In This Blog Post

Share This Article

- Published: Oct 17, 2025

- Last Updated: Oct 24, 2025

- 🔊 Listen

Quick Reads

- E-commerce sales tax covers all online transactions, ensuring fairness between digital and physical businesses.

- Over 400 state-level sales tax changes have already occurred in 2025, making compliance more complex than ever.

- New taxes on digital services and relief programs in states like Washington, Illinois, and Wisconsin are reshaping online business costs.

- Calculating sales tax requires knowing your nexus, registering for tax permits, applying the correct local rates, and remitting to authorities on time.

- Automating tax management minimizes human error, prevents costly penalties, and keeps systems updated with changing laws.

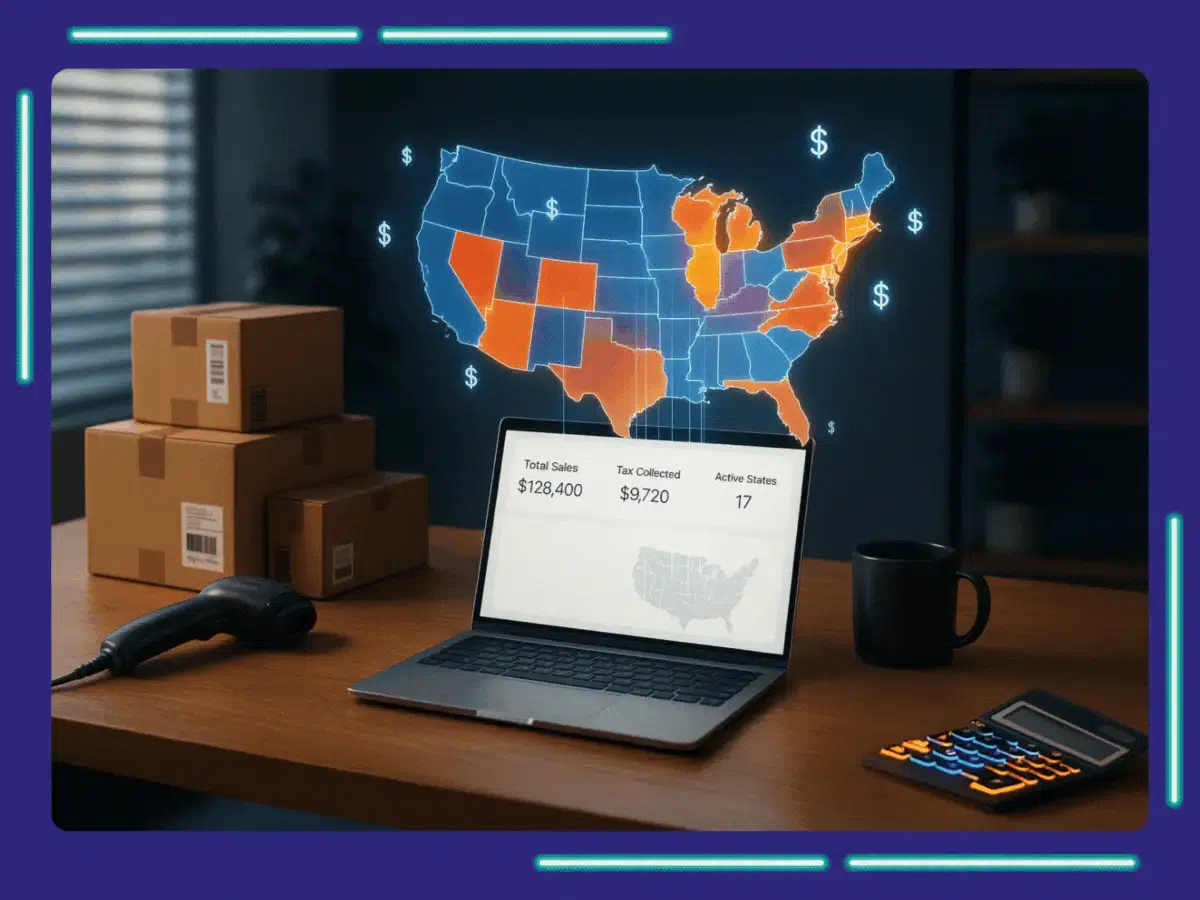

The world of e-commerce is constantly evolving, but 2025 is shaping up to be a year of major change, especially when it comes to sales tax. As online sales continue to soar, states are tightening digital tax enforcement, and global marketplaces are updating their compliance rules.

For online retailers selling through Shopify, Amazon, or their own websites, keeping up with these shifts is the key to protecting margins and avoiding penalties. That’s why many are leaning on accounting services for e-commerce businesses to stay compliant without getting buried in the details, and to navigate these evolving rules with confidence.

This guide breaks down the biggest sales tax changes coming in 2025, and what every online seller should do now to stay ahead of them.

From Data to Dollars

Elevate Your Ecommerce with Smart Accounting & Analytics

What Is E-commerce Sales Tax?

E-commerce sales tax is the tax applied to goods and services sold through online platforms. It functions much like traditional sales tax, but the rules for collection and reporting can vary widely depending on where the buyer and seller are located. Online stores need reliable accounting services for e-commerce businesses to track these changing regulations, calculate taxes accurately, and file them correctly. This not only keeps the business compliant but also ensures it contributes fairly to the local economy, just like brick-and-mortar stores.

Let’s have a closer look at how it actually works:

- Collection Responsibility: Online sellers must collect sales tax at checkout when selling to customers in states or countries where they have a “nexus” (a legal or economic connection).

- Economic Nexus Rules: If your online sales in a state exceed $100,000 or 200 transactions, you’re required to collect and remit sales tax there even without a physical presence.

- Marketplace Facilitators: Online platforms often collect and remit taxes on behalf of their third-party sellers.

- Tax Rate Variation: Rates differ by state, city, or country, depending on where the buyer is located.

- Filing and Remittance: Businesses must file sales tax returns and remit collected amounts to the appropriate tax authorities regularly.

- Exemptions: Some items, like groceries or digital services, may be exempt or taxed differently based on jurisdiction.

Recent 2025 Sales Tax Updates and Trends

With 408 state-level rate changes, new taxes on digital services in Washington, and tax relief in Illinois and Wisconsin, online businesses face a dynamic environment.

Let’s take a closer look at these key trends and what they mean moving forward:

State-Level Rate Changes:

- 408 sales tax rate changes in the first half of 2025, marking a 24% increase from 2024.

- Louisiana raised its state tax rate from 4.55% to 5% on January 1, 2025, with a scheduled decrease to 4.75% by 2030.

Expansion of Taxable Services:

- Washington began taxing digital advertising, custom software, and IT services starting October 1, 2025.

- Florida repealed its sales tax on commercial rents, effective October 1, 2025.

Tax Holidays and Exemptions:

- Illinois launched a tax amnesty program from October 1 to November 15, 2025, offering penalty and interest forgiveness for qualifying taxpayers.

- Wisconsin exempted residential utilities from sales tax, starting October 1, 2025.

Federal Legislation: One Big Beautiful Bill Act:

- Signed into law on July 4, 2025, the act establishes a 1% excise tax on certain electronic transfers of funds from the US to foreign countries, effective January 1, 2026.

- It raises the Form 1099-MISC and Form 1099-NEC reporting threshold from $600 to $2,000, effective in 2026.

Heightened Scrutiny on Tax Evasion and Compliance:

- With increasing budget gaps, states are ramping up enforcement to detect and penalize tax evasion and non-compliance.

- Businesses selling across multiple jurisdictions should expect increased audits and more sophisticated tools used by state tax agencies to identify discrepancies.

How to Calculate Sales Tax for Online Sales?

With the ongoing changes in e-commerce sales tax law and the rise of new tax trends for online businesses, calculating the right amount of sales tax has become more complex than ever. Working with an e-commerce accountant can make this process much easier, but for now, let’s break down the steps and walk through a few examples together.

- Find out where you have sales tax nexus (the states where you are required to collect sales tax)

- Register for sales tax permits in those states

- Identify the sales tax rates for the buyer’s shipping address (this can be state, country, city, or even district levels)

- Check product taxability, as not all products are taxed everywhere

- Calculate the tax amount

- Collect tax at checkout and remit it to the right authorities

Example 1: Standard Item in Destination-Sourced State

Suppose you sell a book online to a customer in Dallas, Texas.

- Texas state rate: 6.25%

- Dallas city rate: 1.00%

- Local rate: 1.00%

- Combined rate: 8.25%

- Book price: 50

Sales Tax Calculation:

Sales Tax = Price × Rate = 50 × 0.0825 = 4.13

Total Charged: 50 + 4.13 = 54.13

Example 2: Food Item in Exempt State

You sell 50 worth of groceries to a customer in California, where grocery food is typically tax-exempt.

- Sales Tax: 0

- Total Charged: 0

Example 3: Digital Download in Taxed State

Selling a 25 digital eBook to a customer in Louisiana, which now taxes digital goods at 5%.

- Sales Tax: 25 × 0.05 = 1.25

- Total Charged: 25 + 1.25 = 26.25

Automating Sales Tax Collection and Remittance for E-commerce

Sales tax automation for e-commerce streamlines tax calculation, identifies nexus obligations, and automates registration, real-time tax calculations, filing, and remittance. With reduced risk of errors and penalties, sales tax automation makes tracking and reporting easier and more accurate. Let’s dive deeper into how this can transform your e-commerce sales tax management.

Integration with E-commerce Platforms

The first step is to seamlessly connect your e-commerce platform with your accounting software. By doing this, all sales transactions are automatically fed into your system, making tax calculation more accurate.

Identify Nexus Obligations

Next, it is critical to identify where your business has a tax nexus. This could be due to factors like physical presence, economic activity, or the volume of sales in a state. By automating the process, the system will alert you when a new nexus is created, helping to keep track of your e-commerce sales tax obligations across multiple jurisdictions.

Register for a tax permit

Once you have identified your nexus, the next step is to register for the necessary sales tax permits. Each state may require different registrations, and automating this process ensures you never miss an essential step.

Real-Time Tax Calculation

Automating sales tax collection means calculating taxes in real-time at the point of sale. When an e-commerce accountant sets up the system, they ensure that taxes are calculated based on customer location, product type, and any exemptions that might apply.

Filing and Remittance Automation

One of the most complex parts of managing e-commerce sales tax is filing returns and remitting payments to the appropriate authorities. Automation helps by creating tax returns based on your sales data and scheduling timely payments to prevent penalties.

Tracking and Reporting

Automated systems track your sales tax collection and remittance across all states, providing you with detailed reports. This visibility ensures that you are always up to date with your obligations.

Periodic Monitoring

Even with automation, regular monitoring is still necessary. This means periodically checking that everything is running smoothly, ensuring the system is pulling the correct rates, and making any updates as needed.

How E-commerce Accounting Experts Strengthen Tax Compliance and Financial Accuracy

For online sellers in 2025, managing e-commerce sales tax is more critical than ever. E-commerce accounting experts ensure compliance with changing tax laws, providing accurate bookkeeping and timely reporting. Their expertise helps businesses avoid penalties, maintain financial accuracy, and focus on growth with confidence in their tax obligations.

At Whiz Consulting, we use automation-driven tools and expert tax planning to simplify e-commerce sales tax management from end to end. Our tailored e-commerce accounting services help online businesses stay compliant, reduce manual work, and make confident financial decisions year-round.

Connect with us to ensure seamless tax compliance and accurate financials for your e-commerce business.

Get customized plan that supports your growth