Table of Content

Share This Article

- Published: Sep 5, 2023

- Last Updated: Oct 27, 2025

- 🔊 Listen

E-commerce has become an increasingly popular way of doing business, allowing business owners to reach customers globally and providing them with a convenient shopping experience. However, in the midst of digital transformation, it is essential to understand the intricacies of the e-commerce cash conversion cycle. Understanding the e-commerce cash cycle is one of the critical tasks for businesses to optimise their financial operations, manage cash flow, and maximise profitability. One can also partner with knowledgeable outsourced e-commerce accountants to identify potential bottlenecks, streamline processes, and optimise cash flow to ensure sustained growth and profitability in the online marketplace.

So, let us dive deep into the e-commerce cash conversion cycle to provide you with a thorough understanding of its key components, the benefits it brings and how to enhance it effectively.

From Data to Dollars

Elevate Your Ecommerce with Smart Accounting & Analytics

Introduction to Cash Conversion Cycle

The cash conversion cycle, which is also popular as a (CCC) is a critical metric that measures the efficiency of a company in utilising its resources to generate cash flows. It basically shows a picture of how long it takes for a company to convert its invested cash into inventory, sell its products or services, and finally collect cash from its customers. CCC is an essential indicator of a company’s working capital management and ability to generate profits while maintaining a healthy cash flow. Having a detailed knowledge of the overall cycle can help you make informed decisions about inventory management, accounts receivable management, accounts payables management, credit policies, and cash management to improve your business’s financial performance.

How Does E-commerce CCC Look Like?

The E-commerce Cash Conversion Cycle (CCC) refers to the time period it takes for an e-commerce business to convert cash invested in inventory and other operating expenses into cash received from customers. Here is what CCC comprises in the context of an e-commerce business:

Customer Acquisition:

The cycle begins with attracting potential customers to your e-commerce platform through various marketing and advertising efforts. This stage focuses on increasing brand awareness and driving traffic to your website or online store.

Product Selection and Order Placement:

Once customers are on your platform, they browse your products and make their selections. They add items to their cart and place an order, providing their shipping and payment details.

Inventory Management:

As orders come in, you must ensure efficient inventory management. This includes tracking stock levels, updating product availability, and managing replenishments to avoid stockouts or excess inventory.

Order Fulfillment:

After receiving an order, you must fulfil it promptly and accurately. This involves picking, packing, and shipping the products to the customer’s designated address. Timely and reliable fulfilment is crucial for customer satisfaction and loyalty.

Payment Collection:

Once the order is fulfilled, it is time to collect payment from the customer. This can be done through various payment methods, such as credit/debit cards, digital wallets, or bank transfers. Efficient payment collection ensures a steady cash inflow and reduces outstanding accounts receivable.

Returns and Refunds:

In the e-commerce world, returns and refunds are inevitable. Handling these processes smoothly is essential for maintaining customer trust. This stage involves managing return requests, processing refunds, and updating inventory accordingly.

Cash Flow Management:

Throughout the entire cash conversion cycle, effective cash flow management is critical. This entails monitoring incoming and outgoing funds, reconciling payments, and optimising working capital to ensure liquidity and financial stability.

What Is an Ideal Cash Cycle?

An ideal cash conversion cycle for e-commerce businesses is essentially the time it takes to convert inventory into sales and cash. It is a critical metric that measures how well a company manages its working capital, which, in turn, affects profitability. A shorter cycle means less money tied up in inventory, better accounts receivable control, and faster cash access. On the other hand, a longer cycle can lead to liquidity problems and ultimately impact on business growth.

However, with the help of specialised outsourced e-commerce accountants, businesses must track every aspect of the cycle, including purchase orders, invoice processing times, shipping duration, payment terms with suppliers or customers and customer returns or refunds, as this immensely affects financial statement analysis. By meticulously monitoring all these vital components, they can help management make informed decisions about pricing strategies or supplier relationships that will reduce the overall cycle time, leading to higher profits for businesses operating within such an industry.

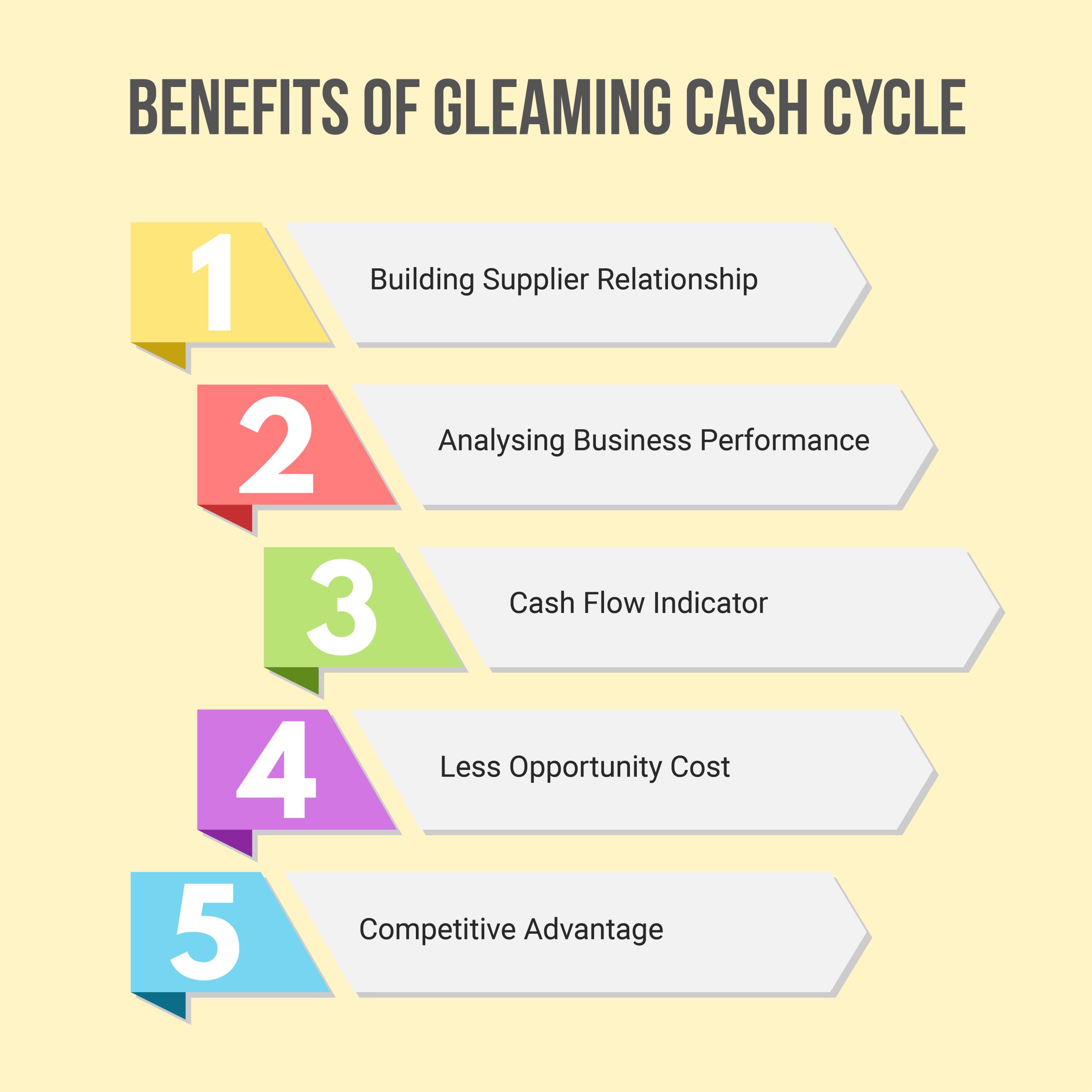

Benefits of Having a Gleaming Cash Cycle

Better Supplier Relationship:

Having a strong cash cycle is essential to any business, but it is not just about money. When you can pay your bills on time and without delay, the suppliers are more likely to trust and value your business. This means they are more willing to work with you in the future, potentially offering you better deals on products or services. To maintain this kind of relationship, it is important for you to communicate regularly with your suppliers and set clear expectations around payment terms.

Analysing Business Performance:

A well-managed cash cycle accurately shows how much money is coming in and going out, allowing you to make informed decisions about your investments, expenses and future growth plans. With the help of outsourced e-commerce accountants, they manage your business’s financial resources effectively. Maintaining a gleaming cash cycle provides more clarity over your business’s financial situation and enables better decision-making for long-term profitability.

Cash Flow Indicator:

A positive cash flow means that you have more money coming in and then going out, which indicates that your business is financially stable and has enough working capital to cover all the expenses. On the other hand, negative cash flow shows that there may be liquidity issues or inefficiencies in the supply chain. By keeping an eye on this indicator, specialised e-commerce accountants can identify areas where they can improve. This allows you to optimise your cash conversion cycles and ultimately increases profitability through improved working capital management.

Less Opportunity Costs:

Opportunity costs are defined as the loss of the potential gain from other alternatives when another alternative is chosen. In business, it refers to the cost incurred by choosing to invest money in a certain way instead of investing it in another profitable way. With efficient accounts payables management and receivable collection process, they can reduce your opportunity costs significantly. This means you will have more money to invest in other areas to generate more revenue. An optimised cash cycle provides many benefits, including less opportunity costs, leading to increased financial stability and flexibility.

Competitive Advantage:

Having a gleaming cash cycle can give you a competitive advantage over other businesses in your industry. It allows you to access credit more easily, negotiate better terms with suppliers, and ultimately operate more efficiently than your competitors. By implementing effective e-commerce accounting practices such as accounts payable management, you can ensure that your cash cycle remains healthy and strong – enabling you to focus on growing your business and achieving long-term success.

Useful read: Streamlining Your E-Commerce Finances with Xero

How to Enhance E-commerce Cash Cycle?

One of the most significant challenges e-commerce businesses face is managing their cash cycle effectively. In order to optimise cash flow and maintain a healthy financial position, it is important for businesses to work in close collaboration with outsourced e-commerce accountants. These professionals can help monitor sales revenue, analyse expenses, manage inventory costs and create accurate forecasts that allow you to make strategic decisions regarding pricing and investment opportunities.

By partnering with e-commerce accountants, you can obtain critical insights into your financial performance that enable you to streamline operations, reduce overheads and ultimately enhance profitability over time. With the right guidance from qualified accounting experts, e-commerce enterprises can maximise growth potential while minimising risk exposure in today’s highly competitive online marketplace.

You can evaluate the efficiency of your cash flow by utilising a simple equation that incorporates three essential components:

CCC = Inventory Conversion Period + Accounts Receivable Period – Accounts Payable Period

This formula will allow you to assess your cash flow management by considering the following factors:

- Inventory Conversion Period: This represents the average time it takes for a company to convert its inventory into sales. It provides insights into how efficiently a company can transform its inventory investment into revenue.

- Accounts Receivable Period: This indicates the average duration it takes for a company to collect payment from its customers after making a sale. It helps assess the effectiveness of credit control measures and the promptness of payment collection.

- Accounts Payable Period: This refers to the average time it takes for a company to settle its outstanding debts with suppliers. It reveals the company’s ability to optimise its cash flow by managing payment schedules and taking advantage of favourable terms.

The goal of an e-commerce business is to minimise the CCC as much as possible to ensure efficient use of cash flow.

Final Words

The e-commerce cash conversion cycle (CCC) is an important metric for any business engaged in electronic commerce. It measures the time it takes for a company to convert its resources into cash by selling goods or services. By optimising the CCC, you can improve your financial performance, increase profitability, and reduce the risk of running out of cash. However, achieving an optimal CCC requires a thorough understanding of the entire e-commerce process, from sourcing raw materials to delivering finished products to customers. With careful planning and execution, you can successfully manage your cash flows and achieve long-term success in the competitive world of e-commerce.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.