-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

Professional Real Estate Bookkeepers for UK Firms

Expanding your real estate business should feel rewarding, not weighed down by financial administration. Backed by a decade of experience and a team of over 150 experts, our real estate bookkeepers deliver customised services that reduce overheads on employee salaries, benefits, and office infrastructure. We help you improve your business’s efficiency and give you real-time financial clarity to guide every decision.

Real Estate Bookkeeping Services We Offer

- Day-to-Day Bookkeeping

- Accurate Financial Statement Preparation

- Comprehensive Auditing Services

- Streamlined Accounts Receivable Management

- Efficient Accounts Payable Processing

- End-to-End Payroll Services

- Comprehensive VAT/Corporate Tax Filing Support

Bookkeeping Challenges We Solve for UK Businesses

Let our real estate bookkeepers help you navigate financial complexities with ease!

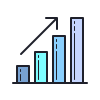

Managing Property Transactions

From leasehold adjustments to multi-entity reconciliations, we take the complexity out of real estate bookkeeping for you. Our services ensure compliance with HMRC while keeping your records up to date.

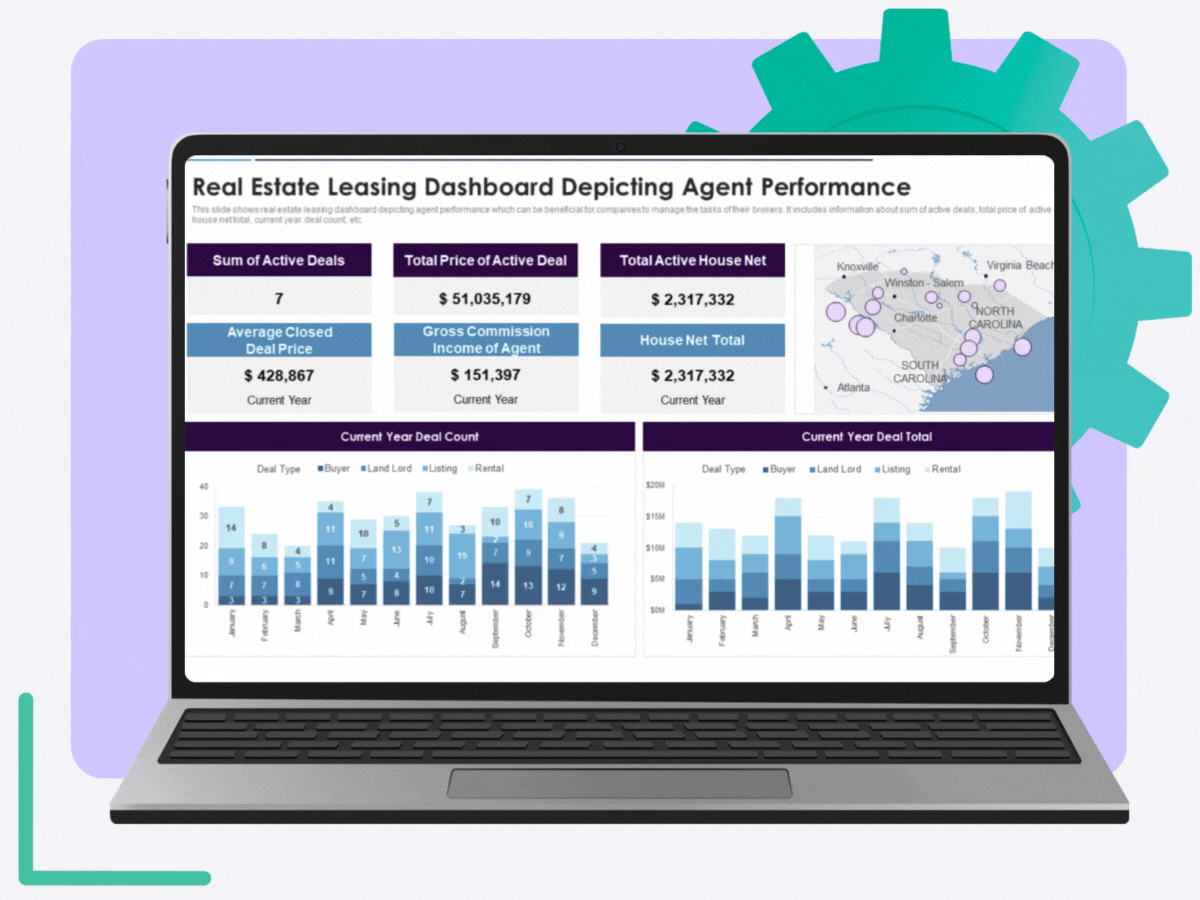

Clear Financial Reporting

We allocate costs across multiple properties, manage assets and liabilities, and evaluate your business’s financial performance to give you accurate and insightful reports that strengthen your decision-making.

End-to-End Tax Support

Our real estate bookkeepers manage all aspects of tax compliance, including helping you with VAT submissions and MTD filings to corporate tax returns, while ensuring alignment with UK GAAP and HMRC requirements.

Hire an Expert Virtual Bookkeeper Who:

Why Choose Us?

-

Value-Driven Solution

Our real estate bookkeeping services provide landlords, developers, and property managers with full visibility over their finances.

-

Accounting Automation

We use automation and AI-driven tools to manage bookkeeping tasks, ensuring accurate records and HMRC-ready reports every time.

-

Outsourcing Expertise

With more than a decade of experience, we simplify the financial complexities of real estate businesses while delivering cost-efficient support.

-

Dedicated Bookkeepers

You’ll have a team of real estate bookkeepers who will help you maintain compliance with UK property-specific requirements.

-

Real-Time Support

Stay updated with real-time access to your accounts and receive prompt support whenever you need it, no matter where your properties are based.

-

Cost-Efficiency

Our expert bookkeeping solutions keep your records accurate and compliant while helping you increase profitability across your portfolio.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner may sound like a task, but with Whiz, it’s completely stress-free. We support you at every step, guaranteeing a seamless transition without downtime or disruptions. Leave your bookkeeping to us, so you can focus on what you do best.

Switch NowClient Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimising disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

At Whiz Consulting, we help property businesses across the UK cut down significantly on overheads while choosing our outsourced real estate bookkeepers. With our flexible, scalable packages, you only pay for the level of support your portfolio truly requires and free up resources for growth and investment.

Yes. Our skilled real estate bookkeepers are trained in HMRC regulations, IFRS standards, and property-specific regulations such as service charge accounts, rental income, and capital allowances.

As a SOC 2 and ISO/IEC 27001 certified finance and accounting service provider, we follow strict protocols, including encrypted systems and GDPR-compliant processes, so your financial data is always safe.

We can onboard you within 48 hours of the consultation and contract signing. Our streamlined process ensures your systems are set up quickly, and a dedicated UK-focused real estate bookkeeper is assigned within two business days.

Yes. You’ll have a dedicated real estate bookkeeper who understands your property portfolio, compliance needs, and reporting requirements. Whether you need bookkeeping for a few rental units or complex property groups, our services are tailored to your business.

Our real estate bookkeepers connect with you through your preferred channels, or you can contact us via email, Zoom, MS Teams, or Slack. For document sharing, we use secure platforms like OneDrive, Dropbox, and Google Drive, ensuring real-time access and smooth collaboration.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Finances Made Simple with UK Real Estate Bookkeepers

At Whiz Consulting, our skilled real estate bookkeepers do more than just track rental income and property expenses. From reconciliations to property transactions and compliance with HMRC and IFRS standards, we ensure your books are always accurate, timely, and growth-ready.

Get a CallLower overheads by removing the expense of recruitment, office space, and staff training. Our real estate bookkeepers enable you to focus your resources on property acquisitions, growth, and investment strategy.

Our specialists are skilled in UK GAAP and property-sector compliance, ensuring your books, accounts, and reports meet HMRC and Companies House requirements accurately.

With extensive experience in outsourced accounting, our team manages residential portfolios, commercial developments, and property groups with precision and expertise.

We integrate with leading cloud-based platforms and property management systems. From automated rent schedules to real-time dashboards, we deliver accuracy, transparency, and better financial control.

Our accounting outsourcing services simplify complex real estate bookkeeping. From onboarding to ongoing reporting, we deliver clean, accurate records and audit-ready insights, which allows you to scale your portfolio without back-office stress.

Whether you manage a single property or a large real estate portfolio, our real estate bookkeepers adapt to your needs. Add or adjust support for new acquisitions, developments, or multiple entities, paying only for what you need.

As an ISO 1900:27001 and GDPR-compliant provider, we safeguard your financial data with bank-grade encryption, access controls, and strict compliance protocols, keeping your records secure and HMRC-ready.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.