Table of Content

Share This Article

- Published: Nov 8, 2025

- Last Updated: Nov 11, 2025

- 🔊 Listen

Quick Reads

- Property management accounting focuses on tracking each property’s finances separately to ensure compliance, transparency, and accurate profitability insights.

- Properly recording rent, deposits, and recharged expenses maintains clear audit trails and prevents financial misstatements.

- UK landlords can reduce taxable income by claiming allowable expenses such as repairs, insurance, and management fees while capitalising long-term improvements.

- Adopting digital accounting software and following Making Tax Digital (MTD) ensures smooth compliance and error-free tax reporting.

- Outsourcing property accounting helps landlords save time, cut costs, and enhance reporting accuracy through expert management and automation.

Accurately monitoring tenant payments, keeping track of spending, and managing complicated rules are just a few of the difficulties associated with property management accounting. You may spend more time expanding your real estate company and less time looking for answers when there are clear answers to frequently asked questions. In order to make the process easier for you, this blog answers the most common queries regarding property management accounting.

Balance Sheets to Blueprints

Bridge the gap between accounting data and property decisions.

Breaking Down Key Questions About Property Management Accounting

Whether you manage a few rentals or a large portfolio, understanding how to handle rent collection, service charges, VAT, and capital costs can make a significant difference in your financial outcomes.

This section breaks down the most common questions landlords and managing agents face, offering clear, practical answers to help you stay compliant, organised, and financially efficient.

What is property management accounting and how does it differ from general accounting?

Property management accounting is a specialised branch of accounting focused on tracking, analyzing, and reporting the financial activities of rental or managed real estate properties. It ensures accurate income and expense reporting for each property, helping owners, investors, and managers understand profitability and cash flow.

Unlike general accounting, which covers overall business finances, property management accounting is property-specific and often trust-based, meaning it involves managing funds that belong to property owners and tenants, not the management company itself.

| Aspect | Property Management Accounting | General Accounting |

|---|---|---|

| Focus | Each property or unit’s financial performance | The company’s overall financial position |

| Funds | Tracks owner, tenant, and security deposit funds separately (trust accounting) | All funds belong to the business |

| Software & Reporting | Uses property management systems (AppFolio, Buildium, etc.) with rent rolls, vacancy reports, and maintenance costs | Uses standard accounting software for P&L, balance sheet, and cash flow |

| Compliance | Must follow local landlord–tenant trust laws | Follows standard UK IFRS principles |

How should rental income and deposits be recorded and reported?

In real estate accounting, rental income is recognised when it’s earned, typically when the tenant occupies the property for the rental period. It’s recorded by debiting cash or accounts receivable and crediting rental income and reported on the income statement as revenue.

Security deposits, on the other hand, are not income; they are liabilities held in trust until the lease ends. When received, they are recorded by debiting cash (or trust bank) and crediting a security deposit liability account.

What expenses related to property management can be claimed as tax-deductible?

Landlords in the UK can claim several property management expenses as allowable deductions to reduce their taxable rental income. These must be “wholly and exclusively” for the purpose of letting the property. Here are the key deductible costs:

- Letting and management fees: Payments to estate agents or property managers for tenant sourcing, rent collection, or ongoing management.

- Repairs and maintenance: Fixing wear and tear, such as plumbing leaks, roof repairs, or redecorating. Improvements or upgrades count as capital expenses and aren’t immediately deductible.

- Advertising and marketing: Costs of listing or promoting the rental to find tenants.

- Insurance: Premiums for landlord, building, or contents insurance linked to the rental property.

- Professional fees: Accountant, solicitor, or other advisory costs related to managing or maintaining the tenancy.

- Utilities and council tax: Deductible if the landlord, not the tenant, pays them as part of the rental arrangement.

- Travel expenses: Business-related travel to and from the property for inspections or repairs.

How is VAT applied to property management services?

Most property management fees are subject to the standard 20% VAT rate. Residential rent is generally exempt, but commercial rent may be taxable if the landlord has opted to tax the property. Here’s how it breaks down:

- Residential properties: Management services for residential lettings (like tenant sourcing, rent collection, or maintenance) are exempt from VAT.

- Commercial properties: Management services for offices, shops, or warehouses are subject to VAT at 20%.

- Mixed-use properties: When a contract covers both residential and commercial units, VAT must be apportioned, so it only applies to the commercial part.

What are best practices for reconciling bank and trust accounts?

Proper reconciliation ensures client funds are protected and records meet the standards set by bodies like HMRC, ARLA Propertymark, RICS, and the Solicitors Regulation Authority (SRA). Here are some of the best practices:

1. Reconcile Regularly: Client (trust) accounts should be reconciled at least monthly or more frequently, such as daily or weekly for high transaction volumes to ensure financial accuracy and compliance with accounting standards.

2. Keep Client Money Separate: Client money must always be held in a designated client (trust) bank account, separate from the firm’s operating funds under Client Money Protection (CMP) regulations.

3. Match Transactions to Source Records: Check every deposit, withdrawal, and transfer against supporting documents such rent schedules, supplier invoices, or payment authorisations. The total of all client ledgers must always equal the balance on the trust bank account.

4. Identify and Resolve Discrepancies Promptly: Investigate any differences immediately; that may include timing delays, duplicate entries, or misallocations. Additionally, record all adjustments with full explanations and supporting evidence.

5. Maintain a Detailed Audit Trail: Keep full records of each reconciliation, including bank statements, reports, and any corrective actions. Regulators and auditors (like RICS or ARLA) may review these at any time.

6. Use Compliant Accounting Software: Choose software that meets UK client money rules (e.g., Xero, Reapit, Arthur, or Sage with trust account functionality). Integrated bank feeds reduce manual posting errors and improve audit accuracy.

7. Apply Segregation of Duties: The person preparing reconciliations should not be the same person authorising client payments. This internal control helps prevent fraud or unapproved transfers.

8. Regular Oversight: A qualified real estate accountant should monitor each reconciliation to ensure accuracy and compliance.

How to handle tax compliance, especially with Making Tax Digital (MTD)?

Tax compliance in the UK has evolved rapidly, and Making Tax Digital (MTD) now sits at the centre of how businesses report and manage their tax affairs. For accounting firms, landlords, and SMEs, staying compliant means understanding how MTD works, keeping digital records, and using approved real estate accounting software to meet HMRC’s filing rules.

Here’s how to handle tax compliance effectively in 2025:

- Use HMRC-approved software such as Xero, QuickBooks, Sage, or FreeAgent that integrates directly with HMRC systems. This ensures your VAT, Income Tax, or Corporation Tax submissions are transmitted accurately and on time.

- All taxable transactions must be stored digitally. Avoid spreadsheets or manual entries where possible; they increase the risk of errors and non-compliance.

- From April 2026, MTD for Income Tax Self Assessment (ITSA) will extend this requirement to landlords and self-employed individuals earning over £50,000, with the £30,000 threshold following in 2027.

- Assign a compliance lead or subscribe to HMRC’s update service to keep your firm informed about changes to thresholds, deadlines, and approved software lists.

- Schedule regular internal reviews of your digital records, VAT returns, and client data. This helps catch errors early and ensures your MTD filings align with HMRC requirements.

- Integrated workflows minimise data duplication, improve reporting accuracy, and create a single source of truth across your digital finance ecosystem.

What financial reports are essential for managing property portfolios?

Effective property portfolio management depends on accurate, timely financial reporting. The following reports provide the insights needed to track performance, manage cash flow, and make informed investment decisions:

- Income and Expenditure Statement (Profit and Loss Report)

- Balance Sheet

- Cash Flow Statement

- Rent Roll Report

- Aged Debtors and Creditors Reports

- Budget vs. Actual Report

- Maintenance and Capital Expenditure Report

- Client (Trust) Account Reconciliation Report

How to manage depreciation and capital improvements?

Depreciation should be calculated using an appropriate method, such as straight-line or reducing balance under FRS 102 or IFRS, supported by a detailed fixed asset register. Regular reviews of asset values, clear distinction between repairs and enhancements, and proper tracking of capital allowances under HMRC rules help maintain precise financial records and optimise portfolio performance.

What software solutions are recommended for property management accounting?

The best software for property management accounting in the UK helps landlords and managing agents stay compliant with Making Tax Digital (MTD), manage rent collection, automate reconciliations, and produce real-time financial reports.

Top recommended solutions include:

- Landlord Studio

- Landlord Vision

- PayProp

- Sage Accounting

- Yardi Voyager

These tools help streamline property accounting, ensure compliance with HMRC rules, and maintain accurate client money records under RICS and CMP standards.

What must a company include in the year-end service-charge pack for leaseholders?

A year-end service charge pack provides leaseholders with a transparent summary of how their service charge funds have been managed over the financial year. To meet UK regulatory and best practice standards (RICS, ARMA, and Landlord & Tenant Act 1985), the pack should include:

- Certified Year-End Accounts: A formal statement of income and expenditure, prepared in accordance with lease terms and accounting standards, showing actual costs versus budgeted amounts.

- Independent Accountant’s Report: An external accountant’s certification or report verifying the accuracy of the accounts and compliance with the lease and statutory requirements.

- Detailed Income and Expenditure Breakdown: A clear schedule of all service charge income (including leaseholder contributions and interest earned) and all expenditure by category such as repairs, cleaning, insurance, management fees, etc.

- Balance Sheet or Statement of Funds: Shows opening and closing balances of the service charge account, reserve (sinking) fund, and any prepaid or outstanding amounts.

- Bank Reconciliation Statement: Demonstrates that service charge funds held in trust have been reconciled with the bank account balance at the year end.

- Schedule of Apportionment: Details how total costs are allocated between leaseholders, referencing each flat’s percentage or apportionment as per the lease.

- Notes and Supporting Schedules: Explanatory notes for major variances, one-off costs, or capital works. Supporting schedules can include invoices, maintenance logs, or contractor summaries.

- Reserve or Sinking Fund Statement: Shows contributions, expenditure, interest earned, and the balance carried forward to support future major works.

- Accountant’s or Managing Agent’s Cover Letter: Summarises key highlights, variances from budget, and any important updates or planned future expenditure.

How can I effectively manage rent collection and reduce rent arrears?

Effective rent collection is central to strong property management accounting. It ensures steady cash flow, accurate reporting, and financial stability across your portfolio.

To manage rent collection and reduce arrears:

- Automate payment systems: Use direct debit or standing order options through trusted property management accounting software to ensure timely, trackable payments.

- Maintain accurate tenant records: Keep tenant details, payment histories, and arrears reports up to date for clear audit trails and proactive follow-ups.

- Set clear payment terms: Communicate rent due dates, late fees, and arrears procedures clearly in tenancy agreements to prevent disputes.

- Monitor rent ledgers regularly: Review rent ledgers weekly or monthly within your property management accounting system to identify overdue accounts early.

- Implement automated reminders: Send payment reminders before due dates and follow up promptly on missed payments to reduce arrears build-up.

- Offer digital payment options: Provide multiple secure online payment methods to make paying rent easy and convenient for tenants.

- Track arrears performance metrics: Use reports from your accounting platform to monitor arrears ratios, tenant trends, and collection rates for better forecasting.

- Take early intervention measures: Contact tenants immediately when arrears occur, early communication often prevents escalation to formal recovery.

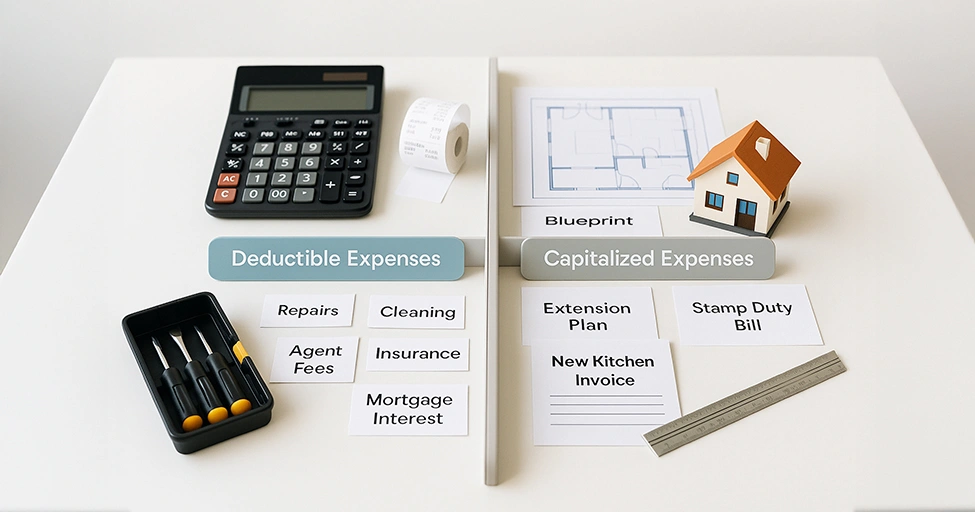

What expenses can I deduct for tax purposes in property management, and what should be capitalised?

In property management accounting, it’s important to separate everyday running costs from long-term improvements.

Deductible expenses are regular costs needed to manage and maintain a property. These can usually be claimed against rental income each year and include:

- Repairs and routine maintenance

- Letting and property management fees

- Mortgage interest (subject to HMRC rules)

- Insurance, utilities, and council tax (if paid by the landlord)

- Cleaning, gardening, and service charges

- Professional fees such as accountants or solicitors

- Advertising and tenant reference checks

- Replacement of domestic items like furniture or appliances

Capitalised expenses are costs that improve or extend the property’s life. These can’t be deducted immediately but may reduce future capital gains tax. Examples include:

- Major refurbishments or structural work

- Extensions, loft conversions, or new kitchens

- Upgrades that increase the property’s value

- Purchase costs like stamp duty and legal fees

How do I account for recharged property expenses like cleaning or repairs billed to tenants?

In property management accounting, recharged expenses are costs you pay on behalf of tenants, such as cleaning, repairs, or maintenance and later recover from them. Recording these correctly keeps your accounts accurate, transparent, and compliant with HMRC and RICS standards.

- Record the original cost when the expense is incurred.

- Invoice the tenant for the same amount as a recharge.

- Match the income and expense so they balance to zero.

- Keep supporting invoices and receipts for audit purposes.

- Apply the right VAT treatment and include in service charge statements if required.

How does depreciation work for rental properties?

For accounting purposes, buildings, fixtures, and fittings are depreciated over their useful lives, often using the straight-line method to spread the cost evenly each year. However, HMRC does not allow depreciation as a tax deduction for rental properties.

Instead, landlords can claim capital allowances on qualifying assets such as plant, equipment, and certain integral features like heating systems or lifts. Keeping accurate records of asset costs, improvements, and depreciation schedules within your property management accounting system ensures compliance with FRS 102 or IFRS standards and provides a true reflection of asset value.

How can outsourcing my property accounting to specialised firms help save time and costs?

Using accounting outsourcing services for property management can streamline operations, reduce overheads, and improve financial accuracy. It allows landlords and managing agents to focus on growth while experts handle compliance, reporting, and daily accounting tasks.

Key benefits include:

- Time efficiency: Specialists manage bookkeeping, reconciliations, and reporting, freeing you to focus on strategic decisions.

- Cost savings: Outsourcing reduces the need for in-house staff, training, and accounting software investments.

- Expert compliance: Professional firms ensure adherence to RICS, HMRC, and MTD requirements.

- Accurate financial reporting: Access to precise statements, service charge accounts, and portfolio insights for better decision-making.

- Scalability: Services can expand with your property portfolio without increasing internal workload.

- Technology advantage: Outsourcing firms use advanced property management accounting systems that automate rent collection, expense tracking, and VAT reporting.

Strengthen Your Property Management Strategies with Reliable Accounting Support

Managing multiple properties requires more than just operational oversight. It calls for accurate financial control. From rent collection and maintenance expenses to tax reporting and compliance, the financial side of property management can quickly become complex. That’s where the right accounting approach makes a real difference.

At Whiz Consulting, we simplify property management accounting by combining skilled professionals with modern accounting technology. Our property accounting services help property owners and managers stay on top of rent rolls, maintenance costs, and financial reports with accuracy and efficiency. We work with leading accounting platforms to utilise automation driven accounting and deliver clear financial visibility.

If you’re ready to manage your properties with sharper financial insight and dependable accounting support, connect with us today and strengthen your property management strategy with Whiz Consulting.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.