Table of Content

Share This Article

- Published: July 19, 2023

- Last Updated: March 5, 2025

Are you ever curious about the financial future of your business? If so, you are not alone. With economic uncertainty and fluctuating market conditions, it is crucial to stay ahead of financial planning for your business. Creating a cash flow forecast for your business is an essential step toward financial stability and growth. By forecasting incoming and outgoing cash, you can streamline your accounts payable and accounts receivable management, take advantage of opportunities and keep your business on track – even during turbulent times. Whether you are just starting out or looking to refine your existing financial planning, this blog will provide information about a cash flow forecast. So, let us dive in and discover how you can create a cash flow forecast that empowers your business!

What Is A Cash Flow Forecast?

In business, cash is king. A business’s ability to pay its short-term and long-term debts is essential to its survival. A cash flow forecast is a financial tool that provides an estimate of the anticipated inflows and outflows of cash over a period of time. A cash flow forecast aims to anticipate potential cash shortages or surpluses, identify trends, enable informed decision-making, and ensure the availability of adequate funds to cover expenses and meet financial obligations. A well-executed cash flow forecast will enable you to proactively address any financial challenges, seize opportunities, maintain a healthy cash flow, and have streamlined accounts payable and accounts receivable management.

Why Create a Cash Flow Forecast?

There are a number of reasons why you should create a cash flow forecast for your business, even if you have a comfortable cushion of cash in the bank. Here are 4 compelling reasons to understand why creating a cash flow forecast is crucial for businesses and how it can help ensure a positive cash flow in the future.

- To anticipate and prepare for leaner times: No business is immune to the occasional slow period, and being prepared with a cash flow forecast can help you weather these storms. By projecting your expected income and expenditures, you can plan ahead to conserve cash during lean periods and avoid having to scramble to find funding when things get tough.

- To make the most of opportunities: With a well-executed cash flow forecast, you will know when your business is projected to have extra cash on hand. This provides an opportunity to invest that money back into the business, whether it is used to finance expansion plans or simply build up working capital reserves. Having this information in advance can help reap the maximum benefit out of the upcoming opportunities.

- To keep tabs on your progress: A cash flow forecast is not a static document; it should be updated regularly as your business’s financial situation changes. This gives you a current snapshot of where your business stands financially, which can be helpful in tracking your progress over time and making course corrections as needed.

- To get buy-in from stakeholders: If you are seeking investment from outsiders or trying to secure a loan from a lender, one of the first things they are likely to ask for is a comprehensive cash flow forecast. Having this document ready can help you demonstrate your business’s financial health, which in turn may increase their confidence in your venture and give you better bargaining power.

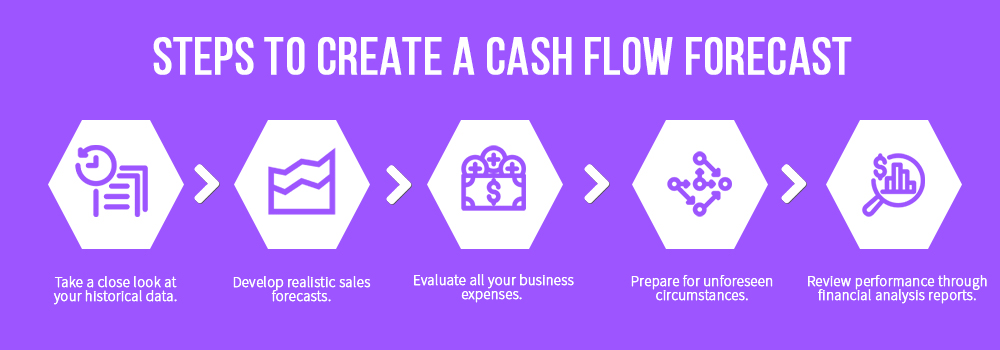

How To Create a Cash Flow Forecast?

- Start with historical data: Look closely at your past financial records and identify patterns and trends. This analysis will provide valuable insights into your cash inflows and outflows, helping you make informed decisions for the future.

- Project sales accurately: Develop realistic sales forecasts based on market research, industry trends, customer behaviour, and historical data. Remember to account for seasonality or any external factors impacting your revenue streams.

- Consider your expenses: Evaluate all fixed costs like rent, utilities, personnel salaries, as well as variable expenses such as raw materials or marketing campaigns meticulously. By anticipating these expenses in advance, you can proactively manage them within budget.

- Prepare for unexpected events: Incorporate a contingency plan into your cash flow projections to guard against unforeseen circumstances that could have potential financial implications on your business operations or liquidity.

- Regularly review performance with financial analysis reports: Once you have a solid cash flow forecast, use a financial analysis report to monitor actual performance against projected figures continuously. These reports help pinpoint areas where predictions were accurate or need recalibration promptly.

By considering these 5 essential points alongside a comprehensive financial analysis report within your cash flow forecasting approach, you will equip yourself with invaluable tools to steer your business toward sustainable growth!

Tips To Make the Most Out of Your Cash Flow Forecast

- Know your numbers: A key part of making the most of your cash flow forecast is understanding your business’s historical cash flow patterns. This will give you a good starting point for estimating future cash needs.

- Make assumptions and adjust as needed: No forecasting exercise is complete without making some assumptions. But do not get too bogged down in the details—you can always adjust your forecast as new information arises.

- Use forecasts to stay flexible: Rather than looking at your cash flow forecast as a one-time exercise, think of it as a living document that you will need to update on a regular basis. This will help you stay flexible and adapt to changes in your business’s cash flow.

- Communicate with your team: Once you have created your cash flow forecast, be sure to share it with your team so everyone is on the same page about the business’s expected cash flow.

- Seek professional advice: Engaging with financial experts like outsourced bookkeeping services providers specialising in cash flow management can offer fresh perspectives on optimising your forecast accuracy and identifying potential blind spots.

Bottom Line

In conclusion, creating a cash flow forecast is an essential practice for any business owner looking to stay financially healthy and make informed decisions. By accurately projecting the cash inflows and outflows over a specific period, business owners can gain valuable insights into their financial standing and plan accordingly. It provides a comprehensive view of the business’s financial health, allowing for better accounts payable and accounts receivable management, identification of potential cash shortfalls or surpluses, and evaluation of investment opportunities. A well-prepared cash flow forecast serves as a guiding tool, enabling business owners to navigate uncertain times, anticipate challenges, and take proactive steps to ensure the smooth operation and future success of their businesses. With careful monitoring and adaptation, a cash flow forecast can be an invaluable asset in achieving long-term financial stability and growth.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.