Table of Content

Share This Article

- Published: February 13, 2023

- Last Updated: May 9, 2025

Accountants are an important resource in a company and are crucial to the business’s financial process. Accountants are beneficial for businesses at any stage of development. An accountant can help you keep track of your finances, which is essential for making sound business decisions. They can also provide valuable insights into where you might be able to save money or improve your financial performance. Accountants also advise on a wide range of business issues, from start-ups to expansions to succession planning. Their experience and knowledge can be invaluable in helping you make the right decisions for your business. Also, they can assist with tax planning and preparation, ensuring that you pay the minimum amount of tax required by law. This can free up cash flow for other important business expenses. While doing all these tasks for you, they also help ensure that your business complies with all relevant laws and regulations. This can save you time and money in the long run, as non-compliance can lead to hefty fines.

While accountants provide a wide range of services that can help your business, virtual or online accountants are a newer term for many businesses. However, with the rise of technology, business owners are recognizing the value of having a professional manage their finances from afar. The idea of hiring an online accountant is becoming more and more commonplace in today’s world.

What is an Online Accountant ?

An online accountant or virtual accountant is an accountant who provides their services remotely, usually via the internet. This means they can work with clients from anywhere in the world and often have a more flexible schedule than traditional accountants.

Useful read: Detailed Analysis: In-house Accountant Vs. Virtual Accountant

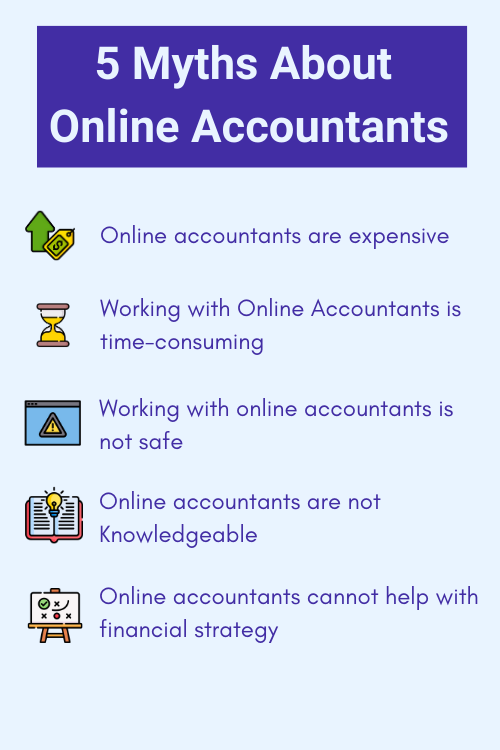

Are you thinking of hiring an online accountant but don’t know where to start and whether it’s the right decision? With so many myths about the process floating around, it can be hard to know whether or not it is the right move for you. Don’t let these misconceptions stop you from getting the help that you need; read on to learn more about the truth behind some of the most common myths about hiring an online accountant.

Myth 1: Online accountants are expensive

Hiring an online accountant may seem like an expensive proposition, but in reality, it can be quite affordable. Several virtual accounting service providers offer very reasonable rates, many of which offer small businesses discounts. In addition, online accountants are third-party contractors, and you do not have to spend on overhead costs like employee benefits and any capital investment like infrastructure and office space. You can choose virtual accountants as per your budget and work requirements instead of having an employee working full time even when the workload is less.

Myth 2: Workflow with an online accountant takes up more time

Another common misconception is that working with an online accountant takes more time than with a traditional accountant. This is simply not true. In fact, working with an online accountant can actually save you time.

First, you won’t waste time travelling to and from meetings if you have an external accountant. You can conveniently have all your meetings and consultations over the phone or via video call.

Second, online accountants are usually more responsive than traditional accountants. They understand that their clients are busy people who don’t have time to wait for days for a response. So they make sure to get back to you in a timely manner. In simple terms, online accountants are quite proactive and get things done faster than traditional accountants.

Third, online accountants often use cutting-edge technology that makes accounting tasks quicker and easier. For example, they might use cloud-based accounting software, which allows you to access your financial information from anywhere in the world at any time.

So if you are worried that working with a virtual accountant will take up too much of your time, don’t be! It could end up saving you time in the long run.

Myth 3: Working with online accountants is not safe

When it comes to online security, it is a common assumption that online accountants are not safe. This simply isn’t true. In fact, online accounting firms use the same type of encryption that banks do to protect your information. So, you can rest assured that your information is safe and secure. In addition to this, you can also take precautionary steps, such as ensuring that your online accountant’s website is encrypted and secure. You can usually tell by looking at the URL – if it starts with “HTTPS” instead of just “HTTP,” that’s a good sign. Second, check to see if the website has a privacy policy – this will let you know what personal information they collect and how they protect it. Finally, take a look at the company’s reviews and testimonials to get an idea of its reputation. If you follow these simple tips, you can be sure that you are hiring a safe and reputable virtual accountant.

Myth 4: Online Accountants Are Not Knowledgeable

Another myth about online accountants is that they lack the knowledge and experience to be able to provide quality services. This simply is not true. Many online accountants have years of experience in their field and are just as knowledgeable and capable as an accountant you would find in a traditional office setting. Additionally, many virtual accounting firms offer resources such as tutorials, webinars, and other tools to help their clients learn more about the basics of accounting.

Myth 5: Online accountants cannot help with financial strategy

While it is true that an online accountant may not be able to provide in-person strategic advice, they can still help with your business strategy in a number of ways. They can review your financial situation and offer advice on where you can cut costs or increase revenue. They can also help you develop a budget and forecast for your business. Additionally, virtual accountants can advise on which accounting software would be best for your business and how to use it to its fullest potential.

Conclusion

When it comes to hiring an online accountant, there are a number of myths that you should be aware of. The truth is that working with an online accountant can be just as beneficial and efficient as working with traditional accountants. While some people may be hesitant to work with an accountant, they have never met in person, but there are many advantages to working with a virtual accountant. There are a few key differences between an online and a traditional accountant. First, online accountants typically have lower overhead costs, which means they can offer their services at a lower price point. Second, online accountants are often more flexible with their scheduling and availability, making it easier to find one that fits your needs. Finally, online accountants typically use modern technology to streamline the accounting process, making it more efficient and effective.

The concept of hiring an online accountant may seem daunting to the average person. After all, the idea of entrusting someone with your financial information can be intimidating. However, whether you are a start-up business or a large corporation, a virtual accountant can provide valuable services to help you manage your finances, save money on taxes, and develop sound business strategies. With the right accounting services provider, you can rest assured that your finances are in good hands and that all of your accounting needs will be taken care of.

So, if you are considering hiring an online accountant, don’t let any myths prevent you from taking advantage of this valuable resource. With the right virtual accountant by your side, you can rest assured that your business finances will be well taken care of and in good hands.

Get customized plan that supports your growth

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.