-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

Streamline Finances with Expert Aussie Real Estate Bookkeepers

Managing properties, closing deals, and growing your real estate portfolio is rewarding, but managing finances can be a challenge. At Whiz Consulting, with our 10+ years of expertise and a team of 150 skilled professionals, our real estate bookkeepers deliver tailored solutions that fit your requirements. From reducing overhead costs to giving you real-time financial insights, we help you make smarter decisions with complete confidence.

Real Estate Bookkeeping Services We Offer

- Day-to-Day Bookkeeping

- Accurate Financial Statement Preparation

- Comprehensive Auditing Services

- Streamlined Accounts Receivable Management

- Efficient Accounts Payable Processing

- End-to-End Payroll Services

- Comprehensive GST/BAS Filing Support

Bookkeeping Challenges We Solve for Aussie Firms

Let our expert real estate bookkeepers take the stress out of managing your property finances.

Streamlining Property Transactions

Whether it’s BAS-related reconciliations, multi-property portfolios, or capital gains tax, we ensure every transaction is managed accurately and in full compliance with ATO regulations.

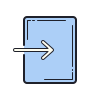

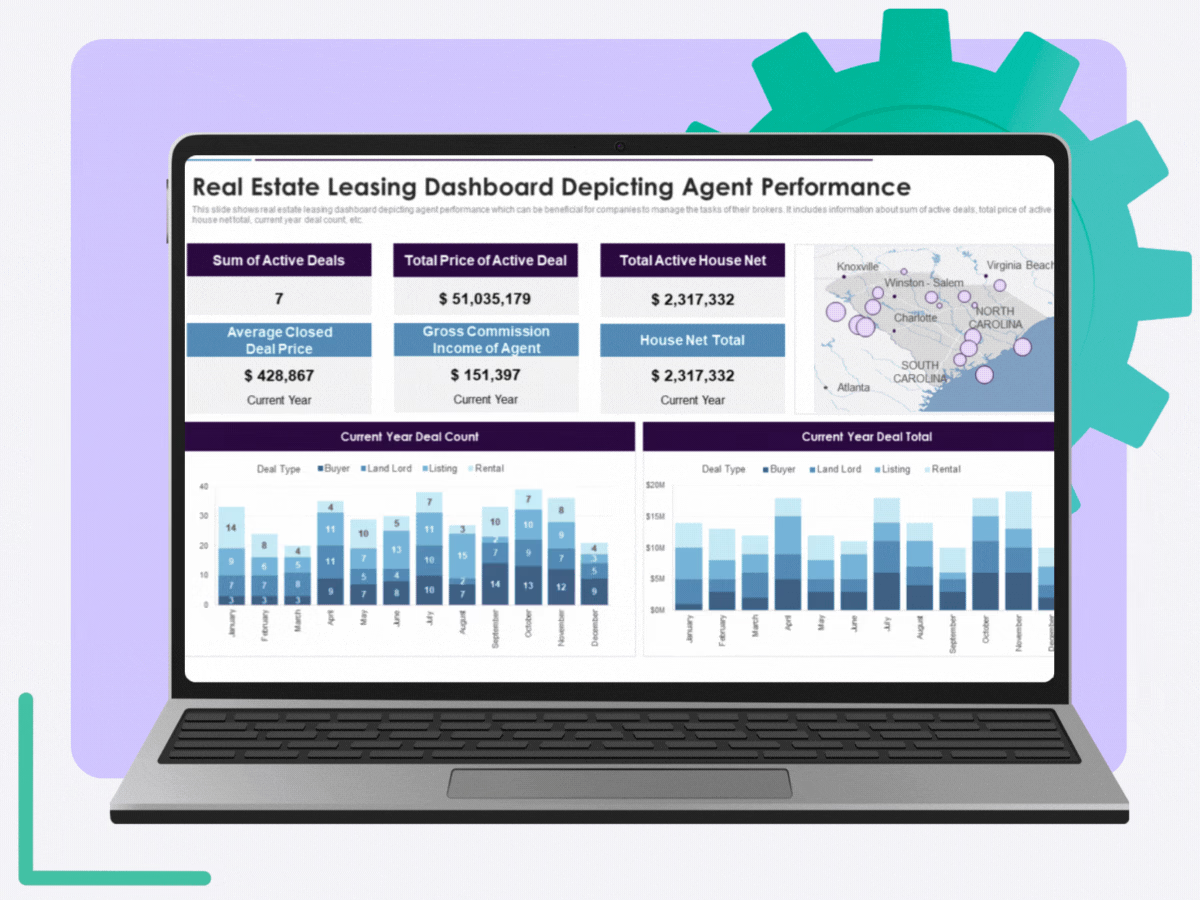

Detailed Financial Reporting

Our experts track property expenses, manage assets and liabilities, and assess property efficiency to provide accurate financial reports that keep your business compliant and cash flow steady.

Comprehensive Tax Support

Our expert real estate bookkeepers provide full tax assistance, ensuring adherence to ATO requirements and Australian Accounting Standards Board (AASB).

Hire an Expert Virtual Bookkeeper Who:

Why Choose Us?

-

Value-Driven Accounting

Our real estate bookkeepers give property investors, developers, and managers complete financial clarity and actionable insights.

-

Accounting Automation

We leverage AI and automation to streamline rent roll management, expense tracking, and BAS-ready reporting with accuracy and speed.

-

Dedicated Bookkeepers

Work with expert real estate bookkeepers who help you comply with ATO, GST, CGT, and other regulations while tailoring services to fit your financial goals.

-

Outsourcing Expertise

With a decade of experience, we help Australian businesses simplify complex financial tasks while keeping their costs under control.

-

Real-Time Support

Get instant access to your financial data and ongoing support, ensuring smooth cash flow and compliance across your property ventures.

-

Cost-Efficiency

Outsourcing your bookkeeping needs to us saves you significantly on staffing and overheads, while still giving you expert bookkeepers!

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch NowClient Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

At Whiz, we help Australian property businesses reduce their overhead costs. Our flexible packages let you pay only for the real estate bookkeeping services you need, freeing resources for acquisitions, developments, or reinvestment.

Yes. Our real estate bookkeepers are trained in ATO regulations, GST, BAS, and CGT reporting, along with property-specific regulations. Our specialists keep your books accurate and compliant.

Definitely. As a SOC 2 and ISO/IEC 27001 certified F&A service provider, we use encrypted platforms, role-based access, and comply with international data security standards to keep your financials safe and confidential.

You can get started within 48 hours of signing the agreement with us. We set up the required accounting systems and assign you a dedicated real estate bookkeeper within two business days, so you can see improvement from day one.

Yes. You’ll work directly with a dedicated real estate bookkeeper who understands ATO compliance, your property portfolio, as well as reporting needs. Whether it’s a single investment or a large-scale property group, we provide tailored support to you.

We stay connected through your preferred platforms, including email, MS Teams, Slack, or Zoom. For document exchange, our real estate bookkeepers use secure cloud platforms such as Dropbox, Google Drive, and OneDrive, ensuring smooth collaboration and real-time updates at all times.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Smart Finances with Aussie Real Estate Bookkeepers

At Whiz Consulting, we have dedicated real estate bookkeepers who go far beyond standard income and expense tracking. Our team manages your bank and trust account reconciliations, property transactions, expense categorisation, and ensures ATO compliance, so your business is always ready to scale!

Get a CallEliminate the costs of office space, recruitment, and staff training by outsourcing bookkeeping to us. Our real estate bookkeepers provide professional support so you can redirect resources towards property growth, acquisitions, and investment planning.

Our experts are proficient in AASB standards, GST, BAS compliance, and property-specific reporting. We ensure your books and financials align seamlessly with ATO requirements.

With years of expertise in outsourced accounting, our team supports residential investors, commercial developers, and property groups, offering tailored bookkeeping for all sizes of businesses.

We work with leading cloud-based platforms such as NetSuite, MS Dynamics, MYOB, Zoho Books, and QuickBooks, and property management software to streamline operations. From automated rent roll updates to live dashboards, we deliver accurate, transparent, and real-time insights.

Our accounting outsourcing services ensure accurate bookkeeping, reliable financial reporting, and audit-ready insights. We simplify real estate bookkeeping so you can focus on building and scaling your portfolio.

From solo investors to expanding property firms, our services scale with your needs. Adjust support for acquisitions, development projects, or multiple entities, paying only for what you require.

As an ISO 1900:27001 and SOC 2 certified provider, we protect sensitive financial data with bank-grade encryption, access controls, and compliance protocols, keeping your records secure and ATO-compliant.