-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

Outsource Accounts Payable Services to Indian Experts

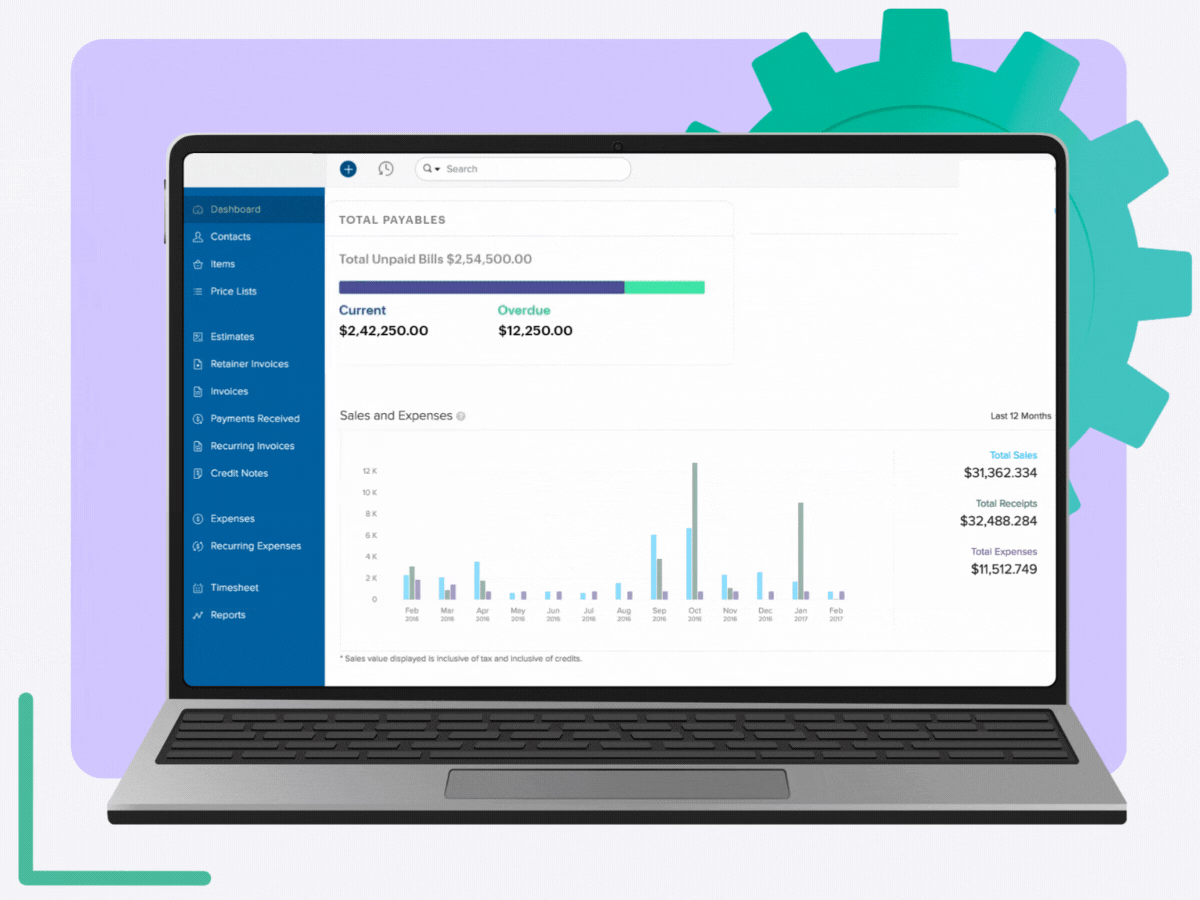

Our accounts payable outsourcing services help you eliminate inefficiencies and stay audit-ready, all at a fraction of your in-house cost. With over a decade of experience, we, at Whiz Consulting, specialise in outsourced accounts payable services, serving businesses across the US, UK, Australia, and UAE. Backed by 100+ skilled accountants and industry-best software like Xero, Zoho, and QuickBooks, we ensure your payables are always timely, accurate, and fully compliant.

Over the last 10+ years we have provided reliable finance and accounting services to over 500+ clients globally.

Outsourced Accounts Payable Services We Offer

- Day-to-Day Bookkeeping

- Handling Expense Tracking

- Monthly & Quarterly Financial Reporting

- Seamless Invoice Processing & Management

- Streamlined Payment Scheduling & Processing

- Efficient Vendor Management & Reconciliation

- Helping You File Taxes

Accounting Challenges We Tackle for Global Businesses

Our virtual accountants know how to address AP challenges and bring financial peace of mind.

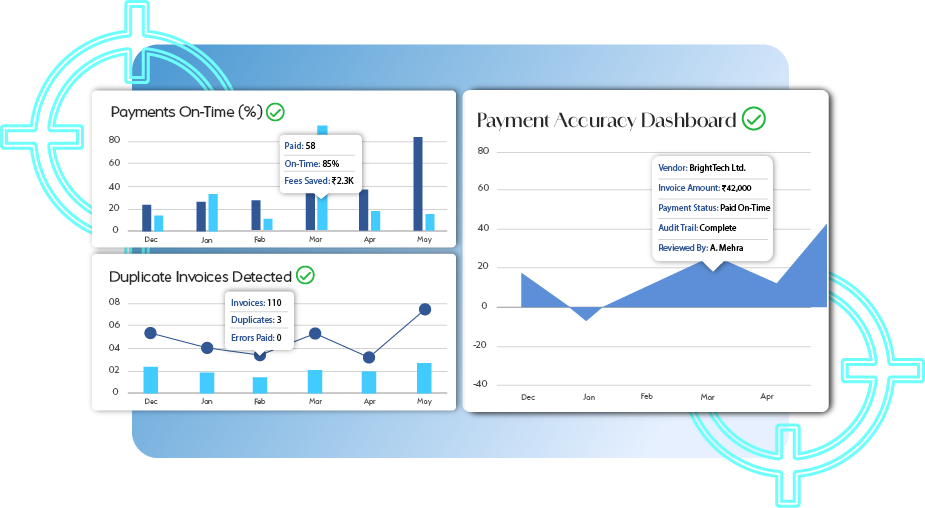

Accurate and Timely Vendor Payments

Our accounts payable specialists follow streamlined workflows that ensure every payment is traceable, approved, and completed on time.

Smarter Cash Flow Control

Our team manages payment schedules based on your vendor terms and available cash, helping you avoid late fees and always keep liquidity optimised.

Global Compliance & Audit-Ready Processes

Whether you follow US GAAP, IFRS (UK/UAE), or ATO regulations (Australia), our AP processes are designed for compliance. From audit support to cross-border invoice matching, we ensure full transparency and audit-readiness.

Hire an Accounts Payable Specialist Who:

Why Choose Us?

-

Value-Driven Accounting

Our accounts payable outsourcing specialists use globally recognised accounting practices and advanced systems to help maintain your cash flow.

-

Accounting Automation

We integrate AI and automation into your AP process, speeding up invoice approvals and disbursements while reducing manual errors and processing time.

-

Outsourcing Expertise

With over a decade of experience in outsourced accounts payable services, we’ve fine-tuned scalable workflows that improve financial accuracy.

-

Dedicated Accountant

You’ll have access to a dedicated AP expert who understands your business, manages your vendor payments, and provides ongoing support.

-

Real-Time Support

Get timely insights and status updates on your accounts payable activity so you can manage commitments with confidence.

-

Cost Efficiency

Outsource your accounts payable to India and cut processing costs by up to 60%, without compromising on quality or compliance.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

We empower innovation with personalized solutions with the help of our trusted and reliable partners.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switch to Whiz Effortlessly!

Whiz makes the experience of shifting to a new accounting partner easy and hassle-free. We make sure that there are no disruptions and that there’s a smooth transition when you switch to us. Let us handle the financial responsibilities while you focus on building your business.

Switch NowClient Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

Costs vary based on volume and complexity but are typically up to 60% more cost-effective than maintaining an in-house team. This is because you save substantially on infrastructure, training, and software.

Yes, our team is trained in US GAAP, UK IFRS, and ATO regulations, offering AP services that align with your local compliance requirements, no matter where your business operates.

Absolutely, you’ll work with a dedicated AP expert who understands your specific vendor terms, cash flow goals, and communication style.

We work with QuickBooks, NetSuite, Zoho Books, Xero, and MS Dynamics, offering smooth integration and full control over your AP functions.

Yes, we provide detailed AP reports, ageing summaries, due dates, vendor balances delivered at your preferred frequency (weekly, bi-weekly, monthly).

Not at all. You maintain full visibility and control through built-in approval workflows, dashboards, and clear documentation. We act as an extension of your team, not a replacement.

Your data is protected by SOC 2 and ISO 27001-compliant systems, secure cloud environments, access control, and multi-factor authentication. We treat your financials with the same care as our own.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Scale Smarter with Outsourced Accounts Payable Services India

Smart businesses worldwide are turning to accounts payable outsourcing to increase efficiency and reduce operational stress. It’s primarily about building a reliable partnership with experts who understand compliance, cash flow, and vendor management inside and out. At Whiz Consulting, we deliver end-to-end outsourced accounts payable services tailored to global businesses, reducing errors, cutting costs, and helping you scale with confidence.

Get a CallReduce AP-related expenses by up to 60% by outsourcing accounts payable to India. Avoid recruitment, training, and infrastructure costs with our accounts payable outsourcing services, you only pay for what you use.

We follow a tech-enabled, transparent workflow for managing your payables, from invoice entry to reconciliation and payment. Our process ensures faster turnaround times, accurate documentation, and complete visibility, keeping your financial operations running smoothly across time zones.

Gain direct access to experienced AP professionals who manage everything from invoice tracking and approvals to vendor follow-ups. Your dedicated expert ensures your outsourced accounts payable services remain compliant, up-to-date, and audit-ready.

We support businesses across regions, ensuring compliance with US GAAP, IFRS (UK/UAE), and ATO standards (Australia). From managing 1099s, sales tax to GST filing, BAS statements and VAT compliance, our team is trained to handle complex AP requirements across multiple jurisdictions.

Stay connected through your preferred channels, be it Zoom, Slack, MS Teams, or email. Our accounts payable team works as your virtual extension, offering quick responses, proactive updates, and full transparency every step of the way.

Whether you’re a growing startup or an enterprise with seasonal fluctuations, our outsourced accounts payable services adapt to your business size and complexity. Scale up or down without disrupting your workflow or finances.

As a SOC 2 and ISO 1900: 27001 certified company, we protect your financial data with encrypted storage, access control policies, and secure workflows, ensuring complete confidentiality and compliance with global data protection standards.

We leverage top-tier platforms like QuickBooks, Zoho Books, Xero, NetSuite, and MS Dynamics to streamline your AP process. From automated approvals to vendor payment alerts, our cloud-based solutions offer real-time visibility, easy collaboration, and seamless integration with your existing systems.