transactions from Buildium will transfer into QuickBooks, where you can review and reconcile them. It’s a good practice to compare synced data against Buildium reports, such as the trial Balance, to confirm everything matches.

What Accounting Data Gets Synced Between Buildium and QuickBooks?

Buildium QuickBooks integration provides a structured data flow, ensuring consistency across financial reporting. For firms relying on real estate accounting, this means greater accuracy in ledgers, better portfolio insights, and less rework for finance teams.

Here is the detail of what data flows between the two systems:

Trial Balance

Buildium pushes a clean trial balance into QuickBooks, reflecting all accounts and balances at a given point in time. This ensures property managers and accountants are working from the same set of books, avoiding discrepancies when preparing financial reports or audits.

Invoices

Tenant invoices generated in Buildium, such as rent charges, late fees, or utility reimbursements, are synced directly into QuickBooks. This means property managers don’t need to re-enter billing data, and accountants can immediately track income against receivables.

Bills/ Vendor Expenses

When vendor bills are entered in Buildium such as contractor fees, maintenance costs, or utility bills, they flow into QuickBooks as accounts payable entries. This eliminates duplicate data entry, ensures vendors are paid on time, and provides a clear expense history that helps monitor property profitability.

Customer Records

Tenant and owner details maintained in Buildium sync with QuickBooks customer records. This ensures that payment histories, outstanding balances, and financial interactions are aligned in both systems. It helps real estate firms maintain a single source of truth for each client while reducing administrative errors.

Vendor Records

Vendor profiles like plumbers, electricians, landscapers, or cleaning companies are shared between Buildium and QuickBooks.

Journal Entries

Adjusting journal entries created in Buildium, such as owner contributions, management fees, or reclassifications, is synced into QuickBooks automatically.

Bank Transactions

Bank feeds and reconciliations from Buildium sync with QuickBooks, meaning deposits, withdrawals, and cleared checks are mirrored accurately.

Payments or Receipts

Tenant payments received in Buildium through checks, ACH, or online portals are recorded in QuickBooks as receipts against invoices. Likewise, vendor payments made through Buildium reflect as expenses in QuickBooks.

Accounts Payable and Receivable

Accounts receivable from Buildium, such as tenant charges, sync directly to QuickBooks and update automatically when payments are made, ensuring accurate overdue rent tracking and streamlined collection follow-ups.

At the same time, vendor bills recorded in Buildium appear in QuickBooks as accounts payable, allowing property managers to monitor obligations, schedule payments, and avoid late fees.

Maximize Efficiency with Expert Buildium Accounting Services

Expert Buildium accounting services help property managers streamline financial processes, reduce errors, and stay compliant while focusing on tenant relationships and growth. By combining software efficiency with accounting expertise, these services deliver accurate reporting, improved decision-making, and cost savings. With professionals managing your books, you maximise efficiency, strengthen profitability, and keep your property management business future ready.

And, partnering with Whiz Consulting means tapping into a dedicated team of expert Buildium accountants who know how to leverage the platform to deliver comprehensive finance and accounting solutions. We ensure seamless collaboration across time zones, prioritise data security, and offer responsive communication, delivering tailored support that drives long-term success and financial clarity.

Get customized plan that supports your growth