Table of Content

Share This Article

- Published: Feb 21, 2026

- Last Updated: Feb 21, 2026

- 🔊 Listen

Quick Reads

- Access to a talent pool specifically trained in US tax laws (Forms 1040, 1120, 1065) and proficient in major platforms like Drake, UltraTax, and Lacerte.

- Leveraging time zone differences creates a 24-hour production cycle where work assigned in the evening is ready for review by the next morning.

- Rapidly increase headcount during peak filing deadlines and scale down when the season ends, preventing staff burnout and high seasonal hiring costs.

- Professional offshore teams operate under SOC 2-aligned processes and secure VPN environments to ensure client data remains confidential and protected.

- Standardised SOPs and layered review mechanisms ensure that tax adjustments, book-to-tax reconciliations, and workpapers are accurate and audit-ready.

With overhead costs and software licenses on the rise, CPA firms must find new ways to protect their margins. Hiring dedicated tax staff in India can reduce operational labor costs by up to 70%, transforming your tax preparation department from a cost center into profit engine. This strategic shift allows firms to reinvest savings into AI technology, marketing, or niche advisory services. Let’s explore why offshoring is the most effective lever for firms looking to scale profitability in today’s demanding financial landscape.

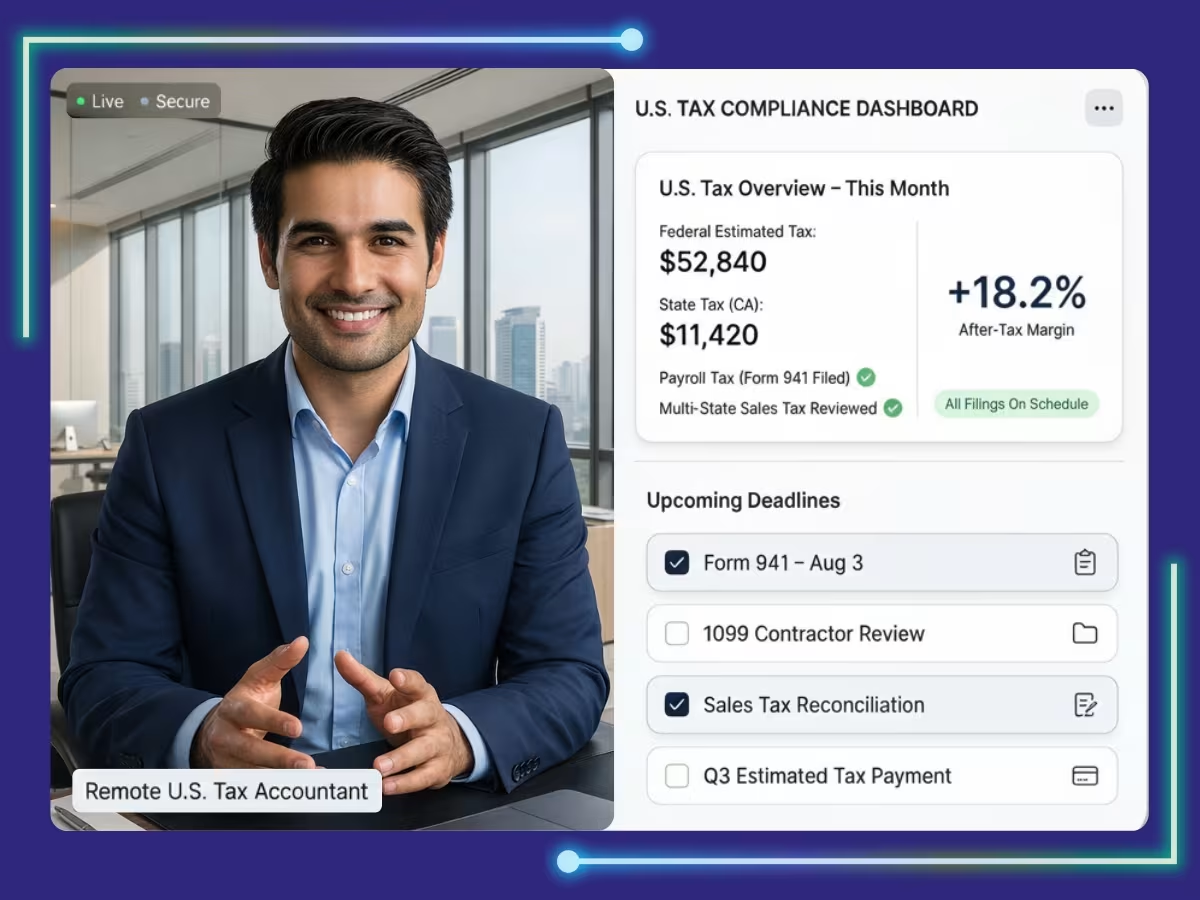

Offshore Advantage Starts Here

Where global skill meets thoughtful execution

Benefits of Hiring an Offshore Tax Preparer for Your CPA Firm

Scaling your firm is now more efficient than ever. By lowering operating costs without compromising skill, you gain specialised expertise in US taxation and a time zone advantage for faster turnaround. With scalable support during tax season, strong data security, and familiarity with US tax software, here is how:

Lowering Operating Cost Without Compromising Skill

Hiring an offshore tax preparer from India allows CPA firms to reduce payroll, infrastructure, and employee benefit expenses substantially. Instead of carrying fixed salaries, insurance, office space, and recruitment overhead, firms can convert much of that cost into a flexible engagement model.

The cost savings often range between 40% and 60%, depending on the structure and experience level. More importantly, this efficiency does not come at the expense of capability. Many offshore professionals are trained specifically in US taxation and operate within well-defined workflows aligned with American CPA standards.

Specialised Expertise in US Taxation

India has built a strong talent base of finance professionals who specialize in US tax laws and IRS compliance. Offshore tax preparers frequently work on Forms 1040, 1120, 1120S, and 1065, along with payroll filings, 1099 reporting, and multi-state tax requirements.

Many professionals hold qualifications such as US enrolled agent certified staff or have experience supporting US CPA firms for years. This allows your internal team to focus on review, advisory, and client communication while the offshore team handles preparation with precision.

Scalable Support During Tax Season

Tax season brings unpredictable volume spikes. Hiring seasonal domestic staff can be expensive and time-consuming, and layoffs after peak season create instability.

An offshore tax team provides immediate scalability. You can increase headcounts during filing deadlines and scale down once the season stabilizes. This elasticity protects your firm from burnout while maintaining consistent output during high-demand periods.

Time zone Advantage for Faster Turnaround

The time difference between the US and India creates a powerful operational advantage. Work assigned at the end of the US business day can be processed overnight and delivered the next morning.

This overnight production cycle reduces turnaround time, shortens review cycles, and enables faster client responses. Firms that leverage this structure often improve both internal efficiency and client satisfaction.

Strong Data Security and Compliance Frameworks

Established offshore providers implement strict data protection measures such as secure VPN access, restricted server environments, role-based access control, and documented security policies. Many operate under SOC 2-aligned processes and ISO 27001-certified systems.

With clearly defined access protocols and confidentiality agreements, CPA firms can maintain client trust while expanding offshore operations securely.

Familiarity with US Tax Software

Offshore tax preparers are commonly trained in major US tax platforms such as Drake, UltraTax, Lacerte, and ProSeries. They also work within secure cloud document management systems and practice management tools.

Because they are already accustomed to these platforms, onboarding tends to be smoother than firms expect, minimizing transition friction.

Standardised Processes and Multi-Level Quality Check

Professional offshore teams operate with detailed standard operating procedures, structured checklists, and layered review mechanisms. Each tax return type follows a defined preparation and quality-control path to reduce errors and maintain uniform output.

This level of documentation often strengthens internal discipline within CPA firms and improves long-term workflow consistency.

What Tax Preparation Functions can be outsourced from India?

From individual tax return preparation (Form 1040) and business tax return preparation to sales and state tax compliance support, outsourcing streamlines your workflow. By delegating book-to-tax adjustments, tax research, and payroll tax return preparation, your firm leverages expert tax software processing and return drafting for maximum efficiency. Let’s look in detail:

Individual Tax Return Preparation (Form 1040)

Individual tax returns are commonly outsourced because they follow structured documentation and standard workflows. Offshore teams handle preparation, while the US CPA firm retains review and signing authority.

- Preparation of Form 1040 and supporting schedules (A, B, C, D, E, SE)

- W-2 and 1099 data entry

- Capital gains computations

- Rental income and expense reporting

- Self-employment tax calculations

- Draft workpaper preparation for CPA review

Business Tax Return Preparation

Corporate and pass-through returns demand careful reconciliation and clean documentation. Offshore professionals handle data organization, tax adjustments, and draft preparation using trial balances and prior-year files, allowing domestic teams to focus on review and planning.

- Draft preparation of Forms 1120, 1120S, and 1065

- K-1 allocations and partner/shareholder schedules

- Depreciation and amortization schedules

- Book-to-tax adjustments

- Trial balance mapping

- Multi-state apportionment computations

Sales and State Tax Compliance Support

State compliance follows structured, recurring processes. Offshore teams prepare draft returns and reconciliation schedules under clear guidelines, while advisory decisions and filing authority remain with the domestic team.

- State income tax return drafts

- Sales tax liability calculations

- Nexus tracking support

- Apportionment workpapers

- Extension filing drafts

- Reconciliation of sales tax reports with accounting records

Tax Research and Technical Documentation

Tax research involves reviewing statutes, IRS guidance, and state rules. Offshore professionals organize findings, summarize key positions, and draft support documents, while final interpretation stays with the licensed CPA.

- Federal and state tax research support

- Summaries of IRS guidance and rulings

- Draft technical memos

- Background notes for client advisory meetings

- Documentation preparation for IRS notice responses

Book-to-Tax Adjustments and Workpaper Preparation

Book-to-tax reconciliation suits offshore execution under controls, detail-oriented, documentation-driven work that ensures return accuracy and eases peak-season pressure.

- Preparation of M-1 and M-3 adjustments

- Trial balance to tax return reconciliation

- Fixed asset schedule updates

- Depreciation roll-forwards

- Supporting tax workpaper documentation

Payroll Tax Return Preparation and Year-End Reporting

Payroll tax preparation follows recurring quarterly and annual compliance cycles. Offshore teams assist with reconciliations and draft preparation while firms retain filing credentials and compliance accountability.

- Preparation of Forms 941 and 940

- State payrolls return drafts

- Quarterly payroll reconciliations

- Year-end W-2 and 1099 processing

- Payroll tax documentation and support schedules

Tax Software Processing and Return Drafting

Modern outsourcing models operate directly within the firm’s licensed cloud-based tax software. Offshore professionals prepare returns inside secure environments, ensuring formatting consistency and diagnostic review before submission for CPA approval.

- Draft preparation using UltraTax, Lacerte, Drake, ProSeries, CCH Axcess, and GoSystem

- Diagnostics review and error flag resolution

- Standardized formatting and documentation control

- Secure system access under firm governance

How to Choose the Right Offshore tax preparer from India?

To find the perfect partner, you must check US tax expertise and verify data security and compliance protocols. Success also requires you to evaluate communication and the review process. By opting to start with a pilot project and choosing value over cost, you ensure long-term reliability.

- Check US Tax Expertise: Ensure the team hands-on experience with US tax returns (1040, 1120, 1065) and works on US tax software like Drake, Lacerte, or UltraTax.

- Verify Data Security and Compliance: Confirm strong data protection, secure VPN access, NDAs, no local data storage, and SOC-aligned processes.

- Evaluate Communication and Review Process: Look for clear communication, a dedicated point of contact, overlapping US hours, and a multi-level quality review system.

- Start with a Pilot Project: Begin with a small batch of returns to access accuracy, turnaround time, and responsiveness before scaling.

- Choose Value Over Cost: Select a partner offering transparent pricing, flexibility during tax season, and long-term reliability, not just the lowest price.

Future-Proof Your CPA Firm with the Right Offshore Tax Preparer

Choosing the right offshore tax preparer is about creating dependable, long-term extension of your CPA firm, one that supports growth without compromising quality or compliance. A skilled offshore team brings strong US tax expertise, secure processes, clear communication, and consistent review standards, helping firms scale efficiently and navigate peak tax season with confidence.

At Whiz Consulting, our team of expert offshore accountants is built around these principles, working closely with US CPA firms to deliver accurate, secure, and reliable tax preparation, so your firm can focus on advisory, client relationships and future growth.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

Onboarding timelines typically range from a few days to a few weeks, depending on your requirements and the complexity of the role. Once the scope, tools, and expectations are defined, the transition process is structured and streamlined to ensure a smooth start.

Teams align working hours to create sufficient overlap for real-time collaboration. Communication is managed through scheduled meetings, shared project tools, and clear reporting structures to ensure transparency and responsiveness.

Secure access is maintained through VPNs, encrypted connections, role-based permissions, and restricted system access. Only authorized team members can access relevant data, ensuring controlled and monitored usage.

Quality is managed through structured workflows, review hierarchies, and defined approval processes. Regular performance reviews, documented procedures, and supervisory oversight help maintain accuracy and consistency.

Client confidentiality is protected through strict data protection policies, signed NDAs, secure infrastructure, and compliance-driven processes. Internal controls and documented security practices are aligned with global standards such as GDPR and SOC 2.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.