Table of Content

Share This Article

- Published: Oct 25, 2023

- Last Updated: Feb 11, 2025

- 🔊 Listen

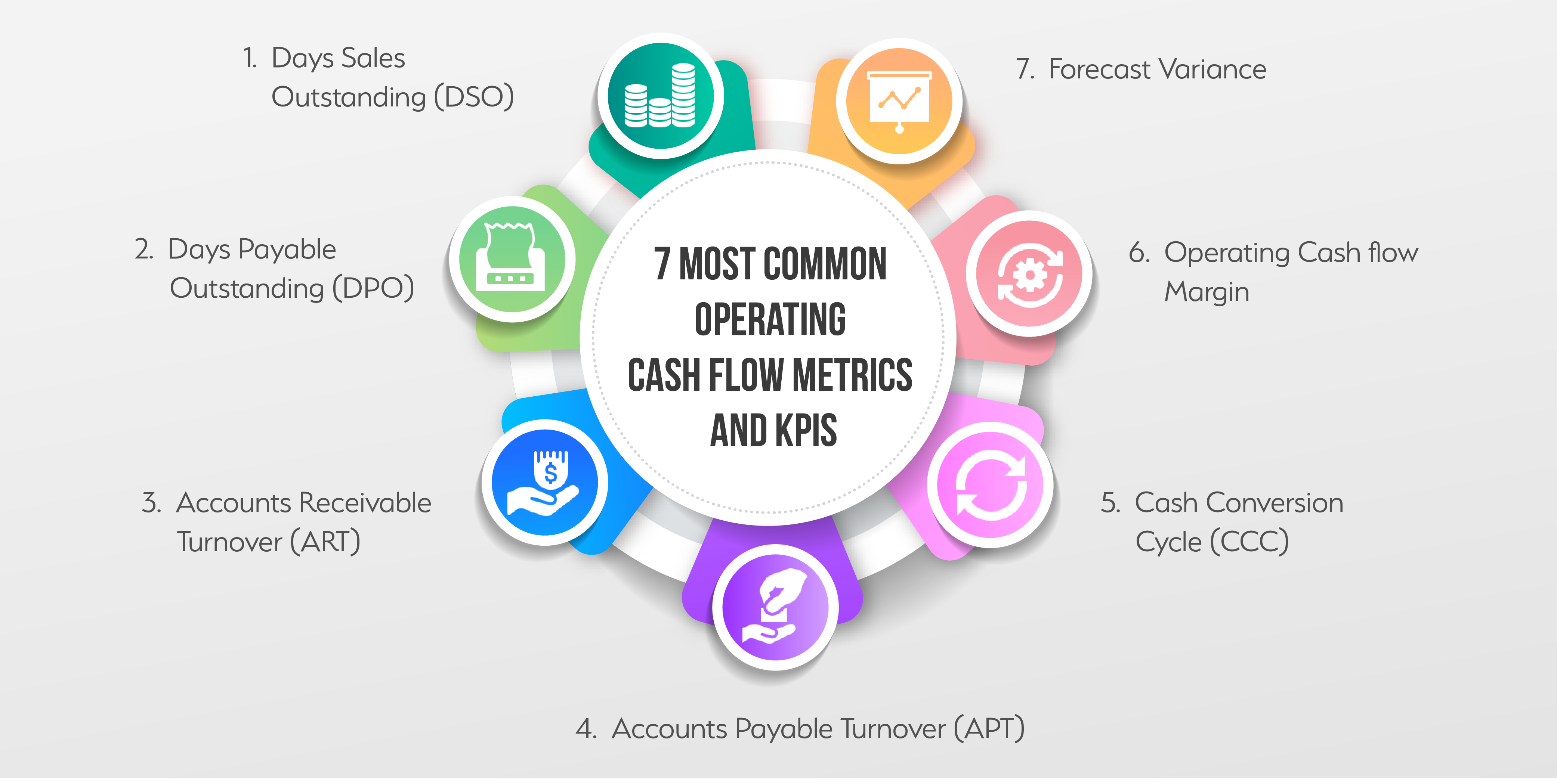

Metrics are an essential component of running a successful business, and operating cash flow metrics hold particular importance for businesses. Operating cash flow metrics and key performance indicators (KPIs) are essential for measuring the health of your business. The importance of these metrics lies in their ability to provide insights into a business’s financial health, identify potential problems or opportunities, and guide strategic decision-making processes. However, with so many options available, deciding which ones are the most important for your business becomes difficult. Often it depends on your specific needs; for instance, if you need help with accounts receivable management, then metrics measuring this business function will probably be more useful than anything else. Whether you are just starting out or running an established business, understanding these key indicators will empower you to formulate better financial decisions and achieve long-term success. In this blog, we will explore 7 different operating cash flow metrics and KPIs so that you can pick the ones that best align with your business goals. Let us dive in!

What Is Operating Cash Flow?

The meaning of operating cash flow can be a bit complex, but essentially it refers to the amount of cash your business generates from its operations. This means that it takes into account all the money you earn and spend as part of normal business activities: salaries, rent, sales revenue, cost of goods sold, etc. Operating cash flow is important because it gives you an idea of how much cash balance your business has available for things like investments or paying down debt. For example, if your business’s operating cash flow is consistently lower than its net income (profit), this may indicate that you are spending too much on non-operational expenses like interest payments or taxes.

7 Crucial Operating Cash Flow Metrics and KPIs

-

Days Sales Outstanding (DSO):

The DSO indicates how long it takes for a business to receive payment from its customers after they purchase goods or services on credit. A high DSO suggests problems with invoice management or poor credit policies, while a low DSO means that the business can convert accounts receivable into actual cash more quickly, giving them more financial flexibility. The calculation for days sales outstanding (DSO) goes as follows:

Days sales outstanding = Average accounts receivable / Revenue * 365 days

-

Days Payable Outstanding (DPO):

DPO measures the average number of days it takes a business to pay its suppliers after receiving goods or services from them. A lower DPO implies that a business is spending more resources than required on inventory and supplies of goods. In contrast, a higher DPO suggests that they are paying off their debts at an optimal rate, resulting in better liquidity conditions. The days payable outstanding can be calculated as follows:

Days payable outstanding = Average accounts payable / Cost of goods sold * 365 days

-

Accounts Receivable Turnover (ART):

This ratio enables businesses to evaluate how quickly they can collect outstanding debts from customers in relation to the amount of sales made over a certain period, typically one year. A high accounts receivable turnover ratio means quicker collection time and boosts operating cash flow, while a low ratio results in longer waiting periods for receiving payment, negatively affecting accounts receivable management and cash flow and potentially impacting overall financial stability. The formula for accounts receivable turnover is as follows:

Accounts receivable turnover = Net credit sales / Average accounts receivable

-

Accounts Payable Turnover (APT):

The accounts payable turnover (APT) metric is a vital financial ratio that helps businesses measure their efficiency in paying off suppliers and vendors. This metric determines how quickly a business pays its bills by calculating the number of times it has paid off its accounts payable during a specific period, like quarterly or annually. A high APT indicates that the business is efficiently managing its cash flow and paying off debts on time, while a low APT could suggest financial problems like inadequate liquidity or slow payment processing. The calculation for the same goes as follows:

Accounts payable turnover = Total Cost of Sales for a Period / Average Accounts Payable for that Period

-

Cash Conversion Cycle (CCC):

The cash conversion cycle is a crucial metric that measures how quickly a business can convert its resources and investments into cash. It is an important indicator of the efficiency of a firm’s operational processes in generating profit. A shorter cash conversion cycle means that a business can generate revenue more quickly and reinvest its profits back into the business. Contrary to this, a longer cycle indicates that there may be underlying financial issues that can impact the positive cash flow of the business. The cash conversion cycle can be calculated as follows:

Cash conversion cycle = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

-

Operating Cash Flow Margin:

Operating cash flow margin is a financial metric that measures the percentage of a business’s revenue generated by its operations, which can be used to determine how efficient and effective it is in managing its cash flows. A higher operating cash flow margin indicates that the business is generating more cash than the required operational expenses, while lower margins suggest otherwise. The calculation is as follows:

Operating cash flow margin = Cash flow from operations / Net revenue

-

Forecast Variance:

The forecast variance metric measures the difference between the actual cash flow and what was predicted by management. A positive value indicates more cash was generated than expected, while a negative value signifies less cash than predicted. Understanding this crucial performance indicator can help businesses identify areas where they need to improve their forecasts.

How To Choose the Right Operating Cash Flow Metrics and KPIs?

Selecting the right operating cash flow metrics and KPIs for your business is essential in determining its financial health. There are various factors that you should consider while evaluating these measures to keep a close eye on the capital generation of your company. Firstly, it is essential to understand what each metric means, how it relates to your industry and why it is significant. It will help you formulate informed decisions while setting targets and goals for the future. Secondly, identifying which indicators align with your company’s objectives is the next step. For instance, if accounts receivable management is one of the primary objectives, then tracking metrics such as accounts receivable turnover (ART) would be beneficial.

For deciding which KPIs will aid in monitoring performance aligned with key objectives, businesses should focus on examining current conditions and future targets within their business (e.g., customer satisfaction rate, employee retention rate). Furthermore, business owners can take assistance from professionals to ease the process. They can hire an in-house team or opt for an outsourced bookkeeping services provider to gain access to a pool of experts. Keeping in mind the need to assess every facet of the business, including sales performance, inventory management, and logistics, provides a comprehensive view of all the elements that contribute to achieving successful operations.

Mistakes To Avoid While Choosing Operating Cash Flow Metrics and KPIs

- One of the common mistakes is relying solely on one metric or KPI instead of considering multiple indicators. Using too few measures may not provide a comprehensive view of how well your business is performing. On the other hand, using too many financial metrics can be overwhelming and time-consuming.

- Another mistake to avoid is taking a short-term view instead of focusing on long-term sustainability. While it may be tempting to prioritise short-term gains, this approach does not always align with a business’s long-term goals and could harm its reputation in the long run.

- Lastly, selecting irrelevant metrics that do little to provide actionable insights can waste resources and distract from what truly matters. It is essential to choose, monitor and track the key performance indicators that directly impact business objectives and are meaningful for decision-making purposes.

Final Words

Operating cash flow metrics and KPIs can be a great way to gauge the success of your business. By understanding the different types of operating cash flow KPIs, you can choose the ones that are most relevant to your particular situation. Whether you are looking for short-term or long-term performance markers, there is likely a metric or KPI suitable for measuring and tracking it. Keep in mind that no single metric will give you an all-encompassing view of how your business is doing, so make sure to consult with financial professionals if necessary, though having these tools at hand can help with better decision-making. When it comes to professional services, you can count on Whiz Consulting. Our capable team of experts will guide you in selecting, evaluating and observing the ideal KPIs for your business. We also offer outsourced bookkeeping services, accounting, accounts payable and accounts receivable services that are sure to take your business to the next level. Do not delay – get in touch with us today, and let us start enhancing your business together!

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.