-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

5000+

Reconciliation in a Month

-

150+

Team Size

Transforming Financial Reporting for Your Organization

At Whiz Consulting, we believe financial reporting is more than just numbers on a page—it’s the story of your business’s financial health. Our team ensures every detail is accurate, compliant, and meaningful, turning raw data into insights you can act on. While we handle the intricacies of financial reporting, you can focus on driving growth and achieving your goals. With Whiz, financial clarity isn’t just a task—it’s a partnership you can trust.

Financial Reporting Services We Offer

- Day-to-Day Bookkeeping

- Preparation of Trial Balance

- Real-time Inventory Tracking

- Seamless Financial Statement Analysis

- Preparation of General Ledger Reports

- Streamlined Bank Reconciliation Reports

- Calculation of Fixed Assets & Depreciation

- Management of Accounts Payable/Receivable

- Helping You File Taxes

Challenges We Tackle for You

Managing your organization’s finances can be complex, but we have the expertise to ease your burden.

Addressing Inconsistent Financial Data

Poorly organized or inconsistent financial data can hinder decision-making. We ensure your records are accurate, reliable, and easy to understand, providing a solid basis for strategic planning.

Simplifying Complex Financial Compliance

Keeping up with current accounting standards can be challenging. Our expert team stays informed of the latest regulations, ensuring your financial records comply with relevant standards and best practices.

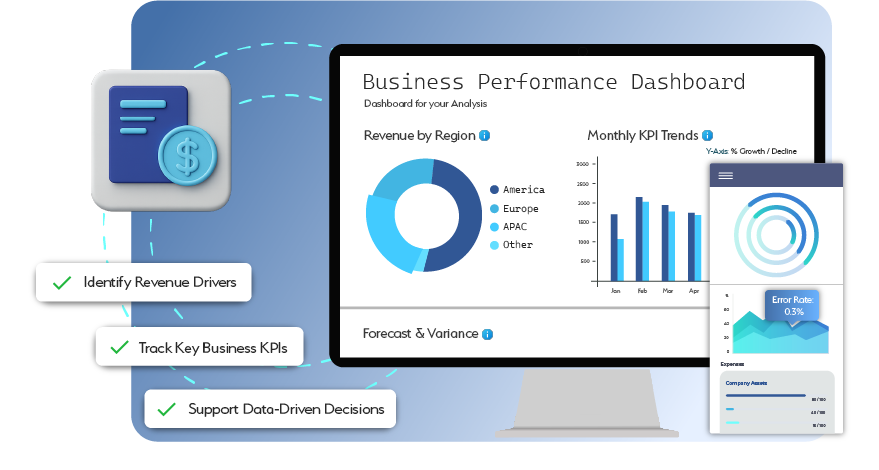

Converting Data into Strategic Insights

Financial data is often complex and difficult to interpret. We simplify it, transforming raw numbers into valuable insights that empower you to make data-driven decisions confidently.

Hire a Financial Reporting Analyst who:

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

We collaborate closely with you and your team for smooth communication and a clear understanding of your bookkeeping needs.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses across diverse sectors stay organized and financially sound.

-

Dedicated Experts

Our team comprises highly skilled, certified professionals dedicated to supporting your business to effectively address your unique challenges.

-

Real-Time Insights

Our regular reporting provides actionable insights, enabling you to make informed decisions and drive business growth.

-

Cost Savings

We offer scalable services tailored to your specific needs, helping you save on the expenses of hiring, training, and maintaining an in-house team.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Switching to a new accounting partner can seem overwhelming. With Whiz, the transition is seamless and hassle-free. We guide you throughout the process, ensuring a smooth transition with no interruptions to your business. Focus on your core competencies while we manage your accounting needs.

Switch NowClient Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind?

Find answers here...

Yes, we implement strict security measures, including encryption and strict confidentiality agreements, to ensure your data is always protected.

Small businesses can greatly benefit from outsourcing. It’s a cost-effective solution that provides access to expert professionals while you concentrate on growing your business.

Reports are typically delivered within agreed-upon timeframes, ensuring accuracy without delays. Custom requests may require slightly longer.

Yes, you retain full control. We provide transparency throughout the process, keeping you informed and allowing you to review and approve reports.

Outsourcing saves you time, reduces costs, and provides access to expert professionals, advanced tools, and compliance assurance, all without increasing overhead.

Streamline Your Finances, One Step At A Time

Let us take care of your books and make this financial year a good one.

Outsourced Financial Reporting Services: Simplifying Your Financial Management

Managing financial reporting internally can be both time-consuming and resource-intensive. It requires a high level of accuracy, adherence to relevant regulations, and the capacity to process large datasets. By outsourcing accounting services to financial specialists, you can ensure precision, gain strategic insights, and improve efficiency. Here’s how outsourcing your financial reporting can benefit your organization.

Get a CallFinancial reporting requires gathering and consolidating substantial amounts of data, necessitating specialized expertise. Hiring internal professionals, investing in infrastructure, and managing resources can be expensive. By outsourcing, you receive accurate, timely, and customized financial reports without significant investments.

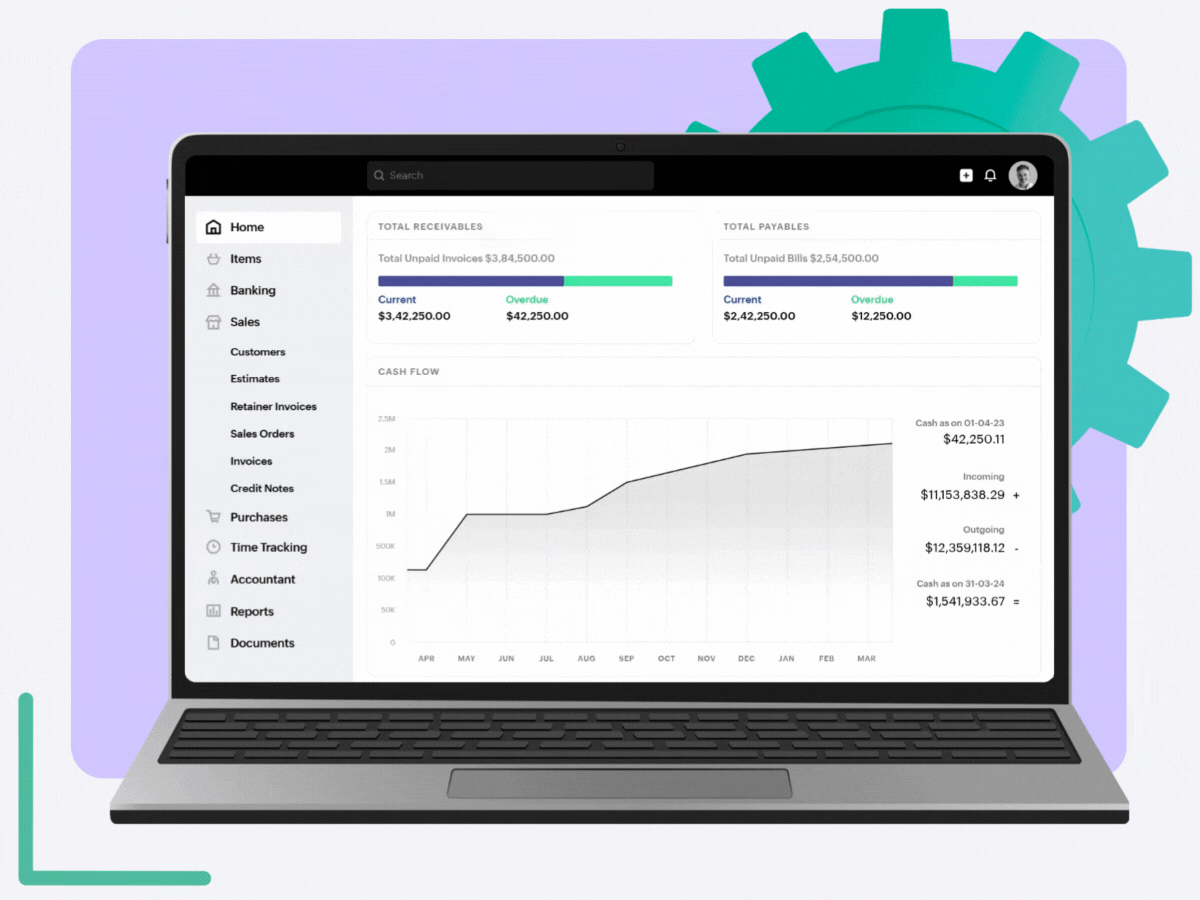

Outsourcing providers utilize sophisticated tools such as automated reconciliation and cloud-based dashboards to enhance the accuracy and efficiency of financial reporting. With cloud platforms, you can securely access real-time financial data from any location, ensuring complete transparency and control over your finances.

Staying current with evolving accounting standards and financial regulations can be complex. By outsourcing your financial reporting, you ensure your reports comply with relevant regulations, mitigating the risk of penalties and improving your audit readiness.

A key benefit of outsourcing is transforming raw financial data into actionable insights. Expert financial reporting services provide comprehensive analysis and visualized data, enabling you to identify trends, discover opportunities, and address challenges effectively. With these insights, you can make well-informed, data-driven decisions for your organization.

Timely and accurate financial reports are essential for effective cash flow management. Outsourcing your financial reporting provides clear visibility into your financial position, enabling improved budgeting, forecasting, and planning. This helps prevent bottlenecks and ensures smooth and uninterrupted business operations.

This website uses cookies to improve your experience. You can accept all or reject non-essential cookies.