Table of Content

Share This Article

- Published: Apr 23, 2024

- Last Updated: Oct 24, 2025

- 🔊 Listen

Quick Reads

- Care homes require tailored financial systems to manage complex revenue streams, regulatory compliance, and unique cost structures effectively.

- Hiring specialised healthcare accountants saves time, ensures compliance, and improves overall financial accuracy without adding overhead.

- Using accounting tools like Xero or QuickBooks enhances billing, reporting, and cash flow visibility, improving day-to-day financial control.

- Staying updated with evolving financial regulations is essential to avoid penalties and maintain trust with regulators and stakeholders.

- Careful budget planning and expense monitoring help balance quality care with financial sustainability, especially under tight funding conditions.

- Maintaining clear, separate records, including resident trust funds supports transparency, audit readiness, and accountability to residents and their families.

Heal Finances, Not Just People

Get Support From Top Healthcare Accounting Experts.

Care homes play a vital role in the UK’s healthcare system, providing essential support and accommodation for those who require assistance with daily living or have more complex healthcare needs. These establishments are at the heart of community care, offering a range of services from residential support to nursing and specialised care for individuals with specific conditions. This makes the effective financial management of care homes even more critical to ensure the highest standards of care and well-being for the residents.

One key way of ensuring sound financial management is to implement a robust accounting system. This can be done by consulting professionals like accountants or bookkeepers for care homes. However, given the unique nature of care homes, their accounting needs are distinct from those of other businesses. This blog aims to offer a complete overview of accounting for care homes in the UK, addressing the unique challenges and best practices to support the delivery of high-quality care.

What is Care Home Accounting?

Care home accounting refers to managing financial records and transactions specific to care homes. This branch of accounting focuses on the unique financial aspects of running a care home. Given the specialised nature of accounting in this sector, the role of accountants for care homes becomes indispensable. The significance of care home accountants and a robust accounting system in this sector is immense. Let us examine these reasons further.

Significance of Care Home Accountant and Robust Accounting System

1. Financial Management:

Robust accounting is essential for effective financial management in care homes. It ensures accurate tracking of income and expenses, which is crucial for budgeting, financial planning, and maintaining the facility’s overall financial health. Good financial management also helps care homes allocate resources efficiently and make informed decisions about investments and expenditures. Professionals like care home accountants play a pivotal role in implementing these practices, ensuring that financial operations are smooth and aligned with the business’s goals.

2. Regulatory Compliance:

Care homes are subject to various regulations and standards, including financial reporting requirements.. Robust accounting practices help ensure that care homes comply with these regulations, avoid penalties, and maintain good standing with regulatory bodies. Many business owners enlist the expertise of care home accountants to ensure compliance with these regulations, offering assurance to stakeholders about their financial health and adherence to regulatory requirements.

3. Cost Control:

In the care home sector, controlling costs without compromising the quality of care is a significant challenge. Robust accounting practices enable care homes to monitor and manage expenses effectively, identify areas for cost savings, and implement strategies to cut unnecessary costs. Engaging skilled accountants for care homes can significantly contribute to achieving these goals. These professionals bring expertise in financial management tailored to the unique needs of the care home sector, helping to ensure financial stability and long-term success.

4. Funding and Investment:

Care homes often rely on various funding sources, including private payments, insurance reimbursements, and government funding. Robust accounting practices help care homes manage these funds effectively, ensure timely billing and collection, and attract investment by demonstrating financial stability and transparency. Skilled professionals, like accountants for care homes, play a crucial role in managing funding and attracting investment, ensuring that the business has the necessary resources to provide high-quality care to its residents.

5. Quality of Care:

Although not directly related to accounting, financial management plays a crucial role in maintaining and improving the quality of care. Adequate funding and efficient resource allocation enable care homes to invest in staff training, facilities, and equipment, which are essential for providing high-quality care to residents.

6. Strategic Planning:

Accurate financial information is crucial for making informed decisions that align with the care home’s mission and objectives. Robust accounting practices provide the financial data and insights necessary for strategic planning. This includes forecasting future financial needs, planning for expansion or renovation, and setting long-term financial goals.

7. Stakeholder Confidence:

Transparent and reliable accounting practices build confidence among stakeholders, including residents, families, investors, and regulatory bodies. Demonstrating financial stability and compliance with regulations helps build trust and credibility, which are essential for the care home’s reputation and success.

6 Accounting Challenges Unique to The Care Home Sector

Accounting for care homes comes with a unique set of challenges that require tailored solutions. Here are some key challenges faced by the care home sector:

1. Budgeting and Funding Constraints:

Care homes often face the challenge of operating within tight budgets while maintaining high standards of care. This requires careful budgeting to allocate resources effectively. Funding can come from various sources, including government funding, private payers, and donations. For expert advice on financial planning and budgeting, consider consulting accountants for care homes or a care home accountant specialising in aged care. These accountants have the expertise to help you navigate funding challenges and optimise your budget allocation.

2. Compliance with Financial Regulations:

Care homes must comply with a range of financial regulations, including those related to healthcare, employment, and taxation. These regulations are complex and can vary depending on the location and size of the care home. This is why staying up-to-date with these regulations and ensuring compliance is essential to avoid penalties and maintain the trust of stakeholders.

3. Cost Allocation and Control:

Proper cost allocation is essential to ensure that each department receives adequate funding while maintaining overall cost control. This requires careful tracking and analysis of expenses to identify areas where costs can be reduced or reallocated. Care home accountants specialise in developing cost allocation strategies that maximise efficiency and control costs, helping care homes operate more effectively. Their expertise ensures that resources are used wisely, benefiting both the care home and its residents.

4. Financial Reporting and Transparency:

Care homes must provide accurate and timely financial reports to stakeholders, including residents, families, regulators, and investors. To achieve this, they can work with professionals who understand the intricacies of the healthcare industry, such as nursing home accountants or accounting services specialising in aged care. These experts can help ensure that your financial reports are accurate, transparent, and compliant with regulations, giving stakeholders confidence in your care home’s financial management. Additionally, staying informed about the types of financial reports can further enhance your financial reporting practices.

5. Fluctuating Cash Flow:

Care homes may experience fluctuations in cash flow due to factors such as seasonal demand, changes in reimbursement rates, and unexpected expenses. Ensuring positive cash flow is essential to ensure that the care home can meet its financial obligations and sustain operations during periods of low cash flow. This includes maintaining adequate reserves and exploring options for short-term financing if needed.

6. Lack of Financial Expertise:

Many care home managers may not have a background in finance, making it challenging to navigate complex financial matters. Outsourced accounting services, such as accounting services for care homes, can play a crucial role in this matter by providing access to expertise in financial management and regulatory compliance. Outsourcing can also free up time for care home managers to focus on providing quality care to residents. Consider partnering with specialised accounting services for care homes to strengthen your financial management capabilities and ensure compliance with regulations.

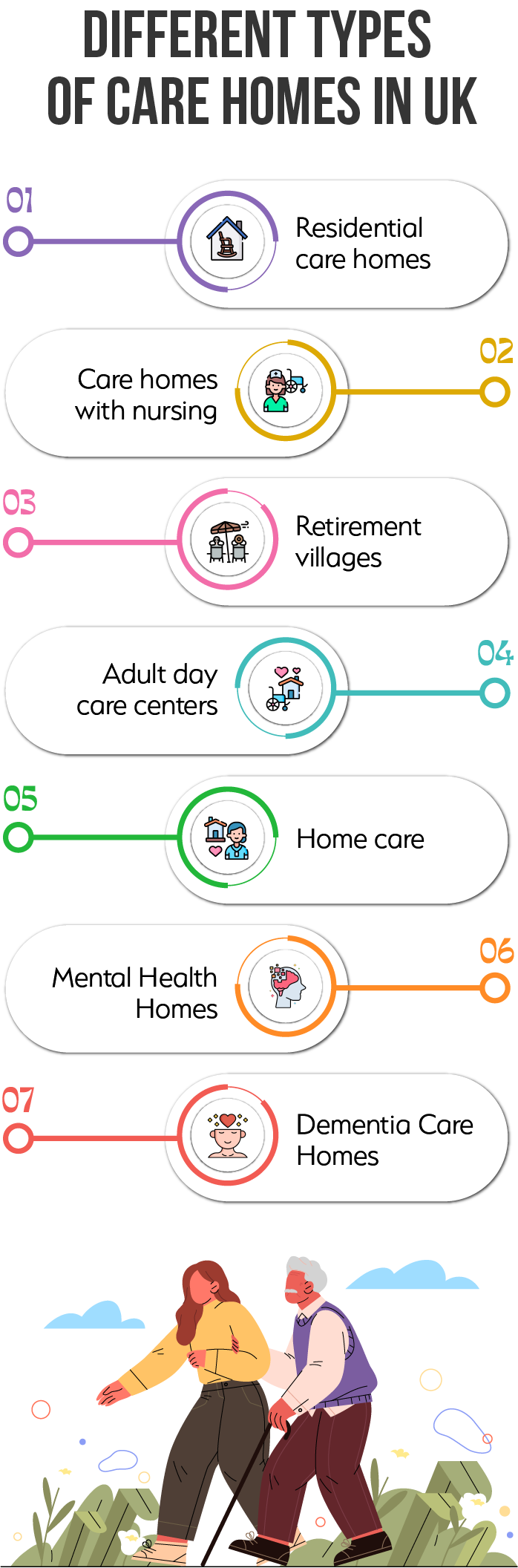

Different Types of Care Homes in the UK

1. Residential Care Homes:

These facilities provide accommodation, meals, and personal care for elderly or disabled individuals who need assistance with daily activities. Accounting for residential care homes involves managing expenses related to staff salaries, food, utilities, maintenance, and medical supplies. To ensure accurate financial management, care homes can engage the expertise of residential care accountants who understand the unique financial needs of residential care homes.

2. Care Homes with Nursing:

These homes offer the same services as residential care homes but with qualified nurses providing medical care and support. In addition to the accounting requirements of residential care homes, care homes with nursing need to manage expenses related to nursing staff, medical equipment, and medications. To address the accounting challenges related to nursing homes, collaborating with experienced nursing home accountants can prove to be beneficial. Skilled nursing home accountants can provide valuable insights and expertise to ensure that your care home with nursing services remains financially healthy and compliant with regulations.

3. Retirement Villages:

Retirement villages are designed for independent older adults and offer access to amenities and support services. Accounting for retirement villages includes managing revenue from accommodation fees, as well as expenses for maintenance, staff salaries, and amenities such as dining facilities and recreational activities. To streamline financial operations and ensure compliance with regulations specific to retirement villages, seek the expertise of outsourced accounting services specialising in aged care. These professionals can provide valuable insights and help optimise financial processes tailored to the unique needs of retirement villages.

4. Adult Day Care Centers:

These centres provide care and companionship for adults needing supervision during the day. Accounting for adult day care centres involves managing expenses for staff salaries, meals, activities, and transportation services. They also need to track revenue from daily or hourly fees paid by clients. Partnering with expert accountants for care homes who understand the specialised needs of adult day care centres can help streamline accounting processes, track revenue effectively, and ensure compliance with regulatory requirements.

5. Home Care:

Home care services offer care in the individual’s own home, ranging from assistance with daily tasks to medical care. Accounting for home care involves managing expenses for staff salaries, transportation, and medical supplies. It also involves tracking revenue from client fees, which can vary based on the level of care provided.

6. Mental Health Homes:

These residential facilities provide care and support for individuals with mental health issues. Accounting for mental health homes involves managing expenses for staff salaries, therapy services, medications, and specialised programs. They also need to track revenue from government funding, insurance reimbursements, and client fees.

7. Dementia Care Homes:

Dementia care homes are specialised facilities catering to individuals with dementia. They offer a range of services, including personal care, medication management, and activities aimed at stimulating cognitive function. Accounting for dementia care homes involves managing expenses for staff training, specialised care programs, and safety measures. They also need to track revenue from resident fees and government funding. Experienced accountants who specialise in the unique financial aspects of dementia care homes can help ensure effective financial management. Dementia care accountants can provide expert advice on financial practices tailored to the needs of dementia care homes, helping to improve financial efficiency and accuracy.

Software Solutions for Care Home Accounting

Accounting software plays a crucial role in managing the complex financial requirements of care homes. Here are some key reasons why care homes need specialised accounting software:

1. Billing and Invoicing:

Care homes often need to manage multiple sources of revenue, including resident fees, government funding, and insurance reimbursements. Accounting software can help streamline the billing and invoicing process, ensuring accurate and timely payments. Additionally, care homes can make the best use of accounting software and improve their financial management by consulting or partnering with professionals like accountants for care homes.

2. Expense Tracking:

Care homes incur various expenses, such as staff salaries, supplies, utilities, and maintenance costs. Good accounting software can track these expenses, categorise them, and generate detailed reports for better financial management. Additionally, professionals like accountants for care homes can further optimise these processes with their expertise and provide strategic advice on cost-saving measures.

3. Budgeting and Forecasting:

Care homes need to create and manage budgets to ensure financial sustainability. Accounting software can help create detailed budgets, forecast future expenses, and analyse financial trends.

4. Compliance and Reporting:

Care homes are subject to various regulations and reporting requirements. Accounting software can help generate reports that comply with regulatory standards, helping care homes avoid penalties and maintain compliance. By utilising accounting software, care homes can ensure compliance and reporting accuracy, leading to improved transparency and trust. Furthermore, accounting experts like care home accountants can assist in interpreting and implementing regulatory requirements, providing assurance and guidance to the care home’s management.

5. Data Security:

Care homes deal with sensitive financial and personal information. Accounting software provides robust security features to protect this data from unauthorised access or breaches. To reap the full potential of accounting software, care homes can opt for accountants for care homes. Skilled accountants for care homes can provide guidance on implementing security best practices, ensuring that the care home’s data remains secure and protected.

5 Benefits of Utilising Accounting Software in Care Homes

1. Time-saving:

Accounting software like Xero, QuickBooks, or Sage automates repetitive tasks such as data entry and calculations, saving considerable time for care home staff. This allows staff to focus more on providing quality care to residents and managing other crucial aspects of the care home’s operations.

2. Real-time Financial Insights:

Accounting software provides real-time access to financial data, enabling care homes to quickly assess their financial health, track expenses, and identify trends. Popular accounting software like QuickBooks, Xero and Sage empower care homes to make informed decisions promptly based on up-to-date information.

3. Cost Reduction:

Accounting software can help care homes reduce overall operational costs by streamlining processes and reducing manual tasks. This cost reduction can significantly impact the care home’s bottom line, allowing for more efficient resource use.

4. Improved Cash Flow Management:

Accounting software offers features like invoicing and expense tracking that help care homes manage their cash flow more effectively. For instance, an accounting solution such as Xero provides a clear picture of income and expenses, enabling care homes to anticipate and address cash flow challenges proactively.

5. Enhanced Security:

Accounting software securely stores and encrypts financial data, protecting it from unauthorised access. This enhanced security helps ensure compliance with data protection regulations and maintains trust with stakeholders.

Choosing the Right Accounting Software for Your Care Home

1. User-Friendliness:

Choose an accounting software that is intuitive and easy for staff to use, minimising the need for extensive training.

2. Specific Features:

Look for software that offers features tailored to the needs of care homes, such as billing and invoicing for resident fees.

3. Scalability:

Choose an accounting software that can grow with your care home, accommodating an increasing number of residents and staff.

4. Compliance:

Select software that helps you comply with regulatory requirements specific to care homes.

5. Security:

Ensure that the software provides robust security features to protect sensitive financial data.

6. Cost:

Consider the cost of the software, including any upfront fees, ongoing maintenance costs, and potential savings from increased efficiency.

How Can an Accounting Service Provider Streamline Care Home Accounting?

1. Expertise in Care Home Accounting:

Outsourced accounting services providers have specialised knowledge of care home accounting practices and regulations, ensuring compliance and accuracy in financial reporting.

2. Efficiency and Precision:

By leveraging the services of outsourced accountants for care homes, these facilities can benefit from the efficiency and accuracy of professional accountants, freeing up staff time for other important activities.

3. Cost-Effective Solutions:

Outsourcing accounting tasks to experienced care home accountants can be cost-effective compared to hiring full-time staff, as care homes only pay for the services they need.

4. Access to Cutting-Edge Technology:

Accounting services providers have access to advanced accounting software and tools, ensuring that care homes have access to the latest technology for their financial management needs.

5. Focus on Primary Functions:

By partnering with skilled accountants for care homes, care home staff can focus on providing quality care to residents without being burdened by financial management responsibilities.

Choosing the Right Outsourcing Partner

1. Specialised Expertise:

Look for an accounting services provider with experience in care home accounting to ensure they understand the industry’s specific needs.

2. Efficiency and Accuracy:

Ensure the service provider has a track record of delivering accurate and timely financial reporting.

3. Cost-Effectiveness:

Compare pricing structures and services offered to ensure you are getting the best value for your money.

4. Access to Technology:

Choose a service provider that uses advanced accounting software and tools to streamline processes and improve efficiency.

5. Risk Management:

Select an accounting services provider that can help identify and mitigate financial risks for your care home.

6. Scalability:

Partner with a service provider that can scale their services according to your needs, whether you are a small care home or a large facility.

7. Focus on Core Activities:

Choose a provider that allows your staff to focus on providing quality care to residents rather than getting bogged down in financial management tasks.

Whiz Consulting is a reputable accounting and bookkeeping services provider that meets all the above-mentioned criteria and more. Their specialised expertise, efficiency, and focus on customer service make them an excellent choice for care home accounting.

7 Accounting Tips for Care Homes

1. Specialised Accounting Software:

Care homes should consider investing in accounting software designed specifically for their industry. Accounting software can help streamline financial processes, such as invoicing, payroll, and expense tracking, tailored to the unique needs of care homes. It can also help ensure compliance with industry regulations and provide insights into financial performance through detailed reporting and analysis.

2. Accurate Record Keeping:

Maintaining accurate records of financial transactions is crucial for care homes. This includes recording resident fees, expenses, payroll, and other financial activities. Accurate record-keeping not only helps in ensuring compliance with regulatory requirements but also provides a clear picture of the care home’s financial health.

3. Separate Resident Trust Funds:

Care homes often manage resident trust funds, which should be kept separate from operational funds. Proper accounting for resident trust funds is essential to comply with legal requirements and maintain trust with residents and their families. This includes ensuring that trust funds are used only for their intended purposes and accurately tracking all transactions related to these funds.

4. Regular Budget Reviews:

Regularly reviewing budgets helps care homes identify areas where costs can be reduced or managed more efficiently. It also ensures that the care home is operating within its financial means and can help prevent overspending or financial strain.

5. Cash Flow Monitoring:

Monitoring cash flow is critical for care homes to ensure that they have enough funds to cover expenses and make necessary investments. Careful monitoring can help identify potential cash flow issues early on, allowing for proactive management to address them.

6. VAT Compliance:

Care homes must comply with VAT (Value-Added Tax) regulations by accurately recording and reporting VAT transactions. This includes understanding which goods and services are subject to VAT, applying the correct VAT rates, and submitting VAT returns on time.

7. Consider Outsourcing:

Outsourcing accounting functions can be a cost-effective solution for care homes. It allows them to focus on their core activities while ensuring that their financial management needs are met by experts.

Wrapping Up

In the UK care home sector, managing accounting intricacies efficiently is pivotal for both compliance and operational success. Outsourcing these tasks to specialised accounting firms offers a strategic advantage, allowing care homes to concentrate on their essential mission of providing excellent care. This approach not only ensures precision and efficiency but also helps in navigating the complex regulatory environment with ease. By entrusting accounting to experts, care homes can achieve significant cost savings, reduce the burden on internal resources, and gain access to a wealth of financial expertise. In the final analysis, outsourcing accounting is a compelling choice for care homes aiming to enhance their service quality. It promises not just financial prudence but a stronger foundation for making informed decisions that can lead to sustainable growth and improved patient care, making it an investment in the future of care home operations.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

UK care homes often struggle with managing complex billing, tracking diverse funding sources, and ensuring compliance with stringent regulatory requirements.

UK care homes can enhance financial efficiency by adopting specialised accounting software, automating routine tasks, and conducting regular financial audits.

Essential financial reports for UK care homes include profit and loss statements, balance sheets, cash flow statements, and reports on receivables and payables.

Key performance indicators (KPIs) for UK care homes include occupancy rates, average daily rates, revenue per available room, and labour costs percentage.

Effective management involves creating detailed budgets, closely monitoring expenses, and employing cash flow forecasting to anticipate financial needs.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.