-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

Expert Accounts Reconciliation Services for UK Businesses

Keeping your financial records accurate and up-to-date is vital for informed decision-making in business. At Whiz Consulting, we bring 10+ years of expertise and the support of 150+ expert accountants to deliver specialised account reconciliation services, ensuring your financial records are always in sync. With our expertise in reconciliation, you’ll always have a clear picture of your financial health. Allow us to handle the details, so you can focus on managing your business efficiently.

Accounts Reconciliation Outsourcing Services We Offer

- Day-to-Day Bookkeeping

- Checks Tracking and Sequencing

- Verifying Invoices Against Ledgers

- Aligning Bank Statements with Records

- Reconciling Accounts Fully or Partially

- Matching Credit Card and Bank Statements

- Preparing For Your VAT/Corporate Tax Filing

Accounts Reconciliation Challenges We Solve for You

Our accounts reconciliation services are designed to tackle the key pain points businesses face.

Timely Reconciliations of Accounts

Our bank reconciliation outsourcing services streamline the process by efficiently handling workload and ensuring all details in your books are accurate and aligned.

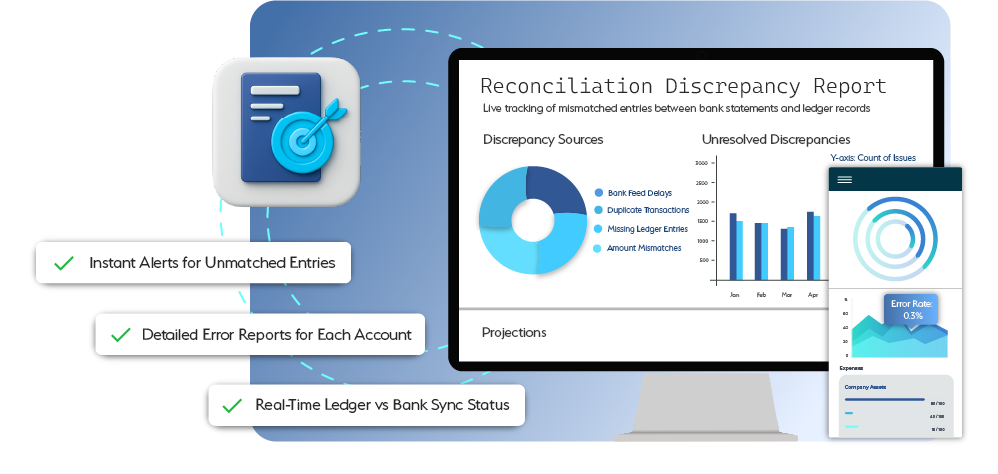

Automated Reconciliation Process

Our accounts reconciliation services connect seamlessly with your accounting platforms, automating transaction matching and resolving discrepancies efficiently. This reduces the manual workload, saves valuable time, and ensures greater accuracy in your financial records.

Comprehensive Tax Assistance

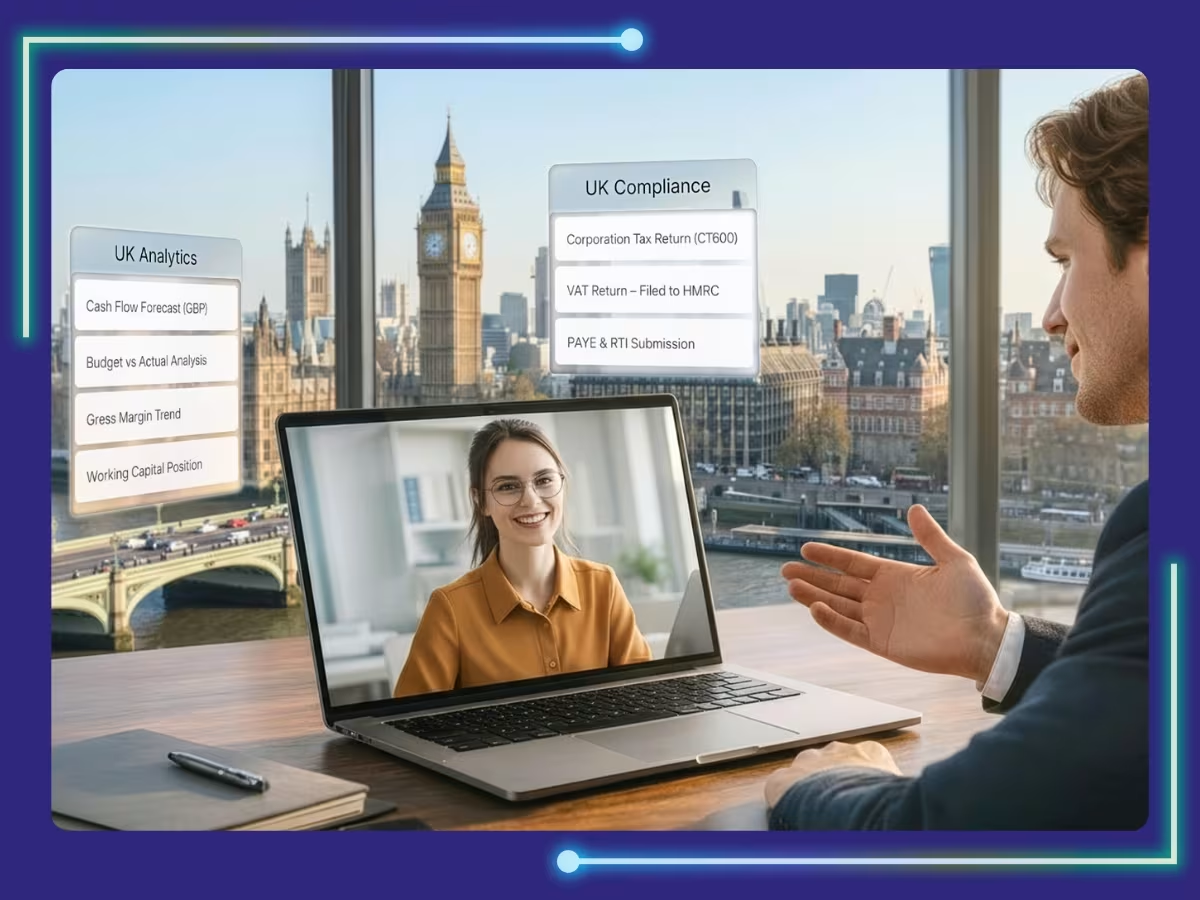

Our experts ensure your business remains fully compliant with UK accounting standards. Whether it’s VAT returns, payroll filings (P60s, P45s), or RTI submissions, you can count on our professional account reconciliation services to keep everything accurate and stress-free.

Hire an Accounts Reconciliation Expert Who:

Why Choose Us?

-

Value-Driven Accounting

Our outsourced account reconciliation services go beyond just matching numbers; we provide insights that empower your smarter financial decisions.

-

Accounting Automation

We use AI-driven tools to make accounts reconciliation faster, more accurate, and effortless, streamlining your day-to-day accounting.

-

Outsourcing Expertise

With over a decade of experience in account and bank reconciliation, we deliver a reliable partnership that optimises your financial operations effectively.

-

Dedicated Accountants

Our committed team handles your accounts reconciliation needs, offering precise, tailored solutions aligned with your business requirements.

-

Real-Time Support

Receive prompt account and credit card reconciliation services whenever you need it, always keeping your finances on track.

-

Cost-Efficiency

Outsource your account reconciliation services to our expert can cut overhead costs by up to 60%, giving your business a measurable boost in savings.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner may sound like a task, but with Whiz, it’s completely stress-free. We support you at every step, guaranteeing a seamless transition without downtime or disruptions. Leave your bookkeeping to us, so you can focus on what you do best.

Switch NowClient Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimising disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

The cost of accounts reconciliation services depends on your transaction volume and operational needs. Many UK businesses reduce overheads and payroll costs significantly by outsourcing while benefiting from expert support at a set, predictable rate.

Yes. Our digital accountants are skilled across leading platforms including Xero, QuickBooks, Sage, and Microsoft Dynamics. We connect directly with your existing setup, enabling smooth, accurate reconciliations without disrupting day-to-day financial operations.

Absolutely. Our online accountants are well-versed in UK accounting standards and HMRC requirements. From credit card reconciliation services to VAT-specific reconciliations, we ensure your records remain compliant, transparent, and audit-ready.

Yes. Detailed reconciliations provide reliable documentation that makes audits more straightforward and keeps you well-prepared for HMRC tax filings and reporting obligations.

Data protection is at the core of our service. As a SOC 2 and ISO 27001 certified provider, we maintain strict security frameworks and advanced encryption to ensure your financial information is always confidential and safeguarded.

Yes. Our bank reconciliation outsourcing services are designed to scale quickly. Whether it’s year-end deadlines or an unexpected surge in transaction volumes, we deliver consistent, uninterrupted support.

Yes. Our team handles multi-entity, high-volume, and multi-currency reconciliations with precision. From managing thousands of supplier invoices to performing bank account reconciliation services or credit card reconciliation, we help UK businesses keep records clear and accurate.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Accounts Reconciliation Services for UK Businesses

At Whiz, we provide accounts reconciliation services that bring clarity and compliance to UK businesses of every size. Our experts handle bank reconciliations, supplier accounts, and error resolution while ensuring HMRC requirements are met. With your books managed accurately, you gain more time to focus on growth.

Get a CallRelying on in-house teams for credit card reconciliation services can be expensive and time-consuming. By outsourcing to our UK-focused professionals, you can save up to 60% on operational costs while still ensuring accuracy, compliance, and efficiency.

Our accountants are trained in UK IFRS, VAT compliance, HMRC submissions, and statutory reporting requirements. With their expertise, your accounts remain accurate, compliant, and ready for inspection at any time.

With more than a decade of experience, we’ve refined our bank reconciliation outsourcing services into a smooth and straightforward process. Once we define your requirements, onboarding can be completed in as little as 48 hours.

Our dedicated specialists bring sector-specific knowledge, allowing you to trust that your financials are being managed with care while your internal teams concentrate on running the business.

We leverage cloud platforms such as Xero, QuickBooks, Sage, and NetSuite to automate reconciliations, providing you with real-time visibility into your cash flow and up-to-date financial reports.

Whether you’re a startup, SME, or a larger enterprise, our bank reconciliation services adapt to your needs. You only pay for the level of service required, making outsourcing a flexible and cost-efficient option.

As SOC 2 and ISO 27001 certified providers, we follow UK-compliant security practices. Through advanced encryption and controlled access, we keep your financial data safe, secure, and confidential at every stage.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.