Table of Content

Share This Article

- Published: Nov 1, 2025

- Last Updated: Nov 11, 2025

- 🔊 Listen

Quick Reads

- A skilled bookkeeper manages complex Australian tax requirements, ensuring your business stays compliant with GST, BAS, PAYG, and other regulations.

- Automating daily financial processes such as invoicing, reconciliation, and expense tracking ensures real-time updates, reducing the risk of errors and saving time.

- A bookkeeper generates tailored financial reports that provide valuable insights into business performance, helping with data-driven decisions.

- Bookkeepers automate payroll and track employee expenses, ensuring compliance with Australian regulations and tax laws.

- A dedicated bookkeeper integrates your bookkeeping software with sales platforms like Amazon, eBay, and PayPal, providing a consolidated view of finances.

- Bookkeepers help set realistic financial goals, forecast cash flow, and guide e-commerce businesses on strategies to optimise their tax position and plan for growth.

E-commerce businesses face a unique set of challenges, from managing high transaction volumes across multiple sales channels to handling complex inventory and tax requirements. These hurdles can quickly overwhelm business owners, leading to errors and missed opportunities. A dedicated ecommerce bookkeeper helps tackle these issues by automating financial processes, tracking expenses accurately, and providing real-time insights.

This blog explores the key benefits of having a specialised ecommerce bookkeeper to streamline your financial management and support your business growth.

From Data to Dollars

Elevate Your Ecommerce with Smart Accounting & Analytics

How E-Commerce Bookkeepers Can Help You Stay on Top of Your Business Finances

Ecommerce bookkeepers play a vital role in keeping your financial processes accurate and organised. They provide specialised ecommerce bookkeeping services such as tracking inventory, managing compliance with tax laws, automating daily financial tasks, overseeing cash flow, and generating clear financial reports. Beyond these, they simplify payroll management, integrate e-commerce platforms with bookkeeping software, create custom financial reports, prepare your business for audits, and offer strategic financial advice. Let’s explore these important functions in detail.

Tracking Inventory and Costs Efficiently

Skilled bookkeeping experts use advanced systems to link your inventory to your financials, offering real-time insights into stock levels, shipping costs, and supplier pricing. They help you avoid stock-outs and overstocking, ensuring your margins remain healthy and that you’re ready to scale during peak seasons like Christmas, Black Friday, or Click Frenzy in Australia.

Ensuring Compliance with Australian Tax Laws and Regulations

A dedicated e-commerce bookkeeper expertly handles Australian tax requirements, including BAS lodgments and PAYG withholding. They ensure your business complies with GST on both local and international sales while managing cross-border tax challenges. Additionally, they maximise deductible expenses such as digital marketing and shipping costs to reduce your overall tax liability.

Automating Daily Financial Processes

Automating daily financial processes allows your bookkeeper to sync sales, expenses, and payments directly with your accounting system, reducing manual work and the risk of mistakes. Automating tasks like bank reconciliation, invoicing, and expense tracking not only saves time but also ensures your financials are updated in real-time. This gives you a clear, accurate view of your business’s performance and keeps your financial data aligned without the need for constant intervention.

Managing Cash Flow and Reducing Financial Risks

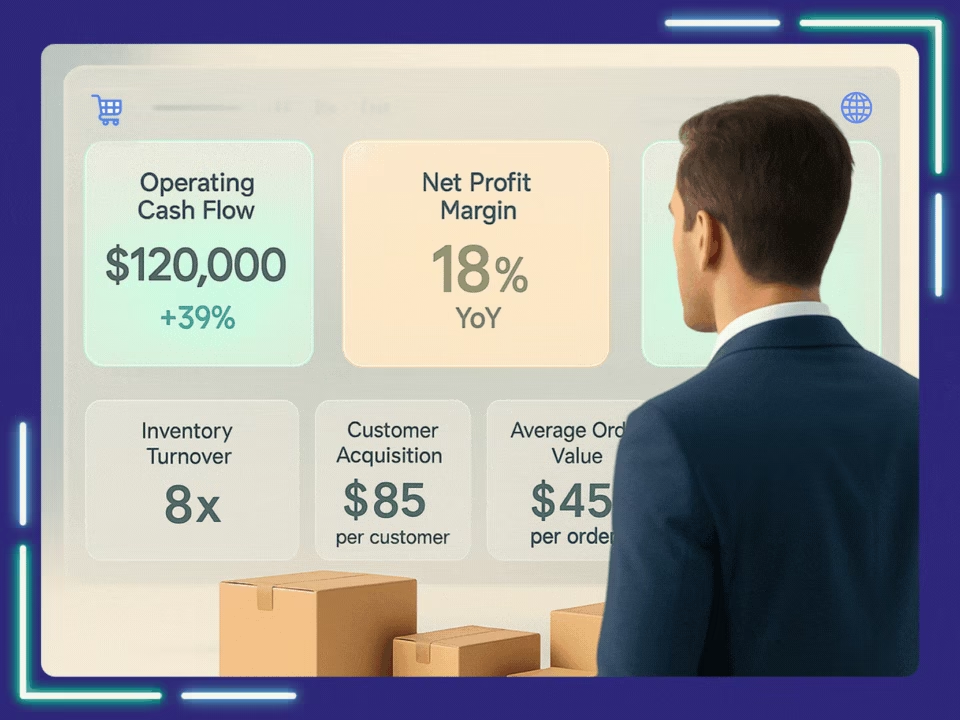

You might have seasonal peaks in sales, or deal with high upfront costs in product development or marketing. An experienced e-commerce bookkeeper helps you navigate this volatility by managing accounts payable and receivable, ensuring you always have cash to fuel growth. They monitor your average order value (AOV), conversion rates, and customer acquisition costs (CAC), making sure your business isn’t spending more than it’s bringing in.

Accurate Financial Reporting

An e-commerce bookkeeper delivers accurate, timely financial reports including cash flow statements, balance sheets, and profit and loss statements, for your online business. Whether it’s tracking cost per acquisition (CPA), profit and loss statements, cash flow statements, or balance sheets, having detailed financial reporting that aligns with industry trends lets you make informed decisions.

Simplifying Payroll and Employee Expense Tracking

E-commerce businesses often have diverse teams including full-time, part-time, and freelance workers. Using MYOB, QuickBooks, Xero, or Zoho Books, your e-commerce bookkeeper can automate payroll, ensuring timely payments and compliance with Australian regulations. They also track employee expenses like travel or home office setups, properly recording them for tax purposes.

Integrating with E-Commerce Platforms

Whether you sell on your website, eBay, Amazon, or Etsy, an e-commerce bookkeeper integrates your bookkeeping software with these platforms to ensure all transactions, fees, and GST are recorded correctly. They will also link your payment gateways like PayPal, Stripe, or Afterpay to your financial records, giving you a consolidated view of your finances, no matter where your sales come from.

Creating Custom Financial Reports

Not every e-commerce business operates the same way, so generic financial reports won’t deliver real insight. A specialised ecommerce bookkeeper creates customised reports suited to your goals, covering profit margins by product line, customer return trends, and tracking of essential KPIs as CAC, CLV, and campaign performance to help you make smarter, data-driven decisions.

Preparing for Audits and Minimizing the Risk of Compliance Issues

Australian online stores are regularly audited by the ATO and having accurate and organised books is essential. A bookkeeper ensures that all records, from sales tax to inventory costs, are up to date and compliant with Australian laws. They also maintain proper documentation for all expenses, invoices, and deductions, so when tax time comes, you’re prepared.

Advising on Financial Strategies

An experienced ecommerce bookkeeper will help you set realistic financial goals, forecast cash flow, and recommend strategies to optimize your tax position. Whether it’s deciding the best time to invest in new products, scaling operations, or making strategic financial moves, your bookkeeper’s financial insights guide you every step of the way. With their expertise, you can confidently plan your business growth, knowing that your financials are in good hands.

Turning Your Books into a Growth Engine With Dedicated E-Commerce Bookkeeper

E-commerce bookkeepers play a crucial role in keeping online businesses financially organised and operationally efficient. Their expertise in areas like inventory management, tax compliance, cash flow, payroll, and customised financial reporting ensures businesses stay on track and prepared for audits.

Integrating specialised bookkeeping support into your existing processes delivers valuable insights, promotes growth, and frees up time to focus on expanding your business.

Whiz Consulting has been delivering bookkeeping support to Australian online businesses for over a decade. Our experienced ecommerce bookkeepers provide specialised services tailored to the needs of Australian retailers, leveraging advanced AI and automation tools to simplify financial processes. Get in touch today to discover how our expert team can streamline your financial management and give your business the support it deserves.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

An e-commerce bookkeeper manages sales, inventory costs, payroll, bank reconciliations, and GST compliance. They produce clear financial reports to track cash flow, profit, and business growth.

They improve cash flow visibility, cut costs, and ensure ATO compliance. With automated systems and tailored reports, you can make informed decisions and focus on scaling your store.

Yes. A bookkeeper keeps your finances accurate, compliant, and organised while you focus on operations. As your store grows, they help manage cash flow and set up efficient systems.

Automation connects sales, payments, and expenses to your bookkeeping software in real time. It streamlines invoicing, tax, and reconciliations, cutting manual work.

DIY bookkeeping risks errors and missed deadlines. A professional ensures ATO and GST compliance, accuracy, and efficiency, saving you time and avoiding costly mistakes.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.