Table of Content

Share This Article

- Published: April 16, 2025

- Last Updated: June 15, 2025

Key Takeaways

- UAE businesses can achieve significant operational cost reductions (up to 60%) by outsourcing accounting to India.

- India offers a deep reservoir of qualified accounting professionals (over 17,360 CPAs and 430,000 CAs), providing UAE businesses access to diverse expertise and specialized skills tailored to their specific industry needs.

- Indian accounting firms are proficient in navigating both international standards like IFRS and UAE-specific regulations (VAT, FTA, CB, FSRA), ensuring accurate financial reporting and minimizing the risk of non-compliance for UAE businesses.

Owing to robust infrastructure, lenient investment policies, tax advantages, and diverse economy, the business landscape of UAE is thriving. However, with this diversity and growth comes increased operational demands, especially in areas like accounting and financial management. Setting up an in-house team may not be feasible for everyone-especially growing businesses. This is why there has been an increasing trend of accounting outsourcing services to India. In this blog, we delve into the intricacies of accounting outsourcing, how it delivers value to businesses, and how you can create your robust team of accountants unbound by borders.

What is Accounting Outsourcing and How Does it Work?

Accounting outsourcing is the practice of delegating key financial functions such as bookkeeping, payroll, tax preparation, and financial reporting to a specialized third-party firm. This allows businesses to reduce overhead costs, access expert-level accuracy, and streamline compliance without the burden of maintaining a full in-house accounting team. In fact, by investing in an outsourced accounting firm, you can save up to 60% on overhead costs, a significant saving that could be invested in other strategic areas. Here’s how it works:

- Assessment Phase: The outsourcing partner evaluates your current accounting processes, systems, and goals to understand the gaps and accordingly tailor services.

- Onboarding & Transition: This phase often includes the seamless integration of accounting software such as QuickBooks, Xero, or NetSuite along with other essential tools. The goal is to create a streamlined, automated environment where data flows effortlessly between platforms, ensuring accuracy and reducing manual effort.

- Recording and Tracking Transactions: Remote bookkeepers take over the day-to-day financial tasks, including invoice processing, bank reconciliations, payroll management, and expense tracking to keep your finances in order.

- Tax Filing: Outsourced accountants handle all aspects of tax filing, including VAT returns and Corporate Tax compliance as per UAE regulations. They ensure accurate documentation and timely submissions to the Federal Tax Authority (FTA) to minimize the risk of penalties while keeping your business fully compliant.

- Compliance & Reporting: The outsourcing provider ensures all financial reports are accurate, timely, and fully aligned with local and international regulatory standards.

- Ongoing Optimization: Regular feedback loops, performance reviews, and KPI tracking allow the provider to fine-tune processes, eliminate inefficiencies, and adapt to your evolving business needs.

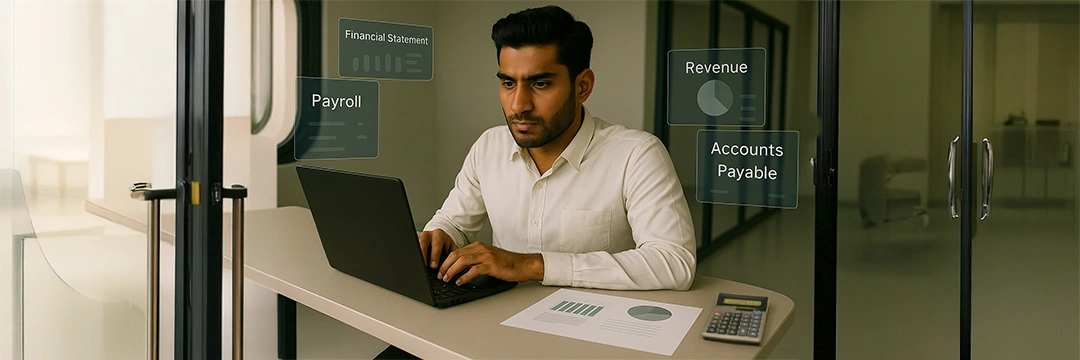

Key Accounting Outsourcing Services Offered by Indian Firms

To ensure operational efficiency, many companies are choosing to outsource accounting to India. This approach guarantees meticulous management of accounts payable and receivable, directly enhancing cash flow. Additionally, streamlined payroll processing and regular financial reporting contribute to strong audit preparedness. By outsourcing accounting work to India, businesses unlock valuable time and resources that can be invested in core operational activities.

Financial Reporting & Analysis

Accounting outsourcing firms create financial statements including Profit & Loss statement, cash flow statement, and balance sheet. These reports reflect the financial health of your organizations in a specific accounting year. Moreover, by providing detailed financial reporting and analysis, they empower you with the right data to make informed decisions.

Accounts Payable & Receivables

Proper management of accounts payable and accounts receivable is crucial for maintaining a healthy cash flow. Indian accountants can efficiently handle invoice processing, vendor management, payment scheduling, and reconciliation for accounts payable.

On the other hand, for accounts receivable, these experts manage invoicing, payment tracking, and follow-up on outstanding payments, helping to optimize the working capital cycle.

Payroll Processing

Outsourcing payroll ensures accurate and timely payment of salaries, wages, and statutory deductions. Remote accountants in India are capable of handling the entire payroll cycle, including calculating gross pay, managing deductions, generating payslips, and ensuring WPS payroll compliance and other governing regulations.

Audit Preparation

When you have an expert taking care of books, it significantly enhances your company’s audit preparedness. Your offshore accountant ensures proper organization and management of financial records. Moreover, they also ensure that your books align with relevant compliance standards such as Federal Tax Authority, Central Bank of the UAE (CB), and Financial Services Regulatory Authority (FSRA).

Cash Flow Management

Effective cash flow management is vital for the solvency and sustainability of any business. Outsourced accounting services from India include monitoring cash inflows and outflows, preparing cash flow forecasts, managing working capital, and providing insights for better financial planning and decision-making. They help businesses optimize their cash flow, avoid shortages, and make informed investment decisions.

Why India is the Preferred Destination for Accounting Services

To outsource accounting services in India is like having wind at one’s back. India allows Dubai businesses to choose from a wider talent pool of accountants, get professionals at cost-effective charges, and have the advantage of time zones. These benefits lead to enhanced accuracy and improved financial operations.

A Wider Pool of Talent

As of 2025, India has over 17, 360 CPAs, 430,000 CAs and thousands of accountants, making the accounting outsourcing to India a smart business move. This abundance ensures access to a diverse range of expertise from basic bookkeeping to specialized skills, allowing UAE companies to find professionals best suited to their specific industry and complexities.

Proficient in Local & International Regulations

Offshore accountants in India are skilled in navigating international accounting standards such as IFRS, VAT regulations, and Federal Taxation Authority. Reputable Indian outsourcing firms invest in training their staff on relevant regulation standards, ensuring compliance and accurate financial reporting tailored to the UAE’s legal framework. This proactive approach minimizes the risk of non-compliance and provides UAE businesses with the assurance of sound financial management aligned with local laws.

Cost-Effective Professional Guidance

For UAE businesses, outsourcing accounting to India means significant reduction in operational expenditure. In fact, with an outsourced accounting team, you don’t have to invest in recruitment, infrastructure, training, and payroll. This helps you save up to 60% in terms of overhead costs; a substantial saving that could be invested in other business areas.

Time-Zone Advantage

The 1.5-hour time difference between the UAE (GMT+4) and India (GMT+5:30) creates a beneficial overlap in working hours. This near real-time synchronization facilitates seamless communication and collaboration throughout the primary business day for both the UAE client and the Indian outsourcing team. This allows for immediate query resolution, efficient task delegation, and a more integrated workflow, effectively extending the UAE business’s operational capacity without significant coordination hurdles.

Streamlined Communication

Both UAE and India has a substantial English-speaking population, making communication seamless. Moreover, reputable accounting outsourcing firms in India leverage best communication and collaboration tools such as Slack, MS Teams, and Asana to ensure optimal efficiency in the work process. Moreover, they also adhere to stringent data protection policies to securely exchange sensitive financial data.

Choosing the Right Accounting Outsourcing Firms in India

Choosing the right accounting outsourcing firm in India is crucial to ironing out messy financial operations, streamlining cash flow, and expanding business seamlessly. However, to select the right agency, first identify your own outsourcing needs, check for a proven track record, and lastly, ensure they use effective communication channels.

Identify Outsourcing Needs

Determine which accounting functions you want to outsource. This could include bookkeeping, payroll processing, financial reporting, tax compliance, management accounting, audit support, or a combination of these. A well-defined scope of outsourced accounting functions ensures better alignment with the chosen firm’s expertise, leading to a more effective and beneficial partnership.

Industry Expertise

If your UAE business operates in a specific industry such as retail, healthcare, manufacturing, and ecommerce, look for firms with experience in that sector. Previous experience goes a long way, reflecting their knowledge in tackling unique challenges associated with your industry.

Software Proficiency

The next step is to make sure they know their stuff when it comes to your accounting software. Whether you use QuickBooks, Xero, NetSuite, or other platforms, the outsourcing firm should be proficient. They need to integrate smoothly with your existing systems or guide you toward smarter alternatives if required.

Can they troubleshoot issues? Customize workflows? Provide reliable support? Make sure to ask all relevant questions to ensure seamless and stress-free financial management.

Inquire About Communication Support

Responsiveness is key for successful offshore accounting collaboration, demanding clear, seamless communication. Reliable firms prioritize this by investing in tools like Microsoft Teams, Zoom, Cisco Webex Calling, and Slack.

These platforms ensure efficient teamwork across borders through instant messaging, video conferencing, and file sharing, fostering real-time collaboration and quicker problem-solving. This tech investment signals an offshore partner’s commitment to effective interaction, ultimately enhancing productivity and building trust between onshore and offshore teams.

Final Thoughts

Outsourcing accounting to India offers UAE businesses cost-efficiency, expert support, and streamlined financial processes. Make the most of offshoring, you need a reliable outsourcing accounting partner that caters to your needs by providing personalized solutions.

With over a decade of experience and a team of 100+ skilled online accountants, Whiz Consulting is well-equipped to be your trusted partner. We offer a full suite of services including bookkeeping, payroll, tax preparation, and financial reporting, customized to meet your unique business needs.

Get customized plan that supports your growth

Have questions in mind? Find answers here...

By accounting outsourcing to India, UAE businesses can save costs up to 60% to 70% as the former country has lower labour costs. Indian expert accountants offer specialised outsourcing services at just a fraction of the cost, leading to enhanced savings.

Indian outsourced accountants can definitely assist UAE businesses in managing VAT for them. They offer expertise in meeting local regulations so the business can be financially compliant. With the help of an Indian accountant, your business can prepare taxes, be updated with ever-changing tax laws, and have frequent financial statements and reports generated for an informed decision-making process.

Absolutely. We provide customisable accounting solutions that can be tailored to your UAE business needs and address specific challenges that you might face. With our comprehensive services and round-the-clock support, your business can reach new heights in no time.

Outsourcing your needs depends entirely upon your requirements. If you think an outsourced expert can better handle your project and you can free more time to focus on other business activities, it’s best to outsource.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.