-

100+

Clients Served

-

100000+

Invoices Processed Per Month

-

500+

Completed Projects

-

1000000+

Reconciliation in a Month

-

100+

Team Size

Gain Clarity in Metrics with Advanced Ratio Analysis

Discover the true potential of your financial data with our professional ratio analysis services. We simplify intricate numbers into actionable insights, focusing on key metrics like profitability, liquidity, and efficiency to drive your business forward. From uncovering growth opportunities to addressing challenges, our analysis provides the clarity you need to make informed, strategic decisions. Harness the power of your data to unlock new possibilities and achieve success!

Ratio Analysis Services We Offer

- Profitability Ratios

- Liquidity Ratios

- Efficiency Ratios

- Solvency Ratios

- Market Ratios

- Turnover Ratios

- Earnings Ratios

Challenges We Tackle for You

At Whiz Consulting, we address the key challenges businesses face in ratio analysis by delivering precise and actionable insights customised to your goals.

Simplifying Financial Interpretation

Understanding the significance of financial ratios can be overwhelming. We translate complex metrics into straightforward insights, empowering decision-makers to act confidently on their financial data.

Guaranteeing Data Reliability

Errors in calculations can distort results and misguide decisions. Our team ensures accuracy through rigorous validation, providing you with reliable data to base critical decisions on.

Enhancing Benchmark Comparisons

Without meaningful benchmarks, assessing performance can be unclear. We provide detailed industry-specific comparisons, enabling you to evaluate your position effectively and identify growth opportunities.

Your Partner in Financial Growth

Understanding your business’s financial performance has never been easier. With our expert ratio analysis services, we simplify complex financial data into actionable insights that matter. Whether it is evaluating profitability, analysing liquidity, or uncovering opportunities for growth, we provide you with a clear strategy for informed decisions. Let us manage the numbers while you concentrate on steering your business toward success with certainty and focus.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switch to Whiz Effortlessly!

Whiz makes the experience of shifting to a new accounting partner easy and hassle-free. We make sure that there are no disruptions and that there’s a smooth transition when you switch to us. Let us handle the financial responsibilities while you focus on building your business.

Switch Now

Our Technology Partners

We empower innovation with personalized solutions with the help of our trusted and reliable partners.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

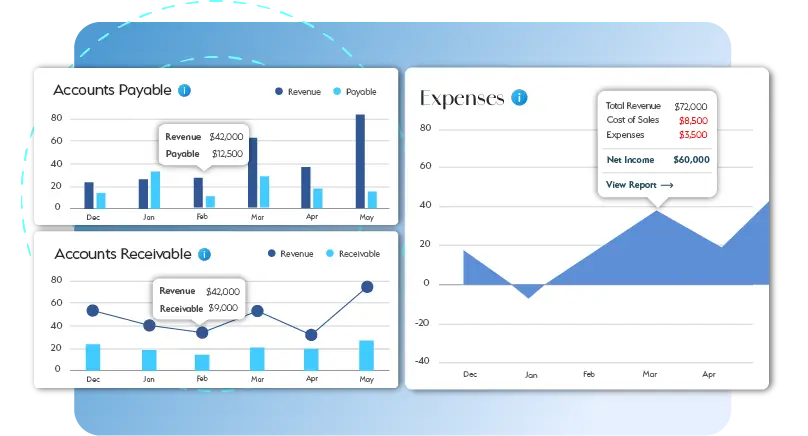

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Financial ratio analysis offers a comprehensive understanding of a company’s financial position by assessing key metrics like profitability, liquidity, and solvency. It simplifies complex financial data, enabling strategic decision-making and effective growth planning.

Industries like retail, manufacturing, healthcare, and technology benefit significantly from debt-to-asset ratio evaluations. These sectors rely on insights to assess their financial leverage and maintain stability in competitive markets.

Businesses should review their debt-to-equity ratios quarterly or annually. Regular analysis helps identify financial risks early, adapt to economic changes, and maintain a balanced capital structure.

Yes, ratio analysis is a powerful tool for benchmarking performance. By analysing metrics like debt-to-equity or profitability ratios, businesses can compare their financial health with industry peers and identify opportunities for improvement.

Outsourcing ratio analysis ensures accurate calculations and expert insights into metrics like debt-to-assets or equity ratios. Professional services save time, provide actionable interpretations, and allow businesses to focus on core activities while staying financially competitive.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Unlocking Business Insights with Expert Ratio Analysis Services

In today’s competitive business landscape, understanding your company’s financial health is essential. Ratio analysis serves as a cornerstone for evaluating financial performance, providing insights into profitability, liquidity, and leverage. For many businesses, outsourcing financial ratio analysis offers a practical and efficient way to access expert insights and make informed decisions without burdening internal resources.

Get a CallRatio analysis examines the relationship between various financial metrics to assess a company’s performance. Key ratios like the debt-to-total-assets ratio and the debt-to-equity ratio are critical for understanding leverage, while profitability and liquidity ratios offer insights into operational efficiency and cash flow. Outsourced interpretation services for ratio analysis ensure these numbers are not just calculated but meaningfully analyzed to guide business strategies.

Expertise in Specialized Ratios

Outsourcing brings access to professionals skilled in analyzing complex metrics like the equity-to-debt ratio analysis or debt-to-asset ratio analysis, ensuring precise evaluations tailored to your industry.

Time and Cost Efficiency

Hiring an in-house team for financial analysis can be resource-intensive. Outsourced services provide high-quality analysis at a fraction of the cost, freeing your internal team to focus on strategic initiatives.

Accurate Insights for Decision-Making

Outsourced providers use advanced tools and proven methodologies to deliver reliable insights into ratios like the debt-to-total-assets ratio and debt-to-equity ratio, helping businesses assess financial stability and risk.

Customized Reporting and Interpretation

Tailored interpretation services ensure the data is not just numbers but actionable insights, offering clarity for growth planning, risk mitigation, and investment strategies.

Debt-to-Total-Assets Ratio Analysis: Understand your company’s financial leverage and its ability to meet long-term obligations.

Analysis of Debt-to-Equity Ratio: Evaluate the balance between borrowed capital and owner’s equity, essential for gauging financial risk.

Equity-to-Debt Ratio Analysis: Determine how effectively your business is utilizing equity compared to debt for funding operations.

Outsourcing financial ratio analysis empowers businesses with precise evaluations of critical metrics, including the debt-to-total-assets ratio and debt-to-equity ratio. By leveraging expert interpretation services, you gain actionable insights that drive smarter decisions and sustainable growth. Partner with professionals to simplify the complexity of ratio analysis and stay ahead in today’s financial landscape.