Table of Content

Share This Article

- Published: Feb 13, 2026

- Last Updated: Feb 13, 2026

- 🔊 Listen

Quick Reads

- Offshore accountants help UK businesses stay compliant with VAT, tax filings, and payroll management.

- Accurate financial reporting is crucial for informed decision-making, reducing legal and financial risks.

- Automation and technology integration streamline accounting processes, improving operational efficiency.

- A strategic partnership with an offshore accountant provides real-time insights, helping businesses stay agile.

- Choosing the right offshore accountant ensures compliance, security, and seamless integration into your workflow.

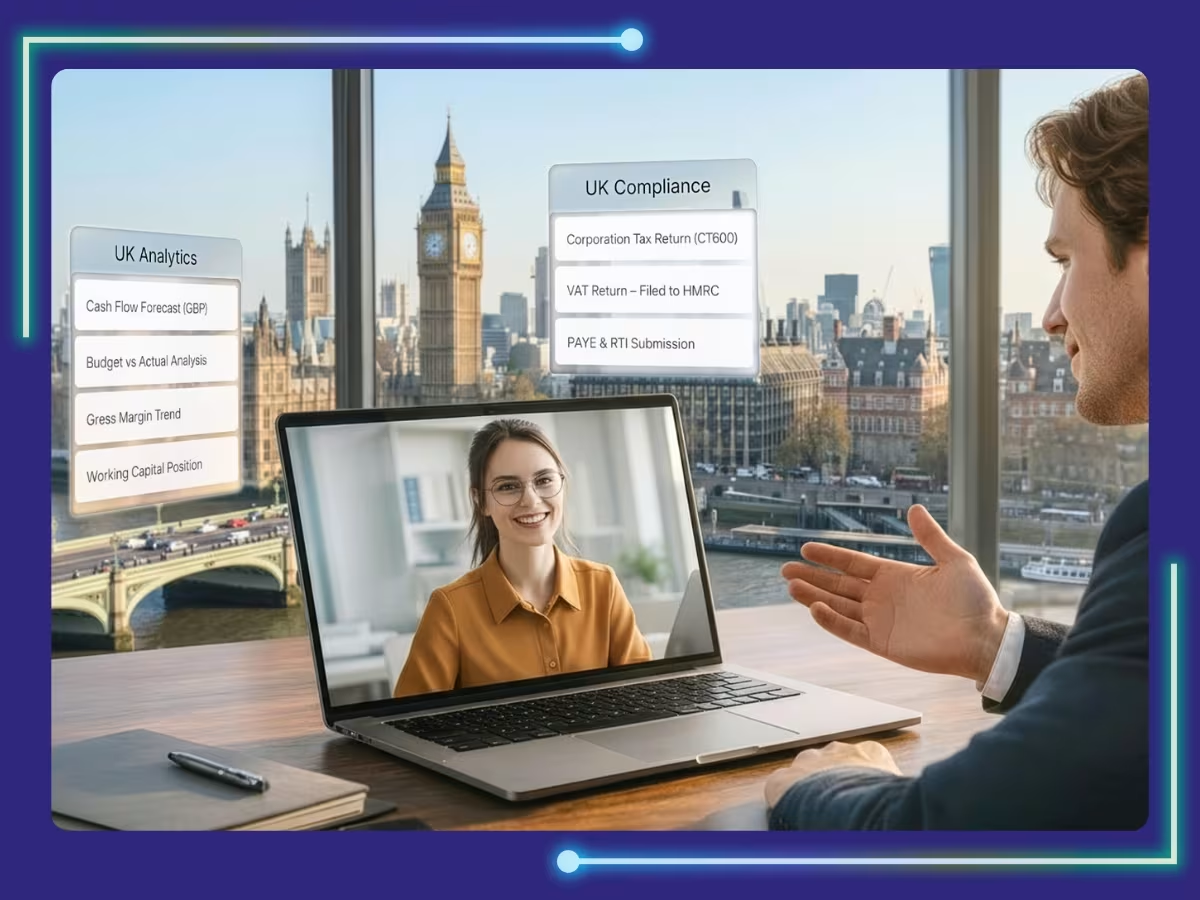

Maintaining a tight grip on financial records is a non-negotiable requirement for any UK limited company. The pressure to submit precise data in accordance with compliance regulations is constant. Errors in bookkeeping often lead to massive fines or disrupted cash flow. Many firms now turn to offshore accounting to close the loop between basic data entry and strategic oversight. Partnering with a skilled offshore accountant provides the technical support needed to manage VAT and payroll with precision. In this blog, we will explain how these partnerships strengthen your financial framework.

Offshore Accounting Simplified

Explore How Global Accounting Talent Transforms Bottom Line.

Why Compliance and Data Accuracy are Important for UK Businesses

A well-run UK business starts with two things: following the rules and trusting the numbers. Financial records, payroll information, VAT submissions, and statutory reports must reflect the true position of the company at all times. When data is reliable and processes follow UK regulations, directors can make informed decisions with confidence, reduce exposure to risk, and build trust with regulators, lenders, and stakeholders. Poor record-keeping, on the other hand, can quickly create legal issues, cash flow confusion, and reputational harm.

Key reasons this matters:

- Legal and regulatory alignment

UK businesses must comply with requirements set by bodies such as HMRC and Companies House. Accurate records support timely VAT returns, corporation tax filings, payroll reporting, and statutory accounts. - Reliable financial reporting

Financial reporting provides clean data such as profit and loss statements, balance sheets, and cash flow reports. Management decisions based on incorrect figures can distort pricing, budgeting, and growth plans. - Audit readiness and accountability

Proper documentation, audit trails, and structured record-keeping make external audits smoother and reduce the stress of last-minute corrections. - Stronger risk control

Accurate data highlights discrepancies early, helping prevent fraud, duplicate payments, tax miscalculations, and reporting errors. - Improved operational efficiency

When systems contain correct, structured information, teams spend less time fixing mistakes and more time focusing on strategy and service delivery. - Data protection and governance

Regulations such as GDPR require businesses to handle personal data responsibly. Accurate records and secure systems reduce the risk of breaches and related penalties.

How an Offshore Accountant Fills the Gap Between Compliance and Insight

An offshore accountant provides compliance excellence, insight generation, technological integration, and strategic partnership to UK businesses. Below is an explanation of each role an offshore accountant in the UK plays:

Compliance Excellence

Offshore accountants ensure businesses stay on top of regulatory requirements, managing tasks like VAT filings, payroll, and audit preparation. They handle accounting compliance with UK-specific regulations such as HMRC guidelines, understanding VAT and its requirements, and international standards like UK GAAP and IFRS, reducing the risk of costly errors and penalties. This allows businesses to focus on operations while maintaining a high level of financial integrity.

Insight Generation

By automating monotonous financial processes, offshore accountants for UK businesses provide up-to-date financial data. This enables real-time analysis and insights into cash flow, variances, and financial forecasting. These insights help businesses make informed decisions and stay agile in hyper growth situations, providing the strategic edge they need to move forward confidently.

Technology Integration

Offshore accountants utilise advanced technology like accounting automation and cloud platforms, including QuickBooks, Xero, and NetSuite, to streamline accounting processes. This technology speeds up financial reporting, improves accuracy, and allows for better data analysis. AI-driven tools also identify anomalies and assist in predictive analytics, making financial data more actionable for businesses.

Strategic Partnership

An effective offshore accounting partnership becomes an integral part of a business’s growth strategy. Offshore teams deliver reliable and compliant financial services, helping businesses plan for the long term. With their expertise, offshore accountants support growth by providing insights and advice, allowing in-house teams to focus on high-value tasks and strategic initiatives.

How to Find the Right Offshore Accountant to Strengthen Compliance

To find the right offshore accounting services, start by defining your needs, verifying qualifications, prioritising accounting compliance, conducting a rigorous vetting process, and using trusted platforms. Below is a breakdown of each factor to consider when choosing the perfect fit for your business:

- Define the accounting services you need, such as bookkeeping, tax compliance, financial reporting, or audit support, to help identify the right candidate.

- Check for recognised qualifications and verify experience with Uhandling VAT or other relevant compliance frameworks as per your industry.

- Confirm the accountant’s knowledge of international regulations, double taxation agreements, and local compliance laws.

- Prioritise security by selecting accountants who adhere to data protection standards like GDPR and ISO27001. Use secure platforms for file storage and ensure role-based access controls are in place.

- Test candidates on their technical skills by presenting real scenarios, such as explaining how to close monthly books using the preferred software.

- Look for familiarity with tools like QuickBooks, Xero, and NetSuite, and their ability to handle integration and multi-currency transactions and tax filings.

- Choose a partner who understands your industry and can seamlessly integrate into your workflow, providing ongoing support and clear communication.

- Use trusted platforms and agencies that have a track record in delivering high-quality offshore accounting services.

How an Offshore Accountant Fills the Gap Between Compliance and Insight

An offshore accountant provides compliance excellence, insight generation, technological integration, and strategic partnership to UK businesses. Below is an explanation of each role an offshore accountant in the UK plays:

Compliance Excellence

Offshore accountants ensure businesses stay on top of regulatory requirements, managing tasks like VAT filings, payroll, and audit preparation. They handle accounting compliance with UK-specific regulations such as HMRC guidelines, understanding VAT and its requirements, and international standards like UK GAAP and IFRS, reducing the risk of costly errors and penalties. This allows businesses to focus on operations while maintaining a high level of financial integrity.

Insight Generation

By automating monotonous financial processes, offshore accountants for UK businesses provide up-to-date financial data. This enables real-time analysis and insights into cash flow, variances, and financial forecasting. These insights help businesses make informed decisions and stay agile in hyper growth situations, providing the strategic edge they need to move forward confidently.

Technology Integration

Offshore accountants utilise advanced technology like accounting automation and cloud platforms, including QuickBooks, Xero, and NetSuite, to streamline accounting processes. This technology speeds up financial reporting, improves accuracy, and allows for better data analysis. AI-driven tools also identify anomalies and assist in predictive analytics, making financial data more actionable for businesses.

Strategic Partnership

An effective offshore accounting partnership becomes an integral part of a business’s growth strategy. Offshore teams deliver reliable and compliant financial services, helping businesses plan for the long term. With their expertise, offshore accountants support growth by providing insights and advice, allowing in-house teams to focus on high-value tasks and strategic initiatives.

How to Find the Right Offshore Accountant to Strengthen Compliance

To find the right offshore accounting services, start by defining your needs, verifying qualifications, prioritising accounting compliance, conducting a rigorous vetting process, and using trusted platforms. Below is a breakdown of each factor to consider when choosing the perfect fit for your business:

- Define the accounting services you need, such as bookkeeping, tax compliance, financial reporting, or audit support, to help identify the right candidate.

- Check for recognised qualifications and verify experience with Uhandling VAT or other relevant compliance frameworks as per your industry.

- Confirm the accountant’s knowledge of international regulations, double taxation agreements, and local compliance laws.

- Prioritise security by selecting accountants who adhere to data protection standards like GDPR and ISO27001. Use secure platforms for file storage and ensure role-based access controls are in place.

- Test candidates on their technical skills by presenting real scenarios, such as explaining how to close monthly books using the preferred software.

- Look for familiarity with tools like QuickBooks, Xero, and NetSuite, and their ability to handle integration and multi-currency transactions and tax filings.

- Choose a partner who understands your industry and can seamlessly integrate into your workflow, providing ongoing support and clear communication.

- Use trusted platforms and agencies that have a track record in delivering high-quality offshore accounting services.

Build a Data-Driven Accounting System with a Skilled Offshore Partner

A reliable and compliant accounting system is primal to any UK business, and partnering with a reputable offshore accounting firm ensures that your company can confidently meet regulatory standards. With accurate data management, timely reporting, and strategic insights, your business can benefit from improved decision-making and operational efficiency. The right offshore partnership allows you to focus on growth while keeping a check on your financials to remain in excellent shape, preventing costly errors and streamlining processes.

Whiz Consulting offers expert offshore accounting services tailored to your needs, from tax compliance to insightful reporting and beyond. Our skilled offshore accountants are equipped with the latest technology to help your business stay compliant and optimize financial strategies. Let us be the trusted partner that supports your financial success. Get in touch today to explore how we can elevate your accounting systems.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Yes, offshore accountants can handle UK VAT and tax compliance if they have the right expertise. It’s essential to check their knowledge of UK tax laws, regulations, and experience working with UK businesses.

The cost of an offshore accountant depends on several factors, including the complexity of your business needs, the services required, and the level of expertise. These factors determine the pricing structure.

Yes, if the service provider holds certifications like GDPR, ISO27001, and SOC2, and uses encrypted communication and multi-factor authentication, your financial data will be secure during sharing and storage.

Offshore accounting helps UK businesses save on overhead costs like office space, utilities, and employee benefits. Outsourcing allows businesses to pay only for the services needed, reducing operational expenses.

Communication with your offshore accountant can be done through mutually agreed platforms such as MS Teams, Google Meet, Slack, or other secure tools, ensuring seamless and efficient collaboration.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.