Table of Content

Share This Article

- Published: November 7, 2023

- Last Updated: February 15, 2025

Bookkeeping, often considered as the financial lifeline of any business, plays a significant role in maintaining a company’s fiscal health and overall success. It involves the systematic recording and organisation of financial transactions, enabling businesses to track their financial performance, make informed decisions, and comply with legal and tax requirements. As we all know, effective bookkeeping is essential for businesses of all sizes and industries, as it provides a clear and accurate picture of their financial performance. In this era of data-driven decision-making, sound bookkeeping practices are indispensable, offering a multitude of benefits that extend beyond mere record-keeping. So, in this post, we will explore the significance of efficient bookkeeping, the manifold ways in which it can positively impact businesses and how, with the help of proficient outsourced bookkeeping services, providers can help to streamline your bookkeeping process and take your businesses to the next level. But before moving on, let us know what exactly the bookkeeping is.

What is Bookkeeping?

Bookkeeping is one of the fundamental processes of recording and organising financial transactions within a business. It involves systematically keeping track of the business’s income, expenses, assets, liabilities, and equity. The role of bookkeeping in businesses is essential as it provides a clear and accurate picture of a business’s health. It allows businesses to assess their profitability, manage cash flows, make informed decisions, and comply with tax laws and regulations. Bookkeeping ensures that financial records are precise and up to date, facilitating smooth operations and enabling businesses to have a solid foundation for financial planning and accountability, which is crucial for investors, creditors, and other stakeholders.

Benefits of An Effective Bookkeeping Processes

Accurate and Financial Records:

Accurate financial records are one of the crucial benefits of implementing effective bookkeeping processes. By maintaining precise and up to date records, businesses can rely on the given information to make informed decisions and confidently assess their financial health. Accurate records enable businesses to track income, expenses, assets, and liabilities, ensuring that financial position. This transparency helps businesses identify potential areas of improvement, spot trends, and effectively allocate resources. Having accurate financial records also aids in compliance with regulatory requirements, lowers the risk of errors or misstatements, and supports the organisations’ overall financial stability and success.

Financial Analysis:

By maintaining organised and accurate financial records, businesses can conduct in-depth analysis of their financial data. This analysis allows them to identify trends, patterns, and anomalies in revenue, expenses, and other financial variables. With these insights, business owners can make informed decisions regarding budgeting, cost control, investment opportunities, and pricing strategies. Financial analysis also helps businesses evaluate the profitability and efficiency of different departments or projects, enabling them to allocate resources effectively. By leveraging the power of financial analysis, businesses can better evaluate their financial performance, identify areas for improvement, and ultimately enhance their overall financial health and success.

Compliance With Legal Requirements:

Compliance with legal requirements is considered as one of the important benefits that stems from implementing effective bookkeeping processes. By maintaining accurate and updated financial records, businesses ensure they align with their obligations in accordance with tax regulations, accounting standards, and other legal mandates. This includes timely reporting, proper documentation, and adherence to specific financial disclosure requirements. By staying compliant, businesses minimise the risk of penalties, fines, audits, and legal disputes. Effective bookkeeping practices provide the necessary transparency and accountability that regulatory bodies and stakeholders expect, fostering trust and accountability that regulatory bodies and stakeholders expect, fostering trust and credibility. Compliance with legal requirements not only ensures a smooth operation but also safeguards the reputation and long–term viability of the business.

Improved Cash Flow Management:

Accurate tracking of income and expenses allows businesses to gain a clear understanding of their cash flow patterns. This insightful information facilitates them for informed decision-making about expenditures, investments, and debt management. By maintaining proper bookkeeping practices, businesses can identify potential cash flow gaps and proactively address them. This may involve the adjustment of payment terms, negotiating favourable credit terms, or implementation of cost-saving measures. Moreover, effective bookkeeping plays a crucial role in monitoring and controlling accounts receivable and accounts payable. This ensures that payments are made and collections are received in a timely manner. By optimising cash flow management, businesses can maintain financial stability, seize growth opportunities, and confidently navigate challenging economic times.

Decision-making Support:

An effective bookkeeping process not only ensures the accurate recording and tracking of financial transactions but also provides decision-making support as a significant benefit. By maintaining organised and up to date financial records, businesses can access vital information that helps for informed decision-making. Bookkeeping processes generate financial statements and reports, enabling business owners and managers to analyse trends, identify key areas for improvement, and make strategic decisions that drive growth and success. With the help of an effective bookkeeping process, businesses can confidently navigate complex financial scenarios, evaluate investment opportunities, and plan for the future with clarity and confidence.

Business Performance Evaluation:

An effective bookkeeping process offers multiple benefits to businesses, and one of them is business performance evaluation. Through accurate and detailed financial records, businesses can effectively evaluate their overall performance and assess various key metrics. Bookkeeping provides regular financial statements showcasing crucial information such as revenue, expenses, and profitability. By closely examining these statements, business owners and managers can identify strengths and weaknesses, pinpoint areas of inefficiency, and make informed decisions to improve business operations. Furthermore, bookkeeping records also enable businesses to compare their performance over time, track progress towards goals, and implement effective strategies for growth. Hence, evaluating business performance is a valuable advantage that an effective bookkeeping process brings to any organisation.

Investor and Creditor Confidence:

Accurate and updated financial records help instil trust in potential investors, as they can assess the business financial health and make informed decisions about their investments. With transparent bookkeeping, investors gain a comprehensive understanding of a business’s financial performance, allowing them to evaluate risks and returns accurately. An effective bookkeeping system also ensures that the business meets its financial obligations to creditors promptly. This reliability encourages creditors to extend credit terms, negotiate favourable loan agreements, or offer better interest rates, ultimately improving the businesses cash flow and overall financial stability.

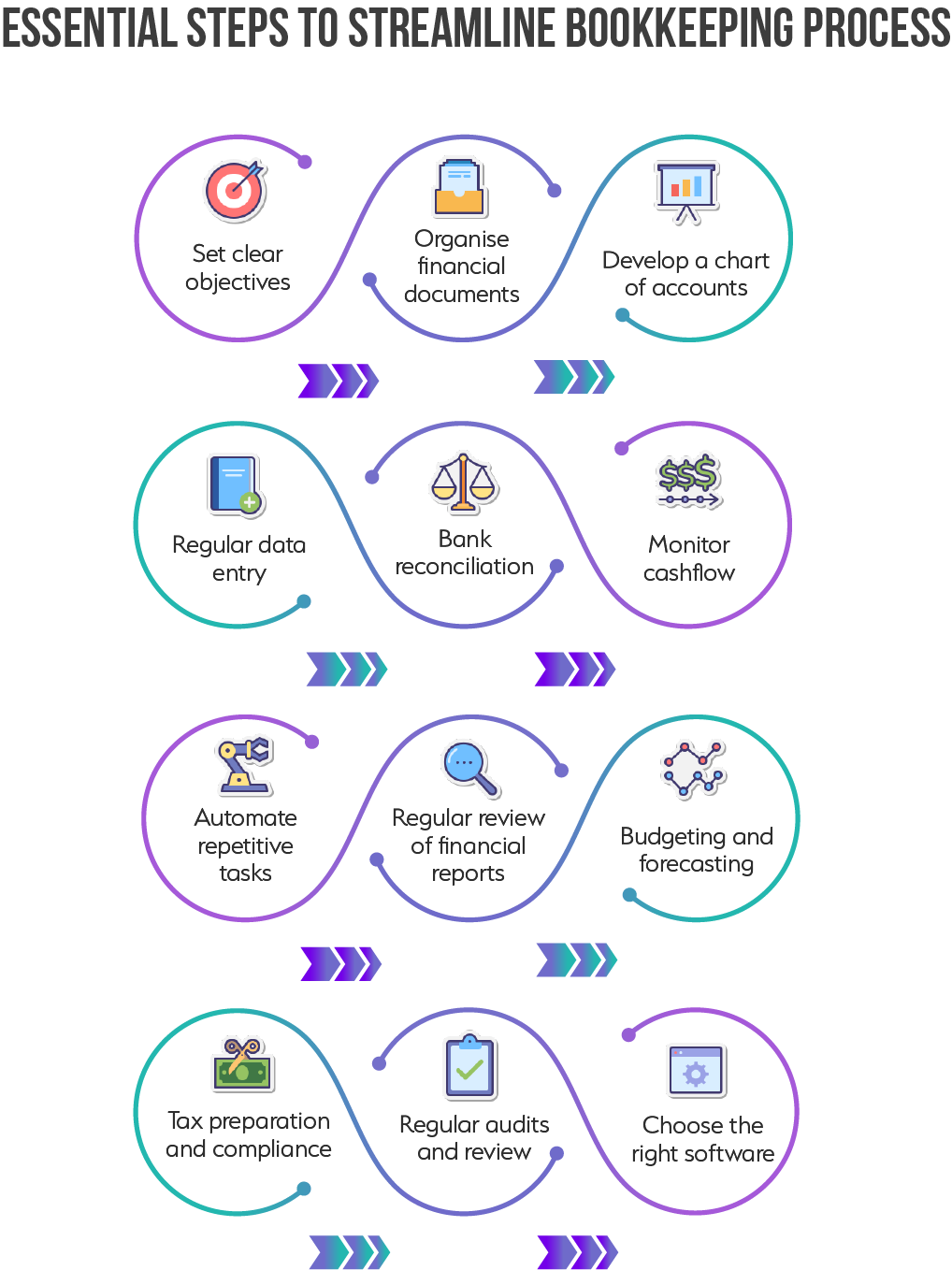

Essential Steps to Streamline Bookkeeping Process

Set Clear Objectives:

Clear and well-defined objectives provide a roadmap for bookkeepers, helping them focus on the specific financial goals and outcomes a business seeks to achieve. By outlining these objectives, bookkeepers can efficiently allocate their time and resources, prioritise tasks, and ensure that the financial records are not only accurate but also aligned with the company’s strategic vision. This proactive approach streamlines the bookkeeping process and enhances the organisation’s overall financial management, making it an indispensable practice for businesses seeking financial success.

Organise Financial Documents:

A well-structured and efficient system for document management ensures that important financial records, such as invoices, receipts, and statements, are easily accessible and systematically stored. This saves valuable time during data entry and reduces the likelihood of errors and omissions. Moreover, it enables bookkeepers to quickly respond to inquiries, audits, and financial analyses, contributing to better financial transparency and decision-making. By making financial documents readily available and well-organised, businesses can streamline their bookkeeping process, promoting accuracy and efficiency in managing their finances.

Develop A Chart of Accounts:

With a clearly defined chart of accounts in place, bookkeepers can consistently classify financial data, making it easier to generate accurate financial reports and statements. This systematic approach not only simplifies data entry but also enhances the overall organisation and efficiency of the accounting system. It ensures that financial information is both accessible and meaningful, enabling businesses to make informed decisions and maintain a clear financial picture.

Regular Data Entry:

Consistency in recording financial transactions as they occur ensures that the company’s financial records are up-to-date and accurate. By maintaining a routine for data entry, bookkeepers can minimise the risk of overlooking or forgetting crucial financial details. This facilitates the tracking of income, expenses, and other financial activities and expedites the reconciliation process. Additionally, up-to-date financial records provide a solid foundation for timely decision-making, budgeting, and financial analysis. Regular data entry is the backbone of an efficient bookkeeping system, contributing to a better-organised and more streamlined approach to managing a company’s finances.

Bank Reconciliation:

This practice involves meticulously comparing the company’s financial records with the bank’s, ensuring they align perfectly. By conducting regular bank reconciliations, discrepancies, errors, or unauthorised transactions can be promptly identified and resolved. This safeguards the business’s financial integrity and provides an accurate and up-to-date picture of its financial health. Bank reconciliation acts as a critical check and balance. It streamlines the bookkeeping process by guaranteeing that the recorded financial data is precise and reliable, ultimately leading to better-informed financial decisions and a more efficient financial management system.

Monitor Cashflow:

Cash flow is the lifeblood of any business, and keeping a vigilant eye on the inflow and outflow of funds is essential for financial stability. By closely tracking cash transactions, bookkeepers can identify trends, anticipate potential cash shortages, and ensure the company has the necessary liquidity to meet its financial obligations. This proactive approach not only aids in preventing financial crises but also allows for effective budgeting and investment decisions. Regular cash flow monitoring enhances financial transparency and provides a comprehensive understanding of the company’s financial health, making it an indispensable component of streamlined bookkeeping and sound financial management. Additionally, you have the option to select a proficient virtual accountant who can assist you in monitoring your transactions and managing your cash flow.

Automate Repetitive Tasks:

Many bookkeeping tasks, such as data entry, invoicing, and reconciliation, are often routine and time-consuming. By harnessing automation tools and software, these tasks can be executed with speed and precision, significantly reducing the risk of human error. This not only frees up valuable time for bookkeepers to focus on more strategic financial activities but also enhances the overall efficiency of the bookkeeping process. Automation also ensures that financial data is consistently processed and recorded, leading to accurate and up-to-date financial records. Ultimately, by automating these repetitive tasks, businesses can achieve greater productivity, cost savings, and improved accuracy, making it an essential component of streamlined and effective bookkeeping.

Regular Review of Financial Reports:

These reports serve as a window into a company’s financial performance and health. By consistently assessing financial reports, bookkeepers can promptly detect anomalies, variances, or discrepancies, allowing for timely corrective action. This proactive approach ensures that the financial records remain accurate and up-to-date, reducing the risk of errors that could lead to financial mismanagement. Furthermore, ongoing financial review empowers businesses to make well-informed decisions, set achievable financial goals, and adjust strategies as needed to improve their financial standing. It is essential to streamlined bookkeeping, providing the insights and data necessary for sound financial planning and effective management.

Budgeting And Forecasting:

A well-defined budget sets clear financial goals and allocates resources efficiently, aiding in cost control and resource optimisation. Meanwhile, forecasting offers a glimpse into the company’s future financial performance, enabling proactive decision-making and risk mitigation. Together, these practices help bookkeepers and businesses maintain financial discipline, enhance resource allocation, and align financial activities with overarching goals. By integrating budgeting and forecasting, companies can establish a proactive approach to financial management, ultimately contributing to a more streamlined and financially resilient operation.

Tax Preparation and Compliance:

Ensuring that a business complies with tax regulations is not only a legal requirement but also an essential part of financial management. By proactively preparing for tax obligations, bookkeepers can avoid last-minute rushes, prevent costly penalties, and maintain financial transparency. Staying abreast of tax laws and deadlines is fundamental for accurate financial records and aids in effective tax planning to minimise liabilities. Incorporating tax preparation and compliance into the bookkeeping process ensures financial legality and contributes to a well-organised, streamlined, and fiscally responsible approach to managing a company’s finances.

Regular Audits and Review:

Through systematic audits and reviews, bookkeepers can identify discrepancies, errors, or irregularities, thus allowing for prompt corrective actions. Moreover, these processes contribute to maintaining financial transparency, which is essential for decision-making and financial planning. By conducting regular audits and reviews, businesses can instil confidence in their financial systems, reduce the risk of fraud or financial mismanagement, and foster a more streamlined and robust approach to bookkeeping, ultimately leading to financial stability and growth.

Choose The Right Software:

In today’s digital age, a plethora of accounting software options are available, each designed to simplify and enhance financial management. The right software can automate repetitive tasks, improve data accuracy, and provide real-time access to financial information. It is essential to select software that meets the business’s unique needs and offers features like easy integration with bank accounts and the capacity to generate detailed financial reports. Making the right software choice not only boosts efficiency but also ensures that financial records are well-organised, accessible, and up-to-date, ultimately leading to a more streamlined and effective approach to bookkeeping.

How Can an Outsourced Accounting Firm Help in Efficient Bookkeeping?

An outsourced accounting firm is instrumental in ensuring efficient bookkeeping processes. By leveraging their expertise and experience, these firms are equipped to handle financial records and transactions accurately and efficiently. They possess a deep understanding of accounting best practices and regulations, guaranteeing the highest level of professionalism. Outsourcing bookkeeping tasks to these firms also leads to significant time and cost savings, as businesses can avoid the need to invest in hiring, training, and managing an in-house accounting department. Moreover, these firms can access advanced accounting software and technologies that streamline and automate bookkeeping processes, further enhancing efficiency. With their scalability, the firms can easily adapt to changing business needs, accommodating increasing transaction volumes or expanding into new markets. By staying up-to-date with the recent accounting standards and regulatory requirements, outsourced accounting and bookkeeping services providers ensure compliance and help mitigate financial risks. By outsourcing bookkeeping to these firms, businesses can focus on their primary operations while relying on experts to handle their financial records accurately and efficiently.

Conclusion

Whether you are an experienced entrepreneur or just beginning your business journey, it is crucial to take proactive measures to streamline your small business bookkeeping process. By dedicating time and resources now to invest in automated solutions for various accounting tasks like payroll, tax filing, and invoicing, you can not only save money in the future but also simplify the day-to-day operations of your business. Additionally, consider leveraging outsourced bookkeeping services to streamline your bookkeeping efforts further and alleviate the stress associated with managing this vital task. No matter what, whether you choose in-house or outsourced bookkeeping, start implementing the essential steps outlined above today to establish an efficient bookkeeping system that will undoubtedly contribute to your company’s overall success.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.