-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

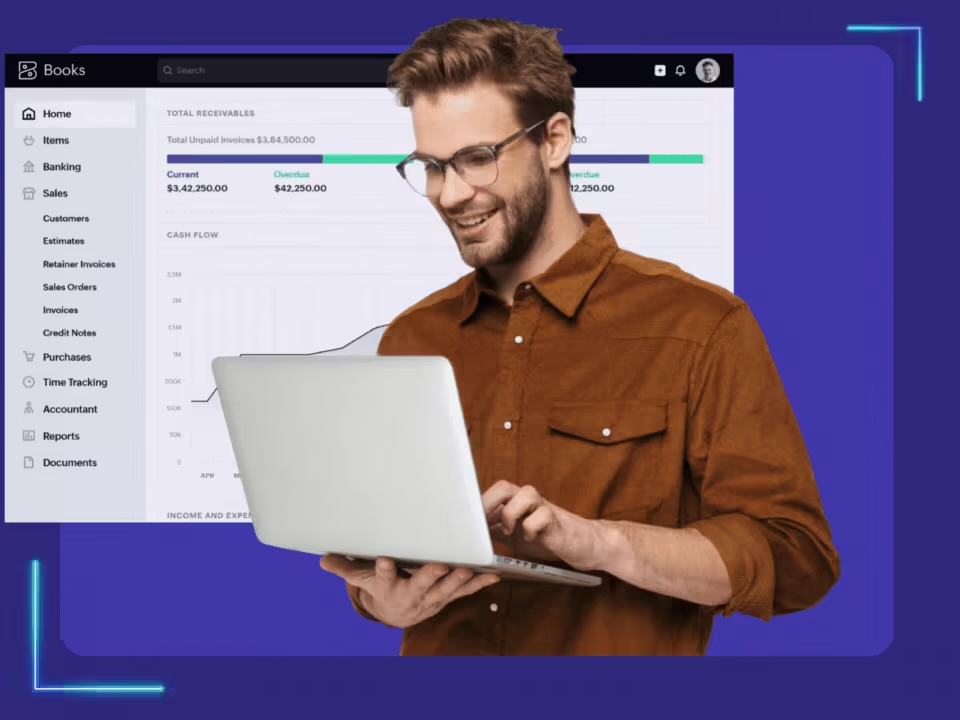

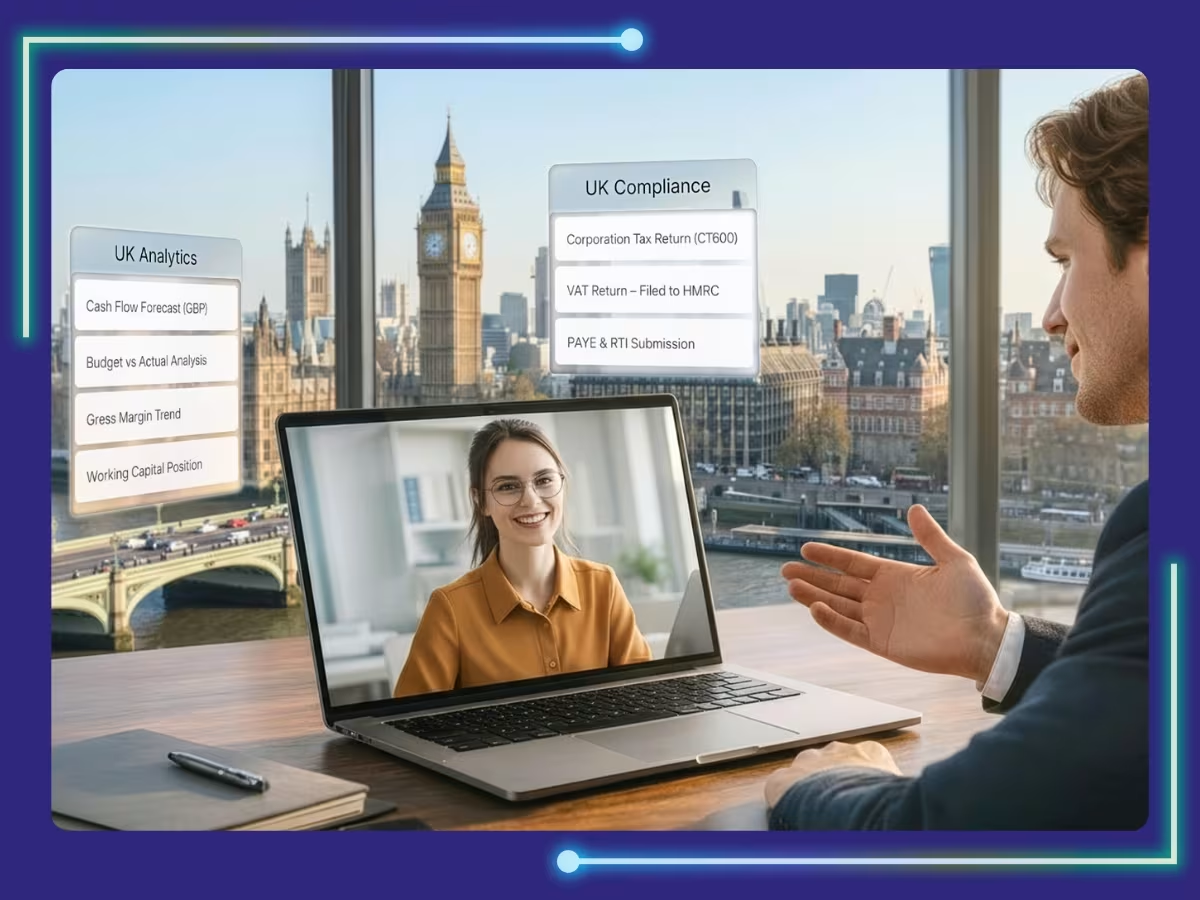

Expert Zoho Books Accounting Services for UK Businesses

Running a business while managing finances, sales, inventory, and payroll can make growth feel out of reach. That’s where our Odoo accounting services step in. With 10+ years of expertise and a team of 150+ specialists, we tailor Odoo to your business’s unique needs, ensuring accuracy, compliance, and efficiency at every step. Let us handle your accounts so you can focus on driving your business forward and achieving long-term success.

Odoo Accounting Services We Offer

- Seamless Bank Reconciliation

- Automated Invoice Processing

- Real-Time Financial Reporting

- Efficient Expense & Payment Tracking

- Accounts Payable & Receivable Management

- Multi-Currency Support & Consolidation

- Preparing For Your VAT/Corporate Tax Filing

- Cloud-Based Access for Anytime, Anywhere Control

Odoo Accounting Services: Supercharge Your UK Business

Let us customise Odoo software to offer exceptional accounting services.

Tailored Accounting Solutions

Our Odoo accounting services provide a customised approach to managing your UK business finances. We configure Odoo to handle everything from inventory and invoicing to advanced reporting, VAT returns, payroll, and full HMRC compliance.

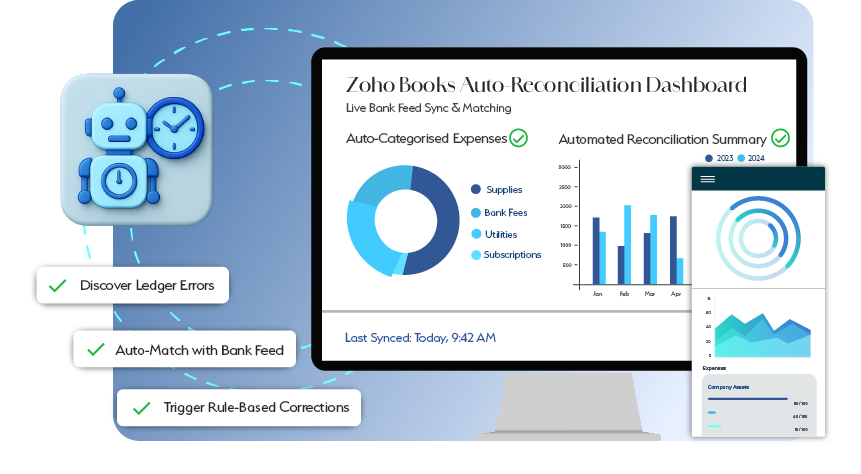

Advanced Automation

From automated invoicing and payment reminders to AI-driven bank reconciliation, our Odoo accountants minimise manual work. This frees your time to focus on business strategy while we ensure VAT accuracy and HMRC compliance.

Actionable Insights

Stay on top of your financial health with customised real-time reports powered by our Odoo accounting services. We translate key metrics like cash flow, profitability, VAT, and expense trends into actionable insights aligned with HMRC requirements.

End-to-End Tax Assistance

We configure Odoo ERP to meet HMRC standards, ensuring smooth VAT submissions, payroll compliance, and Making Tax Digital (MTD) readiness. With automated VAT tracking, real-time reporting, and payroll integration, your books remain accurate, compliant, and always prepared for audits.

Hire an Odoo Accounting Expert Who:

Why Choose Us?

-

Value-Driven Accounting

Our Odoo accountants help UK businesses align with HMRC standards while driving efficiency, scalability, and long-term financial health.

-

Accounting Automation

We configure Odoo automation to simplify VAT tracking, invoicing, and reconciliations, improving accuracy and turnaround times.

-

Outsourcing Expertise

With over a decade of experience, we support UK firms by tailoring our outsourced finance and accounting services.

-

Real-time Support

Get real-time insights into cash flow and compliance with support from our accountants trained in both Odoo and UK accounting standards.

-

Dedicated Accountant

From implementation to scaling, your dedicated Odoo accountant will guide your business with personalised, hands-on support.

-

Cost Efficiency

Reduce overhead with our outsourced Odoo accounting services, ensuring expert support without the cost of an in-house team.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch NowClient Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works?

Start strong with a process built for success from the very first step!

Initial Consultation and Assessment

We begin by understanding your business needs, current processes, and goals to craft personalized bookkeeping and accounting solutions.

Seamless Setup and Data Migration

Our experts Odoo bookkeeper and accountant handle the system setup and securely migrate your data from existing platforms, ensuring a smooth transition.

Customization and Onboarding

We customize Odoo to align with your workflows and provide hands-on training to ensure your team is confident and ready to maximize its potential.

Have questions in mind?

Find answers here...

Our Odoo accounting services costs depends on factors such as business complexity, requirements, transaction volumes, and staff number among other reasons. Also, outsourcing your F&A requirements is quite a better option than hiring in-house staff as we help reduce overhead costs and redirect the same to other core business activities.

Yes, absolutely! Our Odoo accountants are adept at using the platform to their advantage. Moreover, they are well-versed in integrating the system with other accounting software and third-party tools to deliver faster turnaround times.

Odoo supports compliance with UK GAAP and HMRC rules, including VAT submissions and Making Tax Digital (MTD) requirements. Our Odoo accountants configure VAT rates, reporting formats, and digital filing workflows to keep you compliant with tax compliances.

Yes. Our team provides flexible Odoo accounting support, and you may hire us only for part-time services as well. So, if you only need us to carry out specific tasks such as catch-up bookkeeping, payroll processing, or bank reconciliation automation, we are here for it.

With us, your financial data is protected with enterprise-grade encryption, two-factor authentication, and strict access controls. Further, we are SOC 2 and ISO 1900:27001 finance and accounting service provider, so you can trust us to keep your company’s data secure.

Yes. We configure Odoo ERP to match your invoicing, approval hierarchies, and purchasing rules. Whether you’re a startup or a growing SME, we adapt the system to your needs.

Typically, we can get you up and running, possibly within 48 hours, once the scope of work is clear. After onboarding, let us handle everything from COA setup to VAT reporting features so you’re ready without delays.

We work with industries such as real estate, retail, healthcare, hospitality, and e-commerce. Our expert virtual accountants align our accounting practices with sector standards and your business’s unique needs.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Odoo Accounting Services for UK Firms: Smarter Finances

At Whiz Consulting, our Odoo accounting services are designed for UK businesses navigating VAT, payroll, and HMRC compliance. Odoo’s clean, automated platform centralises your financial processes while reducing manual errors. Combined with our accounting expertise, you gain real-time insights, accurate records, and more time to focus on running and scaling your business.

Get a CallOur outsourced Odoo accounting services help UK businesses cut overheads while maintaining compliance and precision. Whether you’re a small firm, a scale-up, or an established company, you get expert support without in-house costs.

Our team is proficient in UK GAAP, VAT returns, HMRC reporting, MTD compliance, and CIS submissions. From Odoo accounting setup to reporting, we deliver accurate and reliable accounting services.

We follow a trusted outsourcing framework to offer smooth onboarding, secure file handling, and transparent communication, so you’re always in control of your finances.

With Odoo’s automation features, we simplify VAT-ready invoicing, approval workflows, recurring billing, and reconciliations, saving time and reducing errors with our accounting outsourcing services.

We provide real-time dashboards and tailored reports inside Odoo ERP, ensuring your numbers are always clear, audit-ready, and HMRC-compliant.

From VAT and PAYE to MTD filings, year-end accounts, our Odoo accountants manage compliance with HMRC requirements, removing stress and last-minute issues for you!

Your financial data is safe with us as we utilise encrypted systems, enterprise-grade protection, and maintain full compliance with UK GAAP and HMRC standards. As an SOC 2 and ISO 27001-accredited provider, we maintain the highest levels of confidentiality and data security.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.