-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

NetSuite Accountant for AU Firms: Gain Financial Efficiency

Backed by 10+ years of experience and a team of 150+ professionals, we help Australian businesses take charge of their finances with our dedicated NetSuite accounting services. Let us worry about routine bookkeeping processes, AP/AR oversight, and bank reconciliations, while you focus on expanding your business. Our expert team makes sure your financials are accurate, up to date, and ready to support smarter business decisions.

NetSuite Accounting Services We Offer

- Day-to-day Bookkeeping Functions

- Financial Statements Reporting

- Assisting with Payroll Management

- Creating Customer Invoices and Follow-up

- Managing Vendor Payments

- Preparing For Your GST/BAS Filing

Accounting Challenges We Tackle for AU Firms

Our customised NetSuite accounting assist you to make smarter business decisions seamlessly.

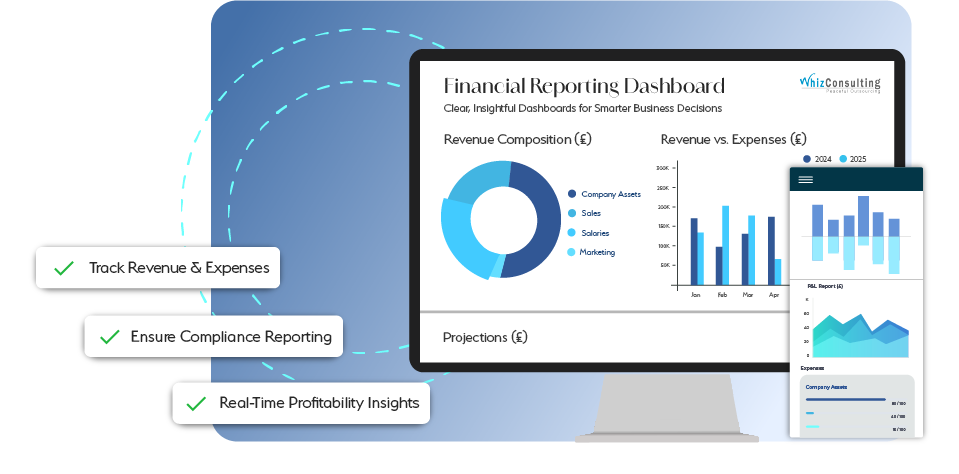

Accurate Finances

Hire NetSuite accountants for tailored financial reports that offer complete visibility into your business performance. With accurate numbers, we support smarter, more confident decision-making!

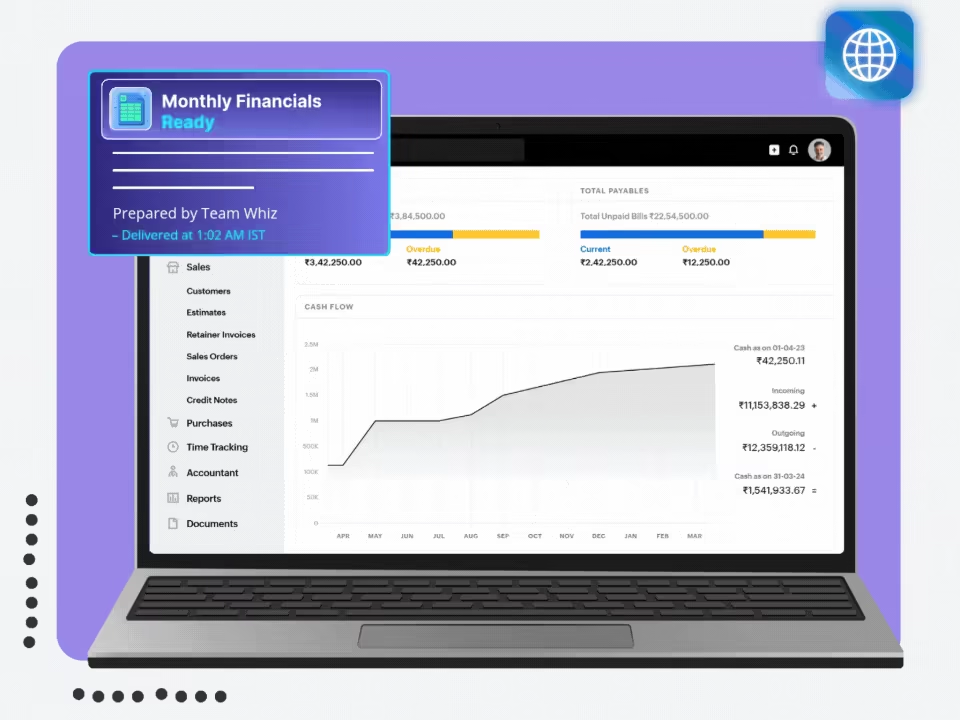

On-time Book Closures

Our NetSuite accounting specialists simplify your month- and year-end processes by checking transactions, reconciling bank accounts, and finalising processes promptly. We offer fast and hassle-free book closures.

End-to-End Tax Support

From BAS and GST lodgements to company tax returns and compliance with ATO standards, our NetSuite accountants deliver end-to-end tax support. We also assist with multi-state operations, helping your business stay fully compliant.

Hire A NetSuite Accounting Expert Who:

Why Choose Us?

-

Value-Driven Accounting

As part of our NetSuite accounting services, we maintain your books accurately and deliver insights that drive better business outcomes.

-

Accounting Automation

By tapping into NetSuite’s latest technology and AI-driven tools, we simplify reporting processes, making them quicker, smoother, and more precise.

-

Dedicated Experts

Our skilled NetSuite experts are committed to providing the expert guidance and attention your AU business deserves.

-

Outsourcing Expertise

With 10+ years of NetSuite accounting outsourcing experience, we’ve supported Australian businesses stay prepared for growth.

-

Real-Time Support

Stay on top of your finances anytime. With live dashboards and instant reporting, you’ll have the visibility to act with confidence.

-

Cost Savings

Outsourcing your NetSuite accounting to us means no overheads, just adaptable support that scales with your business needs.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch NowClient Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

Our fees depend on the complexity of your accounts, the number of entities, and the level of support you require. Hiring our NetSuite accountants is actually more affordable than employing in-house staff, as we help remove overhead costs such as payroll, training, and office space.

Yes. Our NetSuite accountants are well-versed in modules including financial management, inventory, advanced revenue recognition, and multi-entity consolidation.

We are ISO 27001 and SOC 2 certified F&A service provider, and we apply strict measures such as end-to-end data encryption, multi-factor authentication, role-based permissions in NetSuite to safeguard your information.

Once the scope of work is finalised, our NetSuite accountants can onboard you within 48 hours. Our streamlined onboarding process ensures a smooth transition with minimal disruption to your existing operations.

Yes. Our NetSuite accounting specialists can set up and fine-tune automation rules, approval workflows, and recurring reporting within the software to improve efficiency in your accounting function.

Yes, you can. We provide flexible hiring options so you can engage our NetSuite experts for ongoing support, audit readiness, or for just catch-up bookkeeping services without committing to a full-time role.

Yes. Our NetSuite accountants are trained to manage multi-subsidiary and global structures. They can process intercompany transactions, prepare consolidated reports, and ensure compliance with ATO requirements to give you complete peace of mind!

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Expert NetSuite Accountants for Aussie Companies

At Whiz Consulting, we provide end-to-end NetSuite accounting services to help Australian businesses. Our experienced accountants streamline workflows, maintain accuracy, and deliver insights that support smarter decision-making. With the right blend of accounting expertise and platform knowledge, we optimise your NetSuite system for efficiency, compliance, and stronger ROI.

Get a CallOur NetSuite accounting services give you access to expert accountants at a fraction of the cost of building an internal team. Businesses across Australia reduce overheads by cutting recruitment, training, and staffing costs with us!

From routine bookkeeping to advanced financial reporting services and automation setup, our team covers it all. Our diverse industry experience ensures we quickly adapt to your business needs and provide you seamless finances.

Our accounting outsourcing services simplify onboarding and guarantee smooth operations for you. With a dedicated NetSuite accounting specialist, you’ll benefit from risk-free, consistent workflows.

Save time and boost accuracy with automation for billing, invoicing, revenue recognition, and reconciliations, all set up directly within NetSuite with our accountants.

Our NetSuite experts deliver balance sheets, profit and loss statements, and cash flow reports in real time, helping you make quicker, smarter financial decisions.

We integrate NetSuite with all your third-party applications, ensuring seamless data flow without manual errors.

Our NetSuite experts keep your books aligned with ATO standards, BAS/GST reporting, and Australian accounting regulations, so you’re always audit-ready.